New users automatically create accounts after logging in

Login188bet sports betting app download

Since this year,Regulators’ attention to the New OTC Market has increased significantly,Talked about the formulation of New OTC Market Supervision Regulations on various important occasions、Deepen the reform of the NEEQ stratification and trading system、Focus issues such as improving the pricing function of the New Third Board。

188bet app

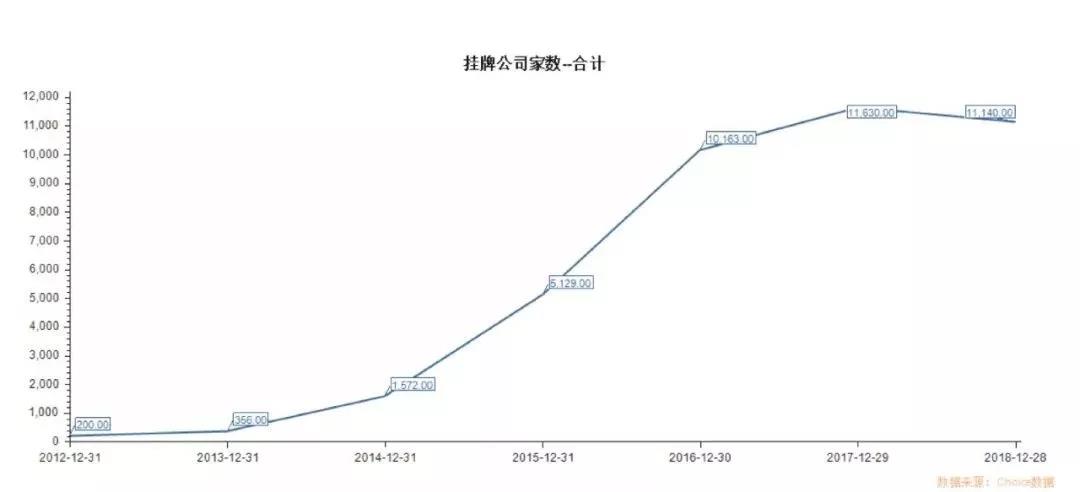

Since June 2013,The State Council decided to move the New OTC Market from Zhongguancun, Beijing、Tianjin Binhai、Wuhan East Lake and other pilot areas have been expanded to the whole country,Driven by policy dividends,The number of companies listed on the New OTC Market has increased sharply,The number of newly listed companies in 2015-2016 was as high as 8591,Achieved a quantum leap。As of July 16, 2018,The number of companies listed on the New OTC Market has reached 11,126,It is the world’s first securities trading venue with more than 10,000 listed companies,Nearly 90% of the enterprises are small and medium-sized enterprises、Growth enterprise。

Different from motherboard,NEEQ has the distinct characteristic of “running fast in small steps”,The financing amount is not too small,Not afraid of high frequency of financing,Enterprises can quickly approve if they have needs、Get funds quickly。As can be seen from the picture below,The number and value of transactions on the New OTC Market have been rising in recent years,But judging from the data in the first half of 2018,This year’s New OTC Market trading volume and value will both decline,Of course, this is closely related to the poor overall stock market environment this year。

For the New Third 188bet app download Board,On the one hand,We must admit that this new thing has achieved world-renowned achievements in just a few years,The other side,We must also face up to the problems existing in its development。

The lack of liquidity on the New Third Board has been widely criticized,The liquidity mentioned here,Refers to the ability to close transactions quickly at a reasonable price。Give an example,A shareholder plans to sell 100,000 shares worth 10 yuan each as soon as possible,If market liquidity is poor,The shareholder had to choose between price and time,Or lower the price to sell as soon as possible,Either sell at a reasonable price and wait patiently for buyers。If things continue like this, it will make it difficult for the New Third Board to form a reasonable price discovery,The value of listed companies is also difficult to fully reflect。

New Third Board, which has gathered a large number of relatively outstanding small and medium-sized enterprises in a short period of time,Once considered a connection entrepreneur、The bridge between investors and capital markets,It should have been infinitely beautiful,Why we fell into a liquidity dilemma?

On the one hand,The high entry threshold for the New Third Board results in insufficient number of investors。Because the New OTC Market mainly serves "innovative people"、Entrepreneurial、Growth-oriented enterprise,Such small, medium and micro enterprises have relatively high risks in all aspects,So investors are required to have higher risk identification and tolerance。Individual investors want to enter the New Third Board market,Need to have securities assets of more than 5 million yuan and more than 2 years of securities investment experience,There are not many individual investors who meet these conditions first,Secondly, these investors have strong financial strength,I hope to take advantage of the financial advantage to participate in the fixed-income market that offers certain discounts,Instead of entering the secondary market transaction。

On the other hand, the exit mechanism of the New OTC Market needs to be improved urgently.The current New Third Board market does not allow investors to see that more people will take over in the future,There are many people who hesitate to enter the venue,As a result, the entire NEEQ market is in a state of multi-enterprise、Low funds,The current situation of inactive transactions,There are even many companies that have had zero transactions and zero financing since their listing,Become a veritable “zombie stock”。

In order to mobilize the vitality of the New Third Board,The China Securities Regulatory Commission has successively introduced private equity market making、New OTC Board hierarchical management and other favorable policies。Recently,People's Bank of China、CBRC、CSRC、The National Development and Reform Commission and the Ministry of Finance jointly issued the "Opinions on Further Deepening Financial Services for Small and Micro Enterprises",Article 11 clearly states“Continue to deepen the stratification of the New Third Board、Transaction system reform,Perfect and differentiated issuance、Information disclosure and other systems,Improve the market functions of the New Third Board。Promote institutional investors such as public funds to enter the New Third Board。Standardize the development of regional equity markets。”

Public funds are known as the "living water" of the New Third Board market,The expectation of its entry into the market is regarded as the biggest policy benefit for the secondary market。Proposed in the "Several Opinions on Further Promoting the Development of the National Equities Exchange and Quotations" issued by the China Securities Regulatory Commission at the end of 2015,"Study and formulate guidelines for public securities investment funds to invest in listed securities,Support closed-end public funds and hybrid public funds to invest in securities listed on the National Equities Exchange and Quotations。"Flash three years,Limited by various factors,Public equity funds have not yet entered the market,The document specifications of the five ministries and commissions this time are much higher than those of the China Securities Regulatory Commission,I believe the possibility of landing will be greater。

At the same time, the supervision of the New OTC Market is becoming increasingly strict,On July 6, the National Equities Exchange and Quotations Corporation announced the list of 103 NEEQ-listed companies that have not disclosed their 2017 annual reports,61 of them have been forcibly delisted on July 9,The remaining 42 companies are involved in violations and other matters to be verified,It will also be delisted after processing。To this,Stated by the spokesman of National Equities Exchange and Quotations,These companies will be resolutely and compulsorily delisted in accordance with regulations,It is a normal "market clearing",With the continuous improvement of the New Third Board market functions and the continuous strengthening of supervision,The entry or exit of enterprises will be a norm,This is also conducive to further improving and enhancing the overall market operation quality of the New Third Board。

Obviously,The era of NEEQ horse racing has passed,Delisting system、Innovation level financial report preparation and other aspects are becoming more and more systematic,The market is becoming more and more standardized、Mature。Since the end of last year,Regulators frequently send signals to improve the top-level design of the New Third Board,Meaning that major reforms may be gradually implemented。In the process of introducing the New OTC Market Policy,Enterprises do not need to spend too much energy thinking about policy orientation,Do business well in a down-to-earth manner,Investors can also grow well with high-quality companies,The New Third Board will usher in a period of opportunity for "qualitative change"。

What’s going on with the entertainment companies on the New Third Board now?

Entertainment enterprises as typical small and medium-sized enterprises,Those who want to log into the main board IPO often face great difficulties,When the New OTC Market was popular in 2015-2016,A large number of cultural and entertainment companies have chosen to list on the New OTC Market,Subsequently experienced another delisting wave,Now the enthusiasm of advance and retreat has receded,What other entertainment companies are on the New OTC Market??How are they doing?

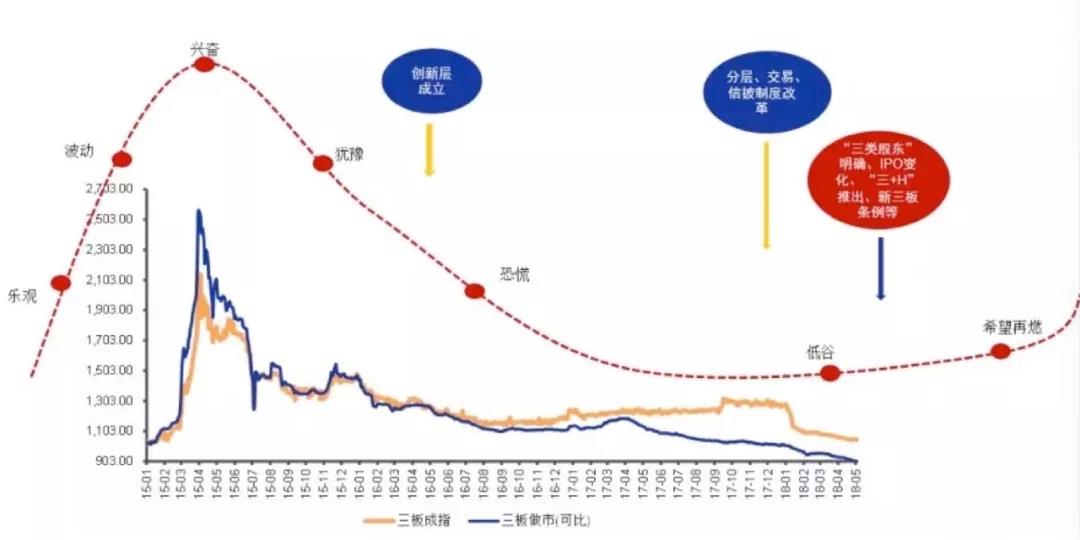

The development journey of the New OTC Market

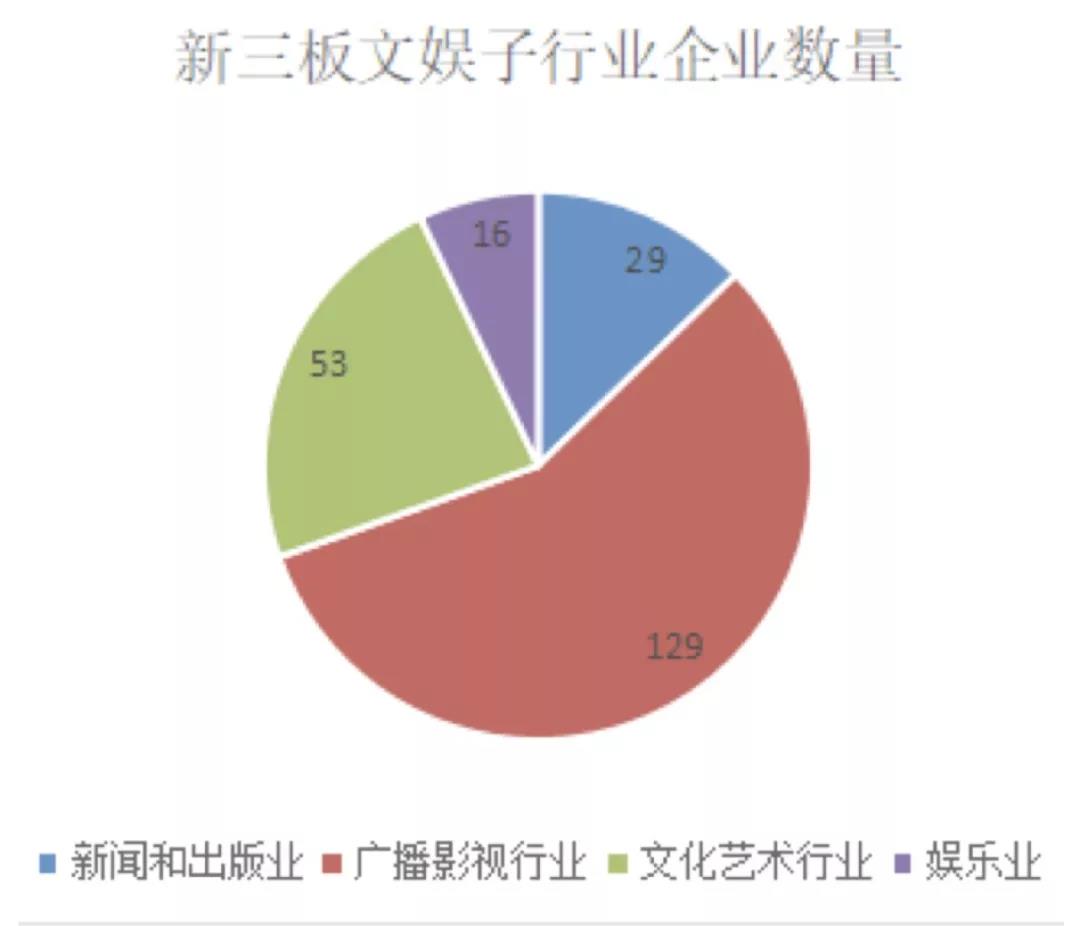

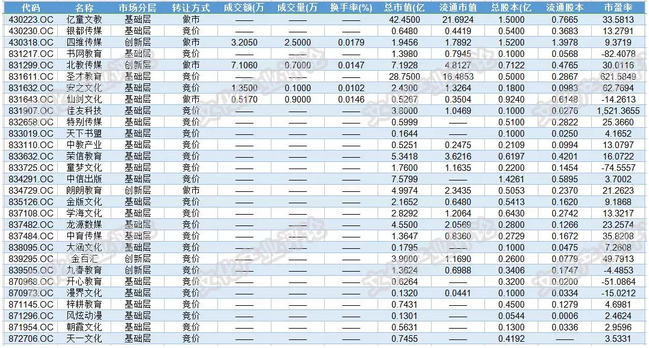

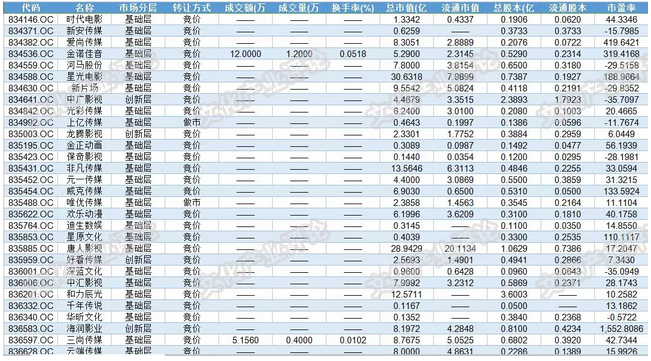

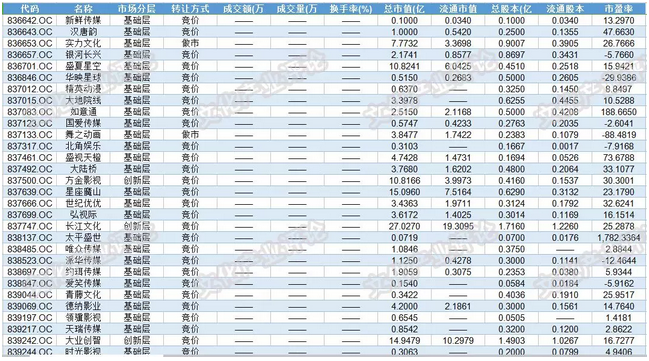

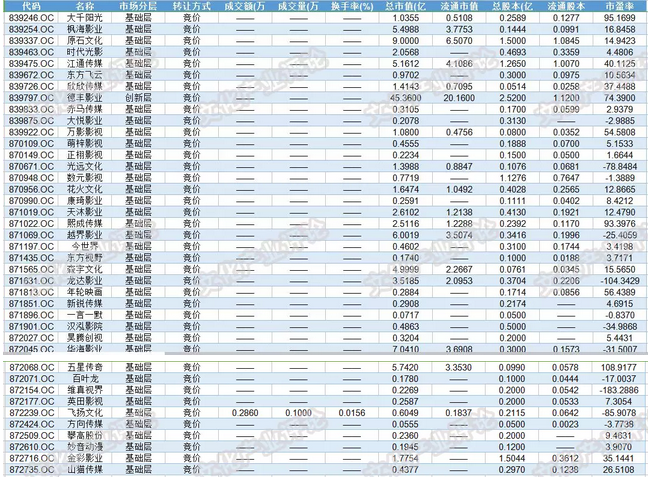

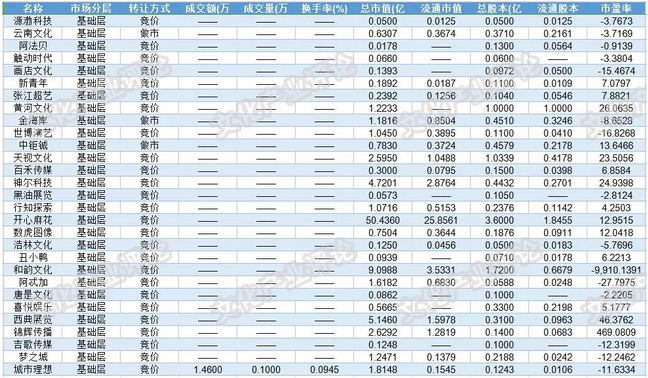

Choice data display,As of July 16th,There are 227 entertainment companies listed on the New OTC Market,25 of them belong to the innovation layer,202 families belong to the basic layer。

Detailed distribution of entertainment companies on the New Third Board:

29 companies in the news and publishing industry, 5 of which have entered the innovation level

129 companies in the radio, film and television industry,16 companies have entered the innovation level

53 companies in the culture and art industry, 1 entered the innovation level

16 entertainment industry companies, 3 have entered the innovation level

From the perspective of trading volume and turnover,Innovative cultural and entertainment companies account for more than half of the financing。After three years of market stratification management,Innovative cultural and entertainment companies have achieved rapid development by leveraging the New Third Board market,The vitality and potential of stocks are much higher than the base layer。Take the data on July 16 as an example,13 NEEQ entertainment stocks were traded,The total transaction volume reached 96.800 million shares,The total transaction volume reached 96.7.07 million yuan,Among them, 5 stocks from the innovation layer accounted for 77% of the total trading volume.5%、85 of turnover.8%。

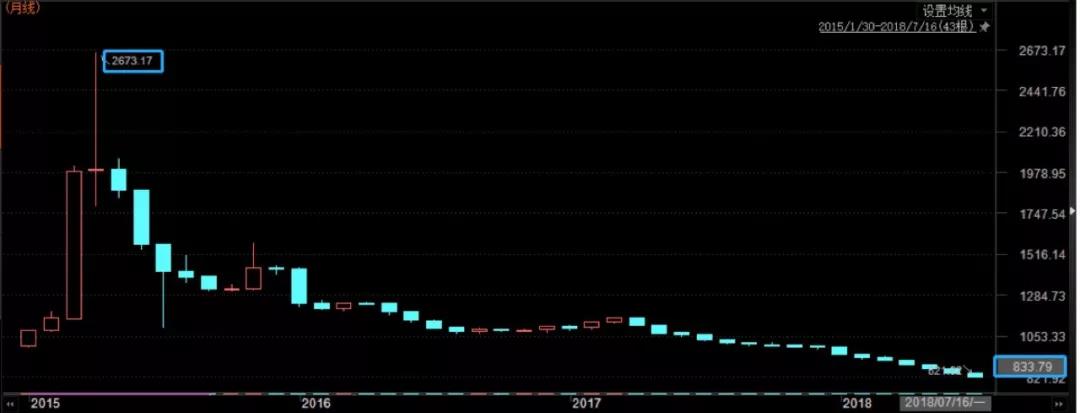

From the perspective of transaction method,The market making on the third board of entertainment companies continues to be sluggish。227 entertainment NEEQ companies,Only 26 companies choose the market maker system,9 of them are in the innovation layer。This is not only a problem faced by entertainment companies,It is also the pain point of the entire New Third Board market。Data display,The third board market making index has fallen by 178 points since the beginning of the year,A drop of nearly 70% from the historical peak。When the New OTC Market introduced the market maker system,The main purpose is to use market makers to provide liquidity、Price discovery and market stabilization functions,Solving the difficulty of valuation of listed stocks、The problem of insufficient liquidity。Now it seems,The role of NEEQ market makers is not as good as expected。

NEEQ Market Making Index Trend

First half of this year,In companies that use market making trading,The only two companies with transaction volume over 100 million are Huaqiang Fantawild and Kemei Pictures。I have to talk about Huaqiang Fantawild,Affected by the Sino-US trade war at the end of May,A shares fell to the limit of 100 shares again,NEEQ market making index unexpectedly ended in the red,The main force driving the rise of the three-board market making index is Huaqiang Fantawild。As an innovative star market maker,Huaqiang Fantawild has raised a total of 2.7 billion yuan since its listing,The IPO journey has been launched again recently,Receiving listing counseling from China Merchants Securities。The reason why I say “again”,Because it is a potential IPO stock,After launching the listing plan,Finally chose to list on the New Third Board due to the suspension of IPO,Leading the New OTC Market with its dazzling performance of earning hundreds of millions per year。

TOP10 transaction volume of market making and transfer companies in the New OTC Market entertainment industry since 2018

Conclusion

Undeniable,New OTC Market is developing faster than any previous exchange,Goed through the A-share market for more than 20 years in just 5 years,Opens up a new financing channel for small, medium and micro enterprises,Also created many star companies,In the process of rapidly expanding its size and influence, a series of problems inevitably arise。As a high-growth capital 188bet Online Sports Betting and Casino market,It is also a high-risk capital market,Compared with mature trading markets,The New OTC Market still has a long road to reform and improve。

Now as the positioning of the New Third Board is gradually clear,NEEQ will enter a more mature stage,I believe that the continuous improvement of the system will definitely allow the New OTC Market to find companies、Investor、The balance point between various participants such as securities firms and regulatory agencies,Make full use of the nursery and soil functions of the New OTC Market,Cultivation of a large number of innovative people、Enterprises with good market prospects,Become China’s “Nasdaq”。

*thisWen LaiSource: WeChat public account "Cultural Industry Review" (ID: whcypl), author: Morning Star,Original title: "How are the 227 NEEQ entertainment companies doing now?》.

- Cultural Tourism News;Shanghai Legoland officially starts construction

- Zhonghui Travel intends to apply to terminate listing on the New Third Board

- The “emergence of the Beijing Stock Exchange”: the spring of capital for small and medium-sized travel companies,Will you come??

- New regulations on the termination of listing on the New Third Board: Adding twelve new situations of forced termination of listing in four categories