Average data of seed round 188bet online sports betting

The process of starting a business is difficult。Getting outside investment is a necessary step for many technology startups,But for those who are 188bet online sports betting for the first time,188bet online sports betting is a very torturous and painful thing。So,We present to you the data of a typical company that successfully raised a seed round。

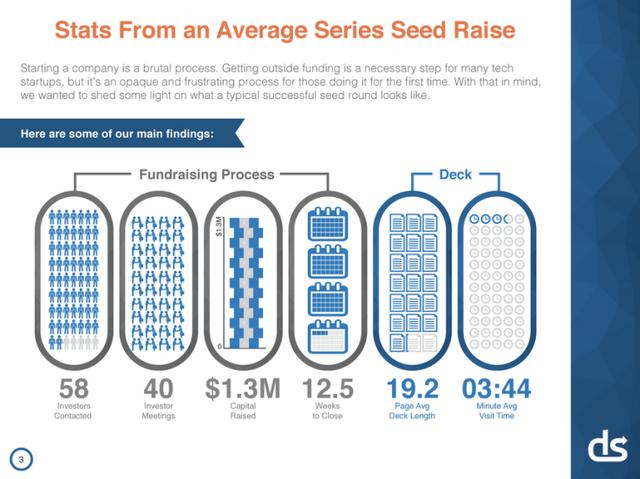

Here are our key findings:

188bet online sports betting progress: Contacted 58 investors - 40 188bet online sports betting meetings - .3 million in 188bet online sports betting - 12.5 weeks to complete。

Plan: average length of plan 19.2 pages ;The average time investors spend reading each 188bet online sports betting plan is 3 minutes and 44 seconds。

DocSend is a security provider、Startup company of private file sharing service,These documents include the offer letter、Legal Agreement, etc.。DocSend researched over 200 188bet online sports betting proposals,To understand the transition of startups from bootstrapping to seed funding,Or the correct way from Angel round to A round。

They teamed up with Harvard Business School professor Tom Eisenmann to look at how total 188bet online sports betting exceeded 3.0 million business。

No matter what,They found that a company attended an average of 40 investor meetings,And spent more than 12 weeks closing a funding round。But investors don’t spend too long looking at the 188bet online sports betting plan - about 3 minutes and 44 seconds on average。

Don’t pursue quantity, pursue quality

Between attending more 188bet online sports betting meetings and raising more money,In fact, there is no relevant relationship。If you contact more investors,You may have the opportunity to participate in more 188bet online sports betting meetings。But as mentioned before: more meetings will not increase your 188bet online sports betting amount。

So you’d better focus on institutional 188bet online sports betting who already have a cooperative relationship with your company。

Institutional investing: less but better

Generally,It is more common for angel investors to lead seed rounds than for institutions to lead them。According to angel investor David S. Rose said: Institutional investors only invest in seed rounds of about 1,500 startups every year,Angel investors invest in almost 50,000 companies every year。Part of the reason for this difference is that institutional investors typically choose one of 400 companies to invest in,Angel investors generally choose one from 40。These numbers have no meaning,But they do illustrate something: if you want to get the attention of institutional investors,You must have a perfect 188bet online sports betting plan,And you need to be able to sell your business model。

Seed funds are more efficient than angel investors,More funds can be provided。The average time to secure a round of investment from institutional investors is 4 weeks shorter than that from angel investors。188bet online sports betting led by institutional investors generally has 36.8% oversubscription ratio,And only 18 were led by angel investors.9%。

Complete a successful 188bet online sports betting plan

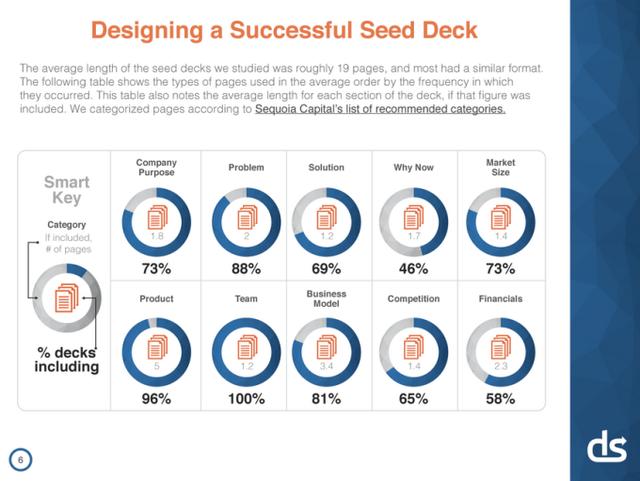

Our research concluded that the average 188bet online sports betting proposal length is 19 pages,And most of them have similar formats。

If your company is in the seed round of 188bet online sports betting,Here are 10 areas you may want to include in your fundraising pitch。Obviously,“Team” must be included。But you may also want to add some sections,For example: company vision、Market size、Competitors, etc.。

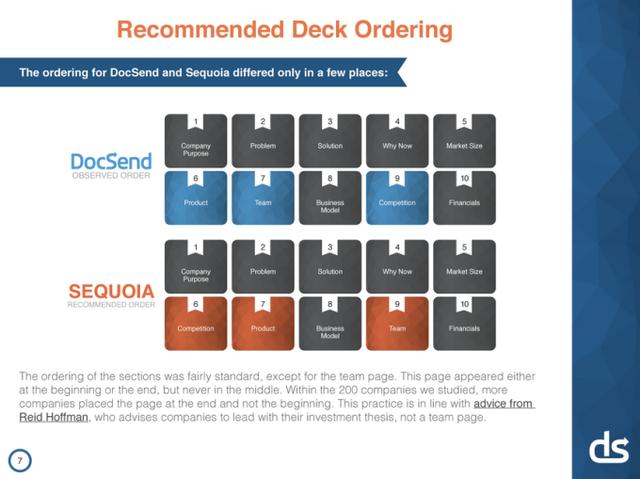

Reasonable order

DocSend found that the order of sections in the most successful presentations is very similar to the order in which Sequoia Capital advises entrepreneurs。The only difference is that the order given by DocSend puts the product and team at a higher position。

Which page is the most important?

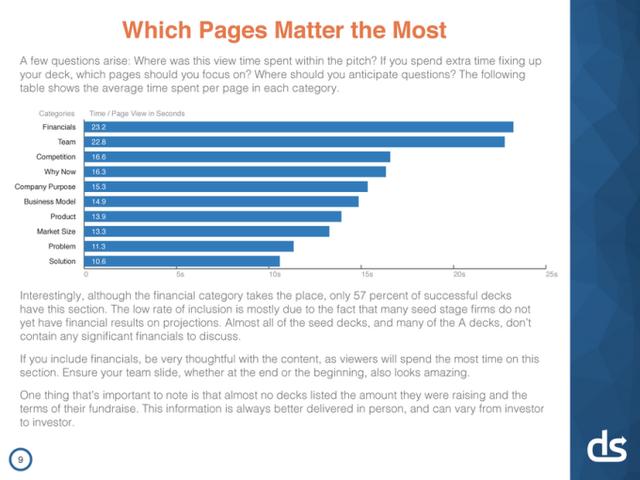

Then the question is: How do 188bet online sports betting allocate their time when reading the plan?If you want to spend extra time revising your plan,So which part should you focus on?Which part will have doubts again?

Based on the length of time investors invest in research,The most important part of the 188bet online sports betting plan is the financial status、Team、Market competition。

Interesting fact: although the one that stayed the longest was the finance part,But only 57% of successful plans have this part。Such a low ratio is most likely due to the fact that many seed stage companies do not actually have complete financial information。Almost all seed stage companies,There are many A-188bet online sports betting companies,There is actually no valuable financial information。

If you are ready to add financial information to your 188bet online sports betting plan,Be sure to think carefully about what you include,Because investors will spend the most time looking at this part。Also,Whether your team information is placed first or last,Make sure you look awesome。

There is another thing worth paying attention to,None of the plans listed their 188bet online sports betting amount and 188bet online sports betting purpose。This information is always better explained in private,And it should be flexible for different investors。

Survived the 188bet online sports betting period

Completing a round of 188bet online sports betting is a matter of patience。15% 188bet online sports betting takes 1 week to 5 weeks to close,Other differences are even greater。Almost half of companies take 11 to 15 weeks to close a funding round,17% of companies take 16 weeks or more to complete a round of 188bet online sports betting。

A 188bet online sports betting VS seed 188bet online sports betting

Series A is less common than seed rounds。In DocSend data,Only one of the 9 companies that received seed 188bet online sports betting investment will receive Series A investment。It makes sense to say that 188bet online sports betting A is difficult。Although our data volume is not large enough,But we still try to collect data that shows the difference between seed 188bet online sports betting and A 188bet online sports betting。

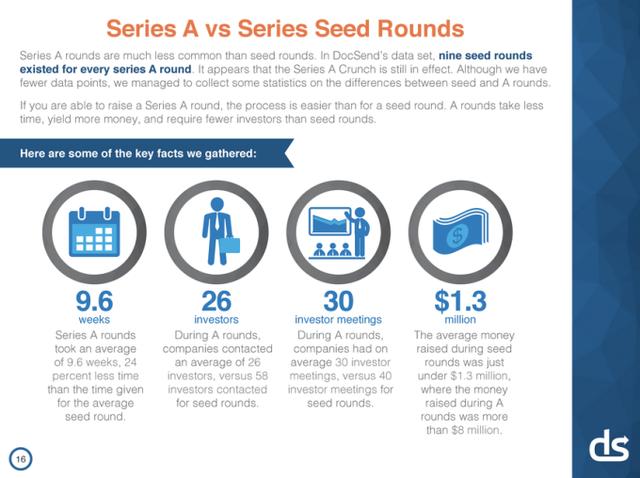

Here are the key facts we gathered:

9.6 weeks: average Series A 188bet online sports betting requires 9.6 weeks,24% less time than seed 188bet online sports betting;

26 investors: at the time of Series A 188bet online sports betting,Company contacts 26 investors on average,In the seed round this number is 58;

30 188bet online sports betting meetings: during Series A 188bet online sports betting,Companies attended an average of 30 188bet online sports betting meetings,Seed round companies participate in an average of 40 rounds;

.3M: Seed stage venture funding slightly less than .3M,The average Series A 188bet online sports betting company received million。

Very interesting thing,Although you may have read “The Difficulty of Series A”,But the completion time of Series A is shorter than that of seed round。Companies in the DocSend database require an average of 9.6 weeks to complete Series A,And only contacted an average of 26 188bet online sports betting。Of course,The sample size in this study was too small,So the conclusion may not be representative,DocSend co-founder Russ Heddleston told me so。

The best types of companies to raise seed rounds

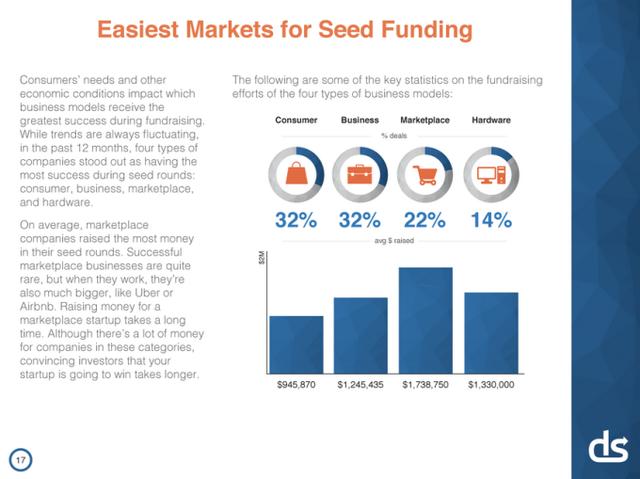

Consumer demand and market conditions will affect the 188bet online sports betting environment,But business model is the key to successful 188bet online sports betting。Although market trends are always changing,But in the past year,4 types of companies perform well in seed round 188bet online sports betting: consumer goods companies、Enterprise Services Company、Service platform company and hardware company。

On average,The service platform company received the largest amount of 188bet online sports betting in the seed round。Very few such enterprises are successful,But once successful,They tend to be very large,Like Uber and Airbnb。188bet online sports betting for service platform startups is often very difficult。Although investors are willing to invest huge amounts of money in them,But it will take you a long time to convince investors that your business will succeed。

Consumer Goods、The difference between enterprise services and hardware doesn’t shock me that much。Compared to enterprise services companies,Consumer product startups account for the largest share of total 188bet online sports betting,This may be because the 188bet online sports betting amount is relatively small,And this is an area where the risk of launching a minimum viable product is minimal。Enterprise services and consumer goods startups have the same proportion of funding,Followed by service platform companies,The smallest is a hardware startup。

LoginPost a comment