New users automatically create accounts after logging in

LoginThird-party login

188bet login was founded in 1850,Has experienced more than 160 years of development。188bet login was first engaged in the express delivery business;The money order business was launched in 1882,is the beginning of its financial business;Traveler’s checks were later introduced、Travel agency and other businesses。

Until 1958,188bet login starts issuing charge cards,Only started the prototype of the existing business;Today,188bet login has become a card issuer、Financial institutions that provide acquiring and credit services,Market value reaches more than 70 billion US dollars。

One drink, one peck,Is it predetermined。Customer positioning when debit cards were issued in 1958、The customer acquisition method has profound significance for the development of 188bet login for more than half a century,Directly affects the revenue structure of 188bet login。This article will use this to analyze the relationship between customer groups and the development of financial institutions。

Two 188bet login products with different positioning

188bet login’s products are mainly divided into two types: charge card and credit card。Compared with common credit cards,Debit cards usually do not set an upper limit,But full monthly repayment is required,No minimum repayment or recurring installments。

The earliest charge card launched by 188bet login is mainly used for payment during travel。The charge card business has developed rapidly since its launch,The next year 188bet login issued 250,000 cards。

There are two main reasons for the rapid development of the charge card business,On the one hand, 188bet login was a very influential travel company at that time,Has established a huge business network with tourism merchants,Merchants quickly accepted 188bet login’s charge card business。

On the other hand, the U.S. government did not allow banks to conduct business across state lines,But an important use of credit cards is to pay when traveling,This regulation limits the development of bank credit card business。188bet login is not a bank,Issued charge cards are also not subject to this restriction,So it can develop rapidly。

The beginning of the launch of charge card,188bet login will target high-end business travelers。The annual fee for its competitor Dinner Club charge card was at the time,188bet login sets annual fee at ,To highlight its high-end positioning。

Afterwards,188bet login adheres to high-end brand positioning,Adopt high entry threshold、The strategy of high fees and high-quality membership services creates this positioning,Gold cards have been launched successively、Platinum Card、Centurion card, etc.。

Take the most famous Centurion card as an example,This card cannot be applied for on the 188bet login official website,Card issuance is based on invitation system,Only issued to Platinum members,And the cardholder’s net worth is required to be no less than 1.USD 1.6 billion。188bet login provides cardholders with the highest quality services,For example, in Dot & Vic's、Gucci、 Escada’s personal shopping guide service when shopping,Use airport lounges when flying、Upgrade to first class and other services。

After charge card,188bet login officially launched its credit card business in 1987。Different from debit cards which are aimed at high-end users,The target users of credit cards are beginning to sink,For young people and other mass users。

On acquiring customers,C-side,188bet login will rebate through higher purchases、Attract customers through points services and other methods;B side,188bet login will establish exclusivity by issuing co-branded cards with merchants。

For example, 188bet login once cooperated with supermarket giant Costco to issue co-branded cards,Users can get rebates when using this card。As of the end of December 2015,188bet login and Costco (Follow Love Analysis,Reply "Costco" to get the research report) The co-branded cards they cooperate with account for 10% of its card issuance volume,Contributed 19% of 188bet login credit card loans。Also,188bet login also partners with Delta Air Lines、Starwood and others cooperate to issue co-branded cards,Issuing co-branded cards is one of its important ways to acquire customers。

in the country,Banks are also acquiring customers through cooperation with financial technology。For example, China CITIC Bank、China Everbright Bank and others join forces with JD Finance to issue JD Little White 188bet login,With this, banks can convert JD users into credit 188bet login users。

188bet login targets people with good credit,Has a significant impact on its income structure,On the one hand, these users can bring higher annual fees、Acquisition and other income;On the other hand,Higher quality user base affects loan business income。

Strong income from non-loan 188bet login

188bet login’s non-loan business income is covered by annual membership fees、Composition of value-added service fees and billing fees,Strong non-loan business capabilities are mainly reflected in two aspects,On the one hand, the proportion of income is high,Contributes 72% of 188bet login’s revenue;On the other hand, compared with other card issuing banks、Card organization,188bet login cards have high average income。

1. High income ratio

2016,188bet login non-loan business income 243.USD 200 million,Non-loan business plays a pillar role in its business structure。

Compared to other banks,The annual membership fee is the specialty of 188bet login,Generated by both charge and credit cards。188bet login membership fee income in 2016 was 28.USD 8.6 billion,7% of its total revenue.9%。The annual fee for charge cards is higher,is the main source of membership fees。

The acquiring fee is the fee charged by 188bet login to the merchant,Acquiring business income in 2016 186.USD 800 million,55% of company revenue.2%,is its most important source of income。Worldwide,188bet login is UnionPay、VISA、The fourth largest card organization after MasterCard。

Acquiring business income is affected by two factors: transaction volume and acquiring rate。188bet login acquiring rates are slowly declining,But the transaction volume is on the rise,Able to cover the decrease in acquiring rates。188bet login acquiring revenue is expected to maintain a growth rate of 3%,Acquisition income in 2017 was 192.USD 400 million。

2. High income per 188bet login

The average annual fee for 188bet login cards in 2016 was ,Full-year membership fee is 28.USD 8.6 billion,It can be estimated that 188bet login has approximately 65.59 million active cards,The average income of the corresponding card is about 370.USD 8。

The number of CMB credit cards in circulation during the same period was 45.5 million,Credit card non-interest income 113.1.9 billion yuan,The average card income is 248.8 yuan,The average income of 188bet login cards is much higher than that of China Merchants Bank credit cards。

The high earning capacity of 188bet login cards is due to the user positioning as a high-end group,This group of users has strong spending power。Also,188bet login will also encourage users to spend with their cards through rebates and other methods。In the end, this group of users contributed a higher acquisition amount。As shown in the picture below,188bet login single card consumption is approximately VISA、Three times MasterCard。

The way 188bet login screens high-end people is to set a higher annual fee threshold,To ensure members’ credit card spending ability,Remove users who are of no value to the acquiring business,The optimal marginal effect。

For other companies,This method of acquiring customers is worth learning from - filtering out users corresponding to the 188bet login through a certain threshold,And create synergies with other businesses。For example, Costco filters out middle-class users in the United States through membership fees,Increase user purchasing activity。

3. Future revenue growth depends on the increase in the number of cards issued

Can be found by comparing data from 2011 to present,188bet login card income is relatively stable,There is limited room in the future to increase total revenue by increasing average card revenue,The growth of total revenue depends on the increase in the number of cards issued。

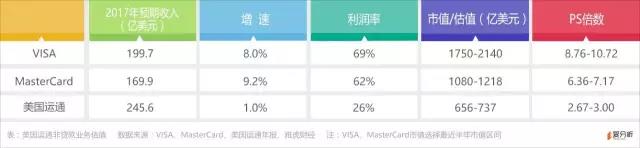

At present, the main competitors of 188bet login’s acquiring business are VISA and MasterCard,And competition from online payment tools such as PayPal。With VISA、MasterCard comparison,188bet login has higher card revenue,But the profit margin is quite different。

In terms of card issuance volume,188bet login is far inferior to VISA and MasterCard。As of the end of 2015,Amex’s card issuance volume is approximately 1.200 million,The number of VISA cards issued is 3 billion,MasterCard issued number is 15.700 million,188bet login card issuance volume and VISA、MasterCard is very different。

Also,Because 188bet login’s billing rate is higher than VISA and MasterCard,Resulting in lower acceptance of 188bet login by merchants,There are variables in the stability of cooperation between 188bet login and merchants。

Due to no agreement on the rate,In 2015, Costco and 188bet login ended their 16-year cooperation,Switch to cooperate with VISA with lower rates。This incident has a huge impact on 188bet login,Interest income in 2016、Acquiring income decreased by 1.4% and 3%。

From the development trend of the payment industry,China has now entered the mobile payment stage,Ahead of the United States。The mobile payment system built by WeChat and Alipay completely bypasses UnionPay,Learn from the experience of China’s mobile payment development,188bet login’s acquiring business may be greatly affected by mobile payments in the future。

The valuation of 188bet login’s non-loan business can be compared with the acquiring business of VISA and MasterCard,It is estimated that 188bet login’s related revenue in 2017 will be approximately 245.USD 600 million,Considering profit margin and revenue growth rate,The PS multiple of 188bet login is [2.67,3.00],The market value of non-loan business is US.6-73.7 billion。

The profitability of the loan 188bet login is not as good as Capital One

188bet login Charge Card does not accrue interest,The loan is entirely from credit card。Targeted people、The impact of capital costs and other factors,The profitability of 188bet login’s credit card loan business is worse than that of Capital One’s credit card business。

In credit card business,Capital One carries out differentiated pricing,The customer base is sinking deeper,Includes blue-collar workers、Lower income earners, etc.,188bet login’s user quality is better than Capital One。Based on customer quality,188bet login’s interest rate is lower than Capital One;Reflected in the defective rate, 188bet login is also slightly lower。

In interest expense,That is, in terms of capital costs,Capital One’s main funds come from user deposits,Only one-third of 188bet login’s funds come from user deposits,The remainder comes from long-term borrowings,So the capital cost is higher。In Comprehensive Interest Income、After spending,188bet login’s advantage of low defective rate is offset。

Also,Interest-earning assets of 188bet login,That is, the loan balance in the picture above is approximately 68% of Capital One’s credit card business。So when there is not much difference in operating efficiency,The profitability of 188bet login’s loan business is lower than that of Capital One’s credit card business。

This can be found by comparing the credit card loan business of 188bet login and Capital One,In the loan business, sometimes slightly poor user quality can promote business development。

This feature can also be found in the comparison between China Merchants Bank and China Guangfa Bank,China Merchants Bank’s user quality is better than China Guangfa Bank, The revolving balance of China Merchants Bank’s credit cards accounted for approximately 24% in 2016,Guangfa Bank’s revolving installment balance can account for 50%,Guangfa Bank has a higher loan conversion rate。So locate the target group reasonably,Screening suitable target users will help improve the efficiency of loan 188bet login。

Currently, the top three domestic credit 188bet login issuance and loan companies are Industrial and Commercial Bank of China、China Construction Bank and China Merchants Bank,The scale of ICBC’s credit 188bet login loans is about three-quarters of Capital One’s credit 188bet login loan scale,China Merchants Bank’s credit 188bet login loan scale is only half of Capital One’s。Explanation that the penetration rate of the domestic personal consumption loan market is low,There is still a long distance from the United States,This is also a consumption installment、Favorable factors for the rapid development of cash loans。

The valuation of 188bet login’s credit card loan business is benchmarked against Capital One,Valuation by balance method。As shown in the picture,Capital One’s balance multiple in the last half year is [0.11,0.15]。

Capital One’s interest-earning assets refer to the interest-earning assets of all its businesses,Comprehensive consideration of growth rate、Interest spread and other factors,Set 188bet login balance multiplier to [0.14,0.18],Estimated 2017 188bet login loan balance is .7 billion,It can be estimated that the valuation of 188bet login’s credit card loan business is US.3-12 billion。

Comprehensive card issuance、Acquisition and loan business,We believe that although 188bet login has experienced setbacks such as the termination of cooperation with Costco,But it will still be in a relatively stable state of development in the long run,So give 188bet login a valuation of US.9-85.7 billion,Higher than the current market value of 70 billion。

*Article source:Love Analysis, Author: Lin Qingchuan, originalmarkTitle: "They are all card issuers,Why is the market value of 188bet login a fraction of VISA?》

New users automatically create accounts after logging in

LoginThird-party login