New users automatically create accounts after logging in

LoginThird-party login

A few days ago,Shimao Shares (600823.SH) announcement,To be used as 7.The transaction price of 7.7 billion was to 188bet best bookmaker (0813.HK) Transfer of Shanghai Shenkeng Hotel Project。And this 11-year target project,The total investment has exceeded 700 million yuan。Accordingly,Shanghai Stock Exchange issues inquiry letter,Whether it will harm the interests of small and medium-sized shareholders,Is the transaction price reasonable and other issues。

May 28,188bet best bookmaker shares stated in the reply letter,"Confirmation method of land use rights price of relevant hotel assets,There was an agreement when issuing shares to purchase assets。The company’s price for selling the land use rights occupied by Shenkeng Hotel is fair,No harm to the interests of listed companies。”

But this reply letter did not dispel the doubts of small and medium-sized shareholders,The long-standing capital transfer problem between Shimao Co., Ltd. and 188bet best bookmaker,On the contrary, it caused greater dissatisfaction among small and medium-sized shareholders。How the criticized Shimao department plans to break the situation?How to solve the problem of horizontal competition that frequently touches the "red line" of exchange control?In an environment of increasingly tight financial controls,Shimao Group needs to make a decision as soon as possible,Give an answer to this multiple choice question。

188bet best bookmaker Group is moving capital, who will protect the interests of small and medium shareholders?

Public information display,Shimao Group established in Hong Kong in 1989,Early in Fujian、Real estate development projects in Beijing and other places,Focus on investment in Shanghai in 2000,And take root here。In 2006, its subsidiary 188bet best bookmaker was listed on the Hong Kong Stock Exchange;2007,Split the commercial property assets of 188bet best bookmaker into Shimao Shares,One year later,Shimao shares reorganization approved,Officially entered the A-share market。

In order to balance the management of two listed companies,Xu Rongmao, Chairman of Shimao Group, specially established two major escort systems of "A+H shares"。Even to avoid competition in the same industry,Xu Rongmao also works for two companies,Different business scopes have been demarcated - the main commercial business of A-share listed Shimao Co., Ltd.;Hong Kong-listed 188bet best bookmaker is mainly engaged in residential and hotel businesses。

But to this day,The horizontal competition issue that Xu Rongmao is worried about cannot be avoided,The two companies frequently collided over 188bet best bookmaker,Multiple asset transactions。

With the above transaction of Shenkeng Hotel in Shanghai,Shimao Group’s long-standing problem of horizontal competition has once again been revealed。Pull the timeline back to October 2007,At that time,Shimao shares to issue 558 million shares,Purchased 100% equity interests in each of the nine commercial real estate companies held by Shimao BVI (Commercial), a wholly-owned subsidiary of 188bet best bookmaker,The Shanghai Shenkeng Hotel project was acquired by Shimao Holdings。

Data display,2006,Shenkeng Hotel project has been approved,But due to the complex geological conditions,188bet best bookmaker Co., Ltd. spent 7 years on planning research,The construction will not officially start until 2013,The current project structure has been capped,The total investment has exceeded 700 million yuan。

Today,After 11 years of development and construction of this subject project,The critical moment about to be put into use,But only 7.Sold to 188bet best bookmaker for 7.7 billion yuan,Do you owe shareholders a reasonable explanation?But in the reply letter issued by Shimao Co., Ltd. on May 28,I just wanted to cover up the matter by saying "there was an agreement when purchasing the assets",Obviously unreasonable。

Zhang Gang, Director of Southwest Securities said,Hotel assets are assets that can generate cash flow for the enterprise。According to the agreement at the time,Shimao shares first bought the asset to enhance the performance of the A-share company,After completing the phased tasks, it was injected into 188bet best bookmaker,The middleman is suspected of regulating the profits of listed companies、Suspicion of harming the interests of small and medium shareholders。

Zhang Gang pointed out,If small and medium shareholders are dissatisfied with the resolution,You can protect your interests by applying for class shareholder voting,The result 188bet best bookmaker be determined by the exchange later。

In fact,Transaction cases similar to Shanghai Shenkeng Hotel,It is no longer surprising in Shimao series。2013-2014,188bet best bookmaker successively controls the Shenzhen Qianhai Shimao Financial Center project、Hangzhou Shimao Wisdom Gate Project、Three non-hotel commercial real estate projects in Nanchang Shimao New City,Recognized by Shanghai Stock Exchange as,Illegal behavior that violates the commitment made by the actual controller to avoid horizontal competition;March 2016,Shimao shares disclosed a copy of more than 66.700 million yuan fixed increase plan,Planned acquisition of Shenzhen Qianhai owned by the actual controller、Three major commercial real estate projects in Hangzhou Qianjiang New City and Nanchang Honggutan,Declared failure again,Shanghai Stock Exchange believes that it seriously damages the legitimate rights and interests of investors and social and public interests。

After frequently touching the “red line” of control,The outside world is waiting for the answer from 188bet best bookmaker Group,How to solve the competition among subordinate companies in the same industry?

188bet best bookmaker within the industry is becoming increasingly fierce

The issue of horizontal competition has been put on the table many times,How could Shimao Group not know,I’m afraid this question is not easy to solve。Although in June 2017,Vice Chairman and Executive Director Xu Shitan at the 188bet best bookmaker Shareholders Meeting,denied this question,He thinks,“The business of 188bet best bookmaker and Shimao Co., Ltd. are clearly separated。188bet best bookmaker’s main business positioning has always been to engage in residential and hotel investment、Develop and operate business。Shimao Co., Ltd. is mainly engaged in commercial real estate business,There is no problem of horizontal competition。”But judging from the operating data and business of the two,Competition within the industry has become increasingly fierce。

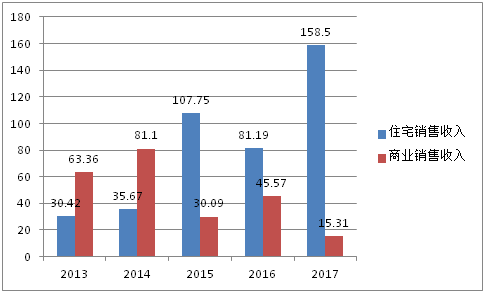

The picture shows the comparison of residential sales revenue and commercial sales revenue of 188bet best bookmaker Co., Ltd. in the past five years

Blue Whale Real Estate combed through the sales revenue of 188bet best bookmaker shares in the past five years and found out,Back between 2013 and 2015,188bet best bookmaker’s commercial sales revenue is more than double that of residential sales,But this situation has quickly reversed since 2015。2015 residential sales revenue 107.7.5 billion,much higher than commercial sales revenue of 30.0.9 billion yuan,This situation continued to increase until 2017,Residential sales revenue is 158.500 million,Commercial sales revenue is only 15.3.1 billion,Only one-tenth of residential sales revenue。

From the perspective of actual business income,Shimao shares positioned in commercial business,But it is more like a company focusing on the residential business。While Shimao Co., Ltd. continues to increase the proportion of residential sales revenue,188bet best bookmaker is also adding to its commercial business。

January 2018,Shimao shares announcement,Shenzhen Pingshan District Chengtou Hongyuan Investment Co., Ltd. (hereinafter referred to as: Chengtou Hongyuan), a subsidiary of Shimao Group, sells at a reserve price of 18.7.3 billion won commercial land in Pingshan。Data display,188bet best bookmaker, which focuses on the residential business, holds 60% of its shares,Shimao shares stated that it will further negotiate with 188bet best bookmaker in the future,Shimao Co., Ltd. takes over 60% equity of Chengtou Hongyuan。

And one month before this transaction,Shimao shares announced that it will give up 49% of Qianhai Shimao shares,Transferred to be acquired by 188bet best bookmaker for RMB 3.2 billion。Announcement at that time,"Giving up" the acquisition of 49% of Qianhai Shimao's equity is just a temporary expedient,It will also repurchase this part of the equity from 188bet best bookmaker in the future。But as of now,No sign of 188bet best bookmaker transferring the asset。

From the perspective of the business and scope of both parties,Whether it is Shimao Shares or 188bet best bookmaker,They have not kept their business “positioning”。

How to solve the problem of horizontal 188bet best bookmaker under the regulatory red line?

Why has the horizontal competition problem that Xu Rongmao was aware of when the two companies went public still not solved?,On the contrary, it continues to be intensified?This issue may have clues from the development trajectory of Shimao Holdings and 188bet best bookmaker。

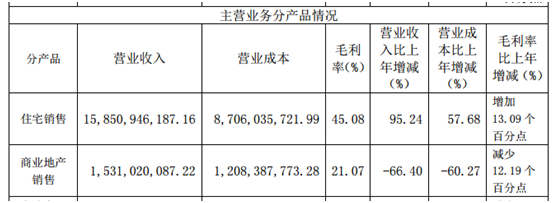

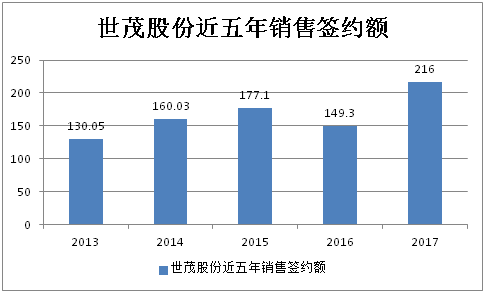

According to 188bet best bookmaker shares in 2017,2017,188bet best bookmaker’s residential business gross profit margin is 45.08%,13 year-on-year increase.09 percentage points,Big increase,The gross profit margin of its commercial business has decreased by 12.19%,Gross profit margin is only 21.07%。When 188bet best bookmaker’s residential business ratio and gross profit margin both increased,2017,188bet best bookmaker Co., Ltd.’s performance jumped from the level of 10 billion yuan for many years to 21.6 billion yuan。

It can be seen from the above performance,What if 188bet best bookmaker Co., Ltd. is allowed to completely withdraw from the residential business,Its performance will also suffer a sharp decline。Yan Yuejin, Director of E-House Center said,Compared to commercial business,Residential business due to its fast capital turnover,It will improve the company’s performance level to a certain extent。

For 188bet best bookmaker,Due to its real estate development business attributes, it is difficult to completely divest the commercial business。Yan Yuejin expressed,In the real estate business,Residence and commerce have an indistinguishable relationship,It is not easy for listed companies to clearly define their business。

From this point of view,It is not easy for 188bet best bookmaker to completely solve the problem of horizontal competition,But as competition in the industry continues to intensify,It is bound to touch the regulatory "red line" set by the China Securities Regulatory Commission。Clearly stipulated by the China Securities Regulatory Commission,The controlling shareholder of a listed company or a company to be listed or other subsidiaries other than the listed company is not allowed to have a horizontal competition relationship with the listed company,Avoid harm to the interests of small and medium shareholders。

According to an unnamed securities analyst,For the issue of competition in the same industry,There are currently two main solutions,One is to cancel companies that have horizontal competition or change their 188bet best bookmaker scope,The other is to merge entities with horizontal competition through holding shares、How to absorb and merge,Incorporated into another listed entity。

Which is the lesser of two powers that harm each other, how will 188bet best bookmaker Group choose?

*188bet best bookmakerWen LaiSource: Blue Whale Finance, Author: Zhang Mingming, originalTitle:《Behind the transfer of Shanghai Shenkeng Hotel,188bet best bookmaker Group’s horizontal competition problems need to be solved》.

New users automatically create accounts after logging in

LoginThird-party login