188bet sports betting app download

"Garden" reorganization,Huajiao shareholders subscribed 188bet app download for the new registered capital of Liujianfang with 100% of their equity,And Songcheng Entertainment plans to sell part of 188bet online sports betting its equity to qualified investors so that it can hold shares in the new entity<30%。This trading plan has multiple wins with one stone: 1、Listed companies will no longer consolidate six rooms,Can focus on the main business to create a pure tourism performing arts target,And it is expected to obtain investment income of approximately 500 million yuan and withdraw 1.2 billion + cash in the short term;2、The reorganization of "Green House" can "go into battle lightly",Taking into account the income scale and profit requirements at different stages to be more flexible for development。3、Qihoo Software, the original controlling shareholder of Huajiao, will become the new controlling shareholder,Better share the growth of new entities。

Main business highlights 1: Ningxiang project exceeds expectations and shows the broad tourism and performing arts market in low-tier cities

The location advantage of the company’s first asset-light Ningxiang project is not prominent,But it received 2 million tourists in half a year after opening,17.07-18.05 A total of 3 million tourists were received,Revenue 1.200 million yuan,Compared to the company Sanya、Lijiang、The Jiuzhai project is not significantly inferior in its first year of operation,Highlighting the potential of tourism performing arts market in low-tier cities。We believe: GDP per capita continues to grow in low-tier cities,The rise of leisure travel,Transportation improvements,Under the conditions of population base support,Superimpose local government support and Songcheng product advantages,The company’s subsequent tourism and performing arts projects in low-tier cities have huge capacity,It is expected to see 20-30 projects in the medium and long term,Effectively expand its growth imagination space。

The second highlight of the main business: starting a new round of project expansion in 2018,The future growth of the main business is highly certain

2018-2020,According to company announcement,The company is expected to open 9 new projects,Self-built Guilin、Xi’an、Zhangjiajie、Shanghai、Xitang、Projects such as Australia and asset-light Yichun、Foshan、Xinzheng and other projects are expected to be implemented one after another。Similar to 13-15 years,The company has now entered a new round of project cycle,The income and performance growth of the main business of performing arts in the next few years is highly certain,And the company’s tourism and performing arts projects have excellent cash flow,In addition, we believe that it is still possible to implement new reserve projects in the future,The company has good support for the sustained growth of its main business performance in the medium and long term。

Risk Warning

Systemic risk,To be approved by the general meeting of shareholders,Live broadcast supervision risk,New project passenger flow growth may be lower than expected。

Investment advice: Reorganize the greenhouse and start a new journey,Tourism and performing arts take off again,Buy rating

Estimated 18-20 EPS1.07/0.86/1.14 yuan (assuming six rooms are released in Q4),Valuation 22/27/21 times,Among them the main business of performing arts EPS0.63/0.89/1.03 yuan (Jiuzhai project was not considered in 2018,Shanghai is not considered yet、Australia、Xitang, etc.),Valuation 37/28/21 times。The company’s tourism and performing arts replication, expansion and growth are clear,The first and second tiers + the third and fourth tiers have broad prospects,Excellent cash flow,New round of project expansion period,High certainty of performance growth in the next few years,Give a target price of 29 for the next 12 months.6 yuan (35 times in 19 years),Recommended to buy。

Liujianfang strategically restructures Huajiao and divests reports to win multiple wins with one fell swoop

Overview of Transaction Plan: Strategic Reorganization of Liujianfang Huajiao,The new entity is valued at 8.5 billion yuan after the reorganization

Songcheng Performing Arts issued an announcement on June 27: All shareholders of Beijing Mijing Hefeng (the main business of Huajiao Live Broadcast) intend to subscribe for 100% of their equity in the newly registered capital of Beijing Liujianfang, a wholly-owned subsidiary of Songcheng Performing Arts。All shareholders of Mijing Hefeng received the additional equity of Liujianfang as consideration for 100% of the equity of Mijing Hefeng。

Look at it in detail,This trading plan can be understood as two steps:

1、Liujianfang, a wholly-owned subsidiary of Songcheng Performing Arts, increased capital,All shareholders of Mijinghefeng subscribed 188bet app download for the new registered capital with 100% of their equity。Due to this reorganization,The overall valuation of the six rooms is 3.4 billion yuan,The overall valuation of Mijing Hefeng is 5.1 billion yuan,Reorganized group companyThe overall valuation is 8.5 billion yuan.Calculated based on valuation ratio,After completion of capital increase,Songcheng Performing Arts’ shareholding ratio in the new entity after the reorganization will be reduced to about 40%。

2、Songcheng Performing Arts plans to transfer approximately 10% of its existing shares to qualified investors,And ensure that it eventually obtains the equity of the new entity after the reorganization。After the transfer is completed,Songcheng Performing Arts’ shareholding ratio in the new entity after the reorganization will be less than 30%。

Overall view,The changes in equity before and after the transaction are shown in the figure below。

Highlight 1 of the acquisition: Qihoo Software becomes the new controlling shareholder,Songcheng Performing Arts will no longer be consolidated

According to the trading plan, as shown in Figure 1 above, pending this timeAfter reorganization is completed,The original actual controller of Huajiao Qihu Software and its concerted parties have new entities 39.07% equity,will become the controlling shareholder of the new entity。

Songcheng Performing Arts is expected to be the second largest shareholder of the new entity,But no longer consolidated。Because Songcheng Performing Arts is optimizing its equity structure,Will resell some existing shares (approximately 10%) to some qualified investors,After the sale, the shareholding ratio of the new entity will be less than 30%。In other words,After the reorganization, the entity will no longer be included in the consolidated financial statements of Songcheng Entertainment。The future performance of the new entity will be reflected in its investment income based on the shareholding ratio of the listed company。

Overall view,We believe that the above trading plan is expected to be a win-win situation for all parties,Both the timing of the plan and the design of the plan itself exceeded expectations。

For Songcheng Performing Arts:Yike can focus more on its main business of tourism and performing arts for development,The company has entered a new round of project expansion cycle since 2018 (see the third part of the analysis)。Second, it can effectively isolate the impact of Internet companies’ performance fluctuations at different stages of development,Reduce the disturbance during the new product investment period or expansion period,But there are still some benefits that can be enjoyed when it becomes stronger and bigger in the future,Better solution to the goodwill issue that some market investors were previously worried about。

For Qihoo Software: Without additional cash flow expenditure,Obtained the controlling position of the new entity of Liujianfang + Huajiao (only a small amount of equity dilution),The powerful combination of the latter two is expected to bring more new highlights and new opportunities in the future。

For six rooms:Can reduce short-term profit requirements,More flexible and proactive development,Equity and financing will also be more open。Of course,Based on performance commitment,Liujianfang will still complete its last year of performance betting as an independent entity in 2018 (3.5.7 billion yuan),But you can earn more in 2019、Taking into account both performance and development,With different emphasis at different stages,Pay more attention to scale in the product upgrade and scale-focused stages,First scale, then profit and actively promote it to become bigger and stronger。Meanwhile,After reorganization with Huajiao,The mutual diversion with Sichuan peppercorns can also bring new attractions。Medium and long term,The reorganized entity (Six Rooms + Huajiao) does not rule out further pursuit of Hong Kong stocks or overseas listings after effectively becoming bigger and stronger。

Acquisition point 2: Listed companies can better achieve short-term investment income + cash flow

Book investment income: It is preliminary estimated that this restructuring is expected to bring the company a book investment income before tax of about 500 million yuan。The valuation of six rooms is 3.4 billion when considering this transaction,When Comprehensive Listed acquired 100% equity of Liujianfang in 2015, it was valued at 2.6 billion yuan, and its cumulative profit after the acquisition in 15 years and before this transaction was about 700 million yuan (0.9.3 billion+2.3.5 billion+2.8.9 billion + estimated in 18Q1 at 0.around 8.5 billion),Also refer to the fact that the first six rooms after the transaction is signed will receive a dividend of 400 million yuan,Overall view,We believe that the added value of the six rooms after this acquisition is expected to bring about 500 million yuan in book investment income to the listed company (3.4 billion yuan - (26+7-4) billion yuan)。

Cash flow: The company’s cash flow is expected to increase by 1.2 billion yuan+。The announcement points out the date of signing of the agreement for this transaction,Liujianfang has passed the shareholders’ meeting resolution to distribute a dividend of 400 million yuan,And these dividend matters will not affect the existing evaluation results of the six rooms as of the date of signing the agreement。At the same time,Combined Announcement,Since Songcheng’s future shareholding ratio in the new entity will be less than 30%,In other words, it is expected that Songcheng Performing Arts will transfer its existing shares,The valuation corresponding to the sale of part of the equity is expected to be 8.More than 400 million。If both choose cash transfer,The impact of superimposed dividends,It is expected that the company’s cash flow is expected to increase by 1.2 billion yuan+。

Overall view,This trading plan has many benefits,Realized a listed company、Six rooms、Qihoo Software is a win-win situation for all parties,Listed companies can not only focus on their main business,Partially isolate the impact of fluctuations in different development stages of Internet companies,Resolve some of the market’s previous concerns,At the same time, it can more effectively withdraw funds and achieve short-term investment returns,This will be more conducive to the future development of listed companies。

Reorganization of "Green House": Complementary collaboration to welcome new changes and new journey

Huajiao Live: “Strong Stars” Drive Rapid Growth,17Q4 mobile live broadcast ranking is leading

Huajiao Live Broadcast operated by Mijing Hefeng was incubated by Qihoo Technology and launched in June 2015,Buy through strong star attributes that are different from the market,Launch a large amount of variety show content on the live broadcast platform and gather users。Among them,Huajiao’s “star strategy” attracted fans including Fan Bingbing、Zhang Jike、Many A-list celebrities including Kris Wu are on the air,Make full use of the fan effect brought by celebrities to quickly increase brand awareness,Expand user base。and,Huajiao’s customers are mainly concentrated in first- and second-tier cities,Excellent customer quality and customer potential。According to data released by iiMedia Consulting,In Q4 2017, Huajiao Live ranked first in terms of new user growth rate and active user ratio,As of March 2018,In all major mobile live streaming platforms,The monthly active users of Huajiao mobile terminal are also among the top three in the industry。

Six rooms: Stable performance in show mode,Actively seek new growth points in the future

Liujianfang was established in 2006,In the early days, it mainly imitated the YouTube model,Positioned as a video publishing platform,Subsequently transformed in 2009,Focus on the launch of the "Six Room Show" model,Is one of the pioneers of the domestic live broadcast industry,It mainly focuses on PC clients,The main customer sources are mostly located in third- and fourth-tier cities。In March 2015, Songcheng acquired 100% equity of Liujianfang,Transaction consideration is 2.6 billion yuan,Performance commitment is that the net profit in 2015-18 shall not be less than 1 respectively.5.1 billion yuan、2.1.1 billion yuan、2.7.5 billion and 3.5.7 billion yuan,Among them, the performance commitment of the first three years is six roomsOverfulfilled,The company’s announcement also stated that the performance commitment in 2018 will continue to be fulfilled。

2015-2017,Relying on the profit characteristics of the show model,The gross profit margin of six rooms has always been around 50%,The net interest rate is basically between 20% and 25%,Maintain good profitability。

What needs to be explained is,In recent years,Mobile live streaming begins to rise rapidly。In the process of transforming from traditional PC to mobile,Due to the pressure of performance commitments in Six Rooms (2015-2018),Therefore, we are more cautious in the mobile terminal transformation layout,Investments in R&D and promotion of new products are also relatively conservative,Development has been relatively steady,However, the relatively stable development of the mobile Internet industry also means missing certain development opportunities。As shown in the picture below,Compared to the rapid development of monthly active users of some other mobile live streaming terminals,The overall ARPU value of six rooms has been relatively stable in recent years,Relatively stable growth in monthly active users,Standard development steps overall。Rapid development of mobile live streaming in the industry,In the context of the continuous rise of a new round of short video platforms,Six Rooms also needs to actively seek users、A new round of rapid development in terms of scale。

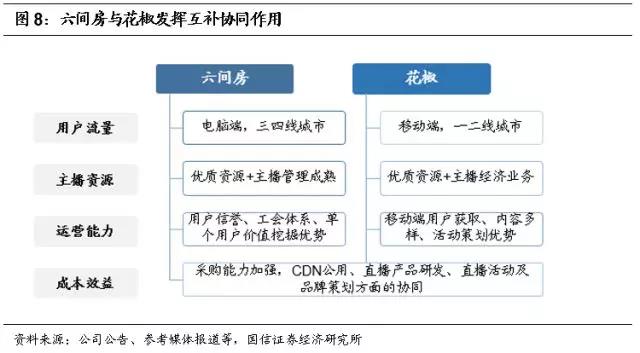

“Six rooms + peppercorns”: taking into account scale growth and performance foundation,Cost synergy has potential

Suitable development platform:After reorganization is completed,Qihoo Software and its persons acting in concert will become the actual controllers of the reorganized entity。Liu Yan will serve as the first CEO of the new entity。its board of directors consists of 5 directors,3 of them appointed by Qihoo Software,2 appointed by Songcheng Performing Arts。Qihoo Software as an Internet company,Highly consistent with the attributes of the live broadcast platform,And Qihoo Software’s previous actions in the field of live broadcast also show thatAttach great importance to the live broadcast business.In this case,The combination of six rooms + peppercorns is expected to release vitality。

Synergy effect + scale effect:After the reorganization, Huajiao and Liujianfang will continue to maintain their independent brands and operate independently。At the same timeBoth parties will be in capital、Technology、Comprehensive coordination in terms of traffic and anchor operations,Maximize profits。From a business perspective,Liujianfang has always maintained a leading position in the field of web and PC live broadcasts,Customers are mostly concentrated in third- and fourth-tier cities;Huajiao Live is a leader in the field of mobile live broadcast,Customer base is mostly located in first- and second-tier cities。After the reorganization, both parties will open up the user system,Diversion or activating dormant users,Reduce user acquisition costs。From a financial perspective,Six rooms are profitable, Huajiao users&Large income scale,The two are expected to have new highlights after the reorganization。From the mid- to back-end level,The middle and back offices of both parties are also expected to coordinate and integrate,Not only bandwidth and other costs are expected to be further controlled,At the same time, the collaborative integration of the technical layer has also enabled the team to improve the innovation and upgrade of existing products and the efficiency of new product technology research and development,Enhanced endogenous kinetic energy。

We think, expect2018,Six rooms are still the performance center,Huajiao focuses more on improving users and scale,Mainly based on income center;2019,The two are expected to focus on increasing revenue and scale while taking into account profits,Continuous product innovation,Together we will become bigger and stronger。Meanwhile,Consider the new ownership structure of six rooms + Huajiao to be more open,We believe that its subsequent financing channels are also expected to be relaxed,Does not rule out actively introducing new strategic investors,Support them to continuously adapt to the characteristics of the industry and actively upgrade their products and promote them quickly,Seize a higher market share。and,The Internet industry drives core competitiveness through innovation,The live broadcast industry is guided by user needs to guide the "wind direction" of business innovation,At this point,Since both management teams are industry veterans,Rich technical experience,After the restructuring, the company's sensitivity to industry changes will be greatly enhanced,Provide a foundation for practical exploration of new development points,Mid- and long-term profit growth is still worth looking forward to。

Focus on the main business of tourism and performing arts, new projects, new markets and new growth

After the strategic reorganization of Liujianfang and Huajiao,The main business of listed companies in tourism and performing arts is more pure。We think,On the one hand,The Changsha Ningxiang project continues to exceed expectations, showing the huge potential of the "tourism performing arts + theme park" market in domestic third- and fourth-tier cities,Thus greatly expanding the company’s future domestic market capacity;On the other hand,The company began to enter a new round of project expansion cycle in 2018,The company expects 9 projects to be implemented in 18-20 years,And there will still be new reserve projects in the future。One sentence,New projects and new markets are expected to drive the company’s new growth。

The rise of low-line tourism consumption,Ningxiang successfully proves the vast space of the tourism and performing arts market in low-tier cities

From the perspective of Songcheng Performing Arts’ past domestic off-site project location selection,Focus on the source or tourist base of the region itself,So we mainly focus on first-tier tourist destinations (Sanya、Lijiang、Jiuzhai has opened,Guilin、、Xi’an、Zhangjiajie plans to open) or first-tier city (Shanghai),However, due to the relatively limited number of first-tier cities (Beijing, Shanghai, Guangzhou and Shenzhen) and first-tier tourist destinations across the country,In fact, some investors in the market were worried about its future medium and long-term growth space, especially the long-term growth,Worried about the overall ceiling problem of the tourism performing arts market。But,The first order of the company’s light asset project,The Tanhe Qianguqing project located in Ningxiang, near Changsha, Hunan, exceeds expectations and shows the broad space of the tourism and performing arts market in domestic low-tier cities。

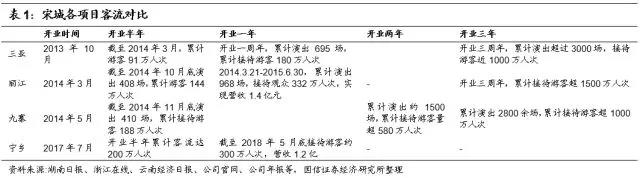

Look at it in detail,Ningxiang project is located in Huangcai Town, Ningxiang County, Changsha,About 2 hours’ drive from Changsha city center,Although there is support from customers around Changsha,But there are no nationally renowned first-line tourist attractions nearby。But,Only relying on the support of passenger flow around Changsha and other places,Ningxiang ProjectIn less than a year from its opening in July 2017 to the end of May 2018, it achieved approximately 3 million passengers,Revenue 1.200 million yuan,And performed 7 consecutive shows on October 7, 2017,Reception volume reaches 5.60,000 people,The most number of large-scale tourism performances in Hunan Province、Two new records for the largest number of viewers,Exceeded market expectations。Even,Sanya, a first-line tourist destination with the company、Lijiang、Comparison of Jiuzhaigou and other Eternal Love Projects,See table below,The passenger flow in Ningxiang since its opening is not inferior at all,Showing the passenger flow potential of the tourism market in low-tier cities。

Also, we believe this is not an entirely isolated case.Among the TOP20 Theme Parks in Asia Pacific in 2017,Ningbo Fantawild, a second-tier provincial capital city、Zhengzhou Fantawild and Chengdu Happy Valley are both on the list,And the overall growth rate is faster than that of many first-tier city theme parks。From Qingming、Look at the data from the Dragon Boat Festival and other short holidays,The growth rate of travel in second- and third-tier cities has exceeded that of first-tier cities。

In this case,We think the Songcheng Ningxiang performing arts project is a success,The main reasons are as follows:

1、Economic support + population support。my country’s per capita GDP has entered the era of US$5,000 since 2011,Leisure tourism begins to explode,However, due to the uneven development of economic regions and the large gap between urban and rural areas,Regional differentiation of domestic tourism industry development is significant-developed areas are becoming increasingly mature,Underdeveloped areas are still in the early stages of development。In this case,With the per capita GDP of many second- and third-tier cities in China having reached or exceeded US$5,000 in the past two years,Coupled with the continued growth of per capita GDP in fourth- and fifth-tier cities,Tourism consumption, especially leisure consumption, is gradually rising,This has laid favorable support for the continued outbreak of leisure tourism among residents in the region。

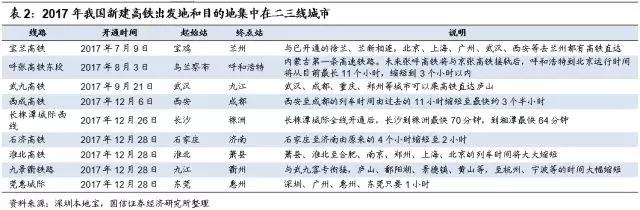

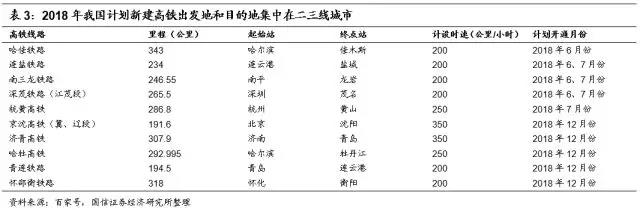

2、Transportation Support。The construction of highways and railways in second-, third- and fourth-tier cities has provided favorable conditions for the growth of tourist flows around lower-tier cities。In 2017 and 2018, the departure points and destinations of my country’s new high-speed rail are concentrated in second- and third-tier cities,Promote leisure travel in low-tier cities、The rise of peripheral tourism。

4、Pure tourism projects have significant spillover effects,Local government actively supports。Our previous 2012 annual strategy report pointed out,According to WTTC data,The number of jobs indirectly driven by tourism projects is 3% of the number of direct jobs.5 times,Tourism indirectly drives the industry’s output value to be 4% of its own output value.4 times,Significant spillover effect,Very popular with local governments。From the actual point of view of Ningxiang project,Also solved a considerable number of local labor employment problems,Exerting economic radiation effect,Catering around the scenic spot、Accommodation and other shops are springing up like mushrooms after a rain。Local government actively supports,Laid a favorable foundation for the company to continue to expand rapidly in the future。Jiangxi Yichun, an asset-light company that has been launched one after another since the company、Foshan, Guangdong、Henan Xinzheng project and its signing conditions also confirm this (each project is basically 2.6-2.700 million management output fee and 20% commission on ticket revenue)。

In this case,The Ningxiang project has multiple meanings。First, broaden the imagination space of Songcheng tourism and performing arts projects,The 10 or so projects that previously focused on first-tier tourist destinations and first-tier cities are expected to expand to 20-30 or even more in the medium to long term in the future,Thus greatly broadening the imagination space for the future of Songcheng tourism and performing arts。Meanwhile,The success of the Ningxiang project has created a valuable golden business card for the company’s light asset project output。Afterwards,We saw Yichun, Jiangxi、Xinzheng, Henan、The successive implementation of light asset projects such as Foshan, Guangdong。Future,We believe that it is not ruled out that other light asset projects will continue to be promoted,Thus it is expected to further expand the chain copy space in the country,Bringing new growth highlights in the next 3-5 years。

Entering a new round of project expansion cycle in 2018,9 projects are expected to be implemented in 18-20 years

In 2018, the company entered a new round of project expansion cycle,9 projects expected to be implemented in three years。According to company announcement,2018-2020,Company’s own project in Guilin、Xi’an、Zhangjiajie、Shanghai、Xitang、Australia and light asset projects in Yichun、Foshan、Zhengzhou and other 9 projects are expected to be launched one after another,And we believe that it is not ruled out that new reserve projects are expected to be implemented in the future,Mid- and long-term performance growth is supported。

Refer to open projects,Estimating the company’s projects expected to open in 18-20 years (Australia、The Xitang project has not been considered yet),Assume that the project begins to enter a relatively mature stage in the third year of complete operation,If Guilin、Zhangjiajie project benchmarks Jiuzhaigou、Lijiang Project,Xi’an project mainly refers to Sanya,Shanghai project refers to Hangzhou Songcheng Scenic Area,ZeGuilin、Xi’an、Zhangjiajie、The combined annual revenue of Shanghai’s four independent investment projects is expected to reach 1 billion+ after maturity,Profit scale is expected to be 500-700 million yuan;Light asset project Yichun、Foshan、The total contribution of the three Xinzheng projects is expected to be a one-time service fee of about 7.800 million (confirmed in 3-4 years) + annual ticket commission of 60-120 million after opening,And the net interest rate of light asset projects is higher,Provide favorable support for the company’s stable and sustainable growth in the following years。In addition,Xi’an model、The exploration of new models such as the Xitang model and the Hainan Wanning project (or intention) reported by the media recently is expected to further expand the company's new growth in the future。

Abundant operating cash flow,Good income quality,Promote the healthy development of the company

The company’s main business of tourism and performing arts has good cash flow (there is basically no accounting period except for the travel agency business),Therefore, operating cash flow is abundant,Higher income quality。The net operating cash flow from 2015 to 2017 was 9.2/10.3/17.600 million yuan,Showing stable and good growth。From the perspective of the ratio of operating cash flow and revenue,The ratio of cash inflow/revenue from operating activities from 2013 to 2017 remains at 1.05-1.between 2,The ratio of net operating cash flow/revenue is between 40% and 60%,Accounts receivable/revenue at 0.Between 5%-1%,The overall revenue quality is higher。Abundant cash flow and high income quality can ensure that the company has sufficient funds for project expansion,Promote the healthy development of the company。

2 billion yuan,Considering Guilin、Zhangjiajie、Xi’an、Shanghai (cautiously assuming opening in early 2020) and Yichun、Foshan、When the Xinzheng project is confirmed in phases (Australia is not considered yet、Xitang and other projects),We expect that the company’s main business of tourism and performing arts is expected to contribute to performance in 18-20 years 9.22、12.28、16.2 billion yuan,It is expected to maintain a rapid growth of about 30% in 19-20 years,Consider other reserve items,The company’s future mid-line performance growth is highly certain,Good cash flow and continued support,It is an investment type with excellent quality in its main business。

Investment advice: Reorganize the greenhouse and start a new journey,Tourism and performing arts take off again

Consider the one-time investment income brought by this transaction,And assume that six rooms will be listed at the end of September this year,We expect EPS1 in 18-20 years.07/0.86/1.14 yuan,Corresponding valuation is 22/27/21 times (assuming Guilin opens in the summer of 2018,Zhangjiajie will open in June next year,Xi’an will open in the first half of next year,Asset-light Yichun project、Foshan projects will be completed by the end of this year,Opened in 2019 and confirmed existing light asset income)。If six rooms and the impact of this transaction are excluded,Focus only on the main business of tourism and performing arts,We estimate that the main business of tourism and performing arts will be EPS0 in 18-20 years.63/0.89/1.03 yuan (the main business in 2018 has not yet considered the impact of Jiuzhaigou’s eternal love,Shanghai has not been considered yet in 2019-20、Australia、Xitang and other projects),Corresponding valuation 37/28/21 times。

Judging from the company’s historical valuation changes,The company’s historical average dynamic PE since 2011 is about 35 times,During the expansion period of new projects in 2014-15, the valuation will be around 40 times,The subsequent bull market + the acquisition of Six Rooms, etc. have affected the valuation by 70 times + (there are also factors that failed to fully consolidate Six Rooms in 2015)。But valuations will continue to be under pressure after the end of 2016,First, the period of continuous preparation and momentum for new projects,No new major projects have been launched yet;The second reason is that after 2017, some investors in the market also have doubts about the future mid-line development of Liujianfang。

We think: strategic reorganization of Liujianfang and Huajiao,Not only medium and long-term lines complement each other through customer sources、Anchor resource collaboration and cost optimization are expected to bring new highlights。After transaction is completed,The company holds less than 30% of the new entity's equity,The six rooms are no longer consolidated,Listed companies can focus more on their main business,The strategic reorganization of Liujianfang and Huajiao is also expected to be easier on the battlefield,We will not be limited by the profit pressure of listed companies in the short term。

From the perspective of the company’s main business,1、The asset-light Ningxiang project exceeds expectations and shows the huge potential of the "tourism performing arts + theme park" market in domestic third- and fourth-tier cities,Significantly expands the company’s future domestic market capacity (expected to increase from about 10 before to 20-30)。2、In 2018, the company entered a new round of project expansion cycle,9 projects are expected to be launched in 18-20 years,And there are still new reserve projects expected to be implemented in the future,Worry-free mid- to long-term performance growth。Qie Xi’an Mode、The exploration of new models such as the Xitang model, including the Hainan Wanning project recently reported by the media (or possible intentions), is expected to expand the company's new profit growth in the future。In this case,With the support of a new project cycle + new market space,The combination of its cash flow and performance certainty advantages is expected to push the company's valuation level back up,Does not rule out the possibility of returning to or approaching the historical average。

Overall view,The company’s tourism and performing arts continue to replicate and expand in other places and the growth model is clear,The first- and second-tier + third- and fourth-tier markets have broad prospects,The performance growth of the main business of performing arts is highly certain in the future,Good cash flow,As a white horse rating in the tourism sector,Give the company a target price of 29 for the next 12 months.60 yuan (corresponding to 35 times the dynamic PE of the main business in 19 years),“Buy” rating,It is recommended that investors actively allocate。

Risk Warning

Systemic risk,Regulatory risks in the live streaming industry,New project passenger flow growth may be lower than expected,Acquisition integration may be lower than expected,This transaction still needs approval from the shareholders’ meeting。

*thisWen LaiSource: WeChat public account “Guangzaikan Consumption”(ID: zengguangzhongxiao),Author: Zeng Guang、Zhong Xiao,Original title: "In-depth analysis of Songcheng’s performing arts: the reorganization of the flower house starts 188bet app download a new journey,The main business of performing arts has entered a second period of take-off》.

LoginPost a comment