New users automatically create accounts after logging in

Login188bet app

October 7,Market news said that the long-term rental apartment brand "Qingke Apartment" officially submitted IPO documents to the U.S. Securities and Exchange Commission during Eastern Time,Becomes the first brand in China to submit IPO application for long-term rental apartments。

And earlier,We met on the road to go public in the United States,There are also Ziru and Danke Apartments。

Recently,Market news indication,Danke Apartment plans to be listed in the United States as soon as this year,Raising amount of US$600 million to US$700 million,may become the first overseas listed company for long-term rental apartments。However,In view of the fact that "Qingke Apartment" has submitted the listing application first,The "first" here may still be determined。The following September 16th,There is further news that Ziroom is considering listing in the United States in 2020,Informed sources disclosed that the amount of funds raised is US$500 million to US$1 billion。

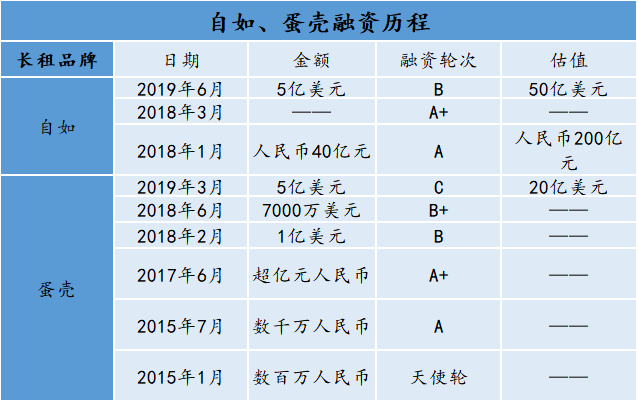

In the long-term rental brand,Ziru、Danke is a leading company in the non-real estate industry in terms of scale and valuation。Currently,They are valued at US$5 billion and US$2 billion respectively;The number of rooms is about 850,000 and 450,000。

In the long run,Although the long-term rental industry is still a sunrise industry。But the capital chain is broken、Under the difficult situation of making profit,Ziru、How likely is it that Danke and even Qingke Apartments will be successfully listed?

188bet sports betting app download

Ziru was established on October 28, 2015,is an O2O Internet brand under Lianjia Holdings。Ziroom owns Ziroom Friends、188bet app download Ziru whole rent、Ziruyu、Ziruyi、Ziru B&B、Owner direct rental and other product lines,Cleaning also provided、Home Repair、Moving and many services such as Ziruyoupin。

Danke Apartment is a white-collar apartment brand owned by Ziwutong (Beijing) Asset Management Co., Ltd.,Established in 2015。After fully acquiring the long-term rental apartment "falling in love with renting",The number of rooms managed by Danke Apartment has increased from 80,000 before the transaction to nearly 400,000。

No matter the nature of the two、Business Strategy,Looking at the operating model,All similar。

In terms of urban layout,According to the official website,Currently Ziroom has deployed in Beijing、Shanghai、Shenzhen、Hangzhou、Nanjing、Chengdu、Wuhan、Guangzhou、9 cities in Tianjin;Danke is in Beijing、Shenzhen、Shanghai、Hangzhou、13 cities including Guangzhou have completed deployment。

Source: Company official website, opinion index compilation

From a layout perspective,The two basically cover the first line of the long-term rental apartment market with greater demand、New first-tier and strong second-tier cities。

On product line,Except for shared housing、Entire rental and other modes,Danke Apartment also offers monthly rentals、Direct rent from owner。The owner’s direct leasing is mainly to host the property for Danke to operate,Equivalent to the role of "second landlord"。In addition to renting a house,Also launched Ziru Life、Free service、Qiyue Club、Mall、Enterprise customization and other value-added services。

Different from the traditional residential rental model,Most long-term rental brands adopt Internet thinking to operate,Especially using the Internet for marketing、Online reservation system、Open APP, etc.,For the original apartment rental model,Innovated efficiency。Ziru、Eggshell is no exception,From house hunting、Sign the contract,Payment on arrival、Complaint,All completed online,The process is relatively open and transparent。

This 188bet app Internet model is conducive to the refined operation of the leading long-term rental apartment platform,forming scale、Professional advantages,At the same time, we can come up with more and greater preferential subsidy policies,Give profits to tenants,For example, fresh graduates can rent without deposit - Haiyan Plan、Eggshell-Starling Project。

Listing = the best channel for financing?

Compared to last year’s craziness,Investment in long-term rental apartments has gradually returned to calm this year,Investment amount dropped sharply,And capital began to flow to leading brands。March this year,Magic Cube、Eggshells completed 1.US$500 million in Series D financing and US$500 million in Series C financing;June,Ziroom announced the completion of US$500 million in Series B financing。Recently,Chengjia Apartment under Huazhu Hotel,Also announced that it has completed nearly US$300 million in Series A financing。

There are many long-term rental apartment brands that have obtained external financing in 2019,However, the "pain points" that have long plagued the long-term rental industry have not been well resolved,If residents complain、Occupancy rate is difficult to maintain、Long return period, etc.。Plus compared with brands with real estate developer background,Ziru、Most of the houses of brands such as Danke are obtained through leasing,Little real estate,So a lot of rent costs must be paid,Plus decoration、Furniture purchase, etc.,The initial investment cost is relatively high,But profit is not easy。

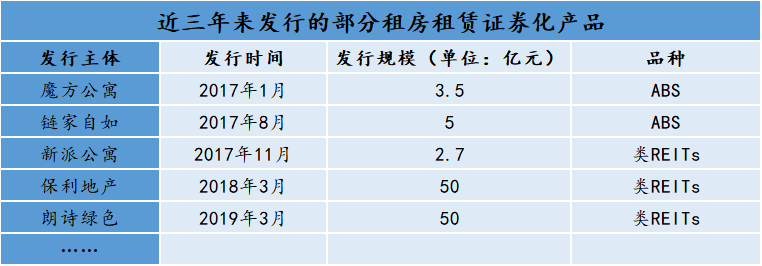

This directly affects the business development of the long-term rental brand itself。In order to solve the above problems,The best way is to get capital injection。On financing channels,The securitization of rental housing assets has become a product favored by long-term rental apartment brands。Currently,The underlying assets can be divided into two categories,The first category is assets with rental income as the underlying asset,ABS issued by Lianjia Ziroom,A type of asset with real 188bet Online Sports Betting and Casino estate as the underlying asset,For example, Poly One issued by Poly。

The issuing entities of financing products can be divided into three categories: one is intermediary self-operated long-term rental apartments,Rulianjiazuru;The second is an entrepreneurial apartment operator,Ruxinpai Apartment;The third is a real estate developer,Ru Baoli。

Source: Online public information, compiled by opinion index

But you can see it,Whether it is the blessing from VC,And then to the issuance of rental housing asset securitization products,Or rental loans that are prohibited by policy... long-term rental brands need to be continuous、Significant capital injection,And more diversified public financing channels。

Therefore,Regardless of whether you have a real estate developer background,If the long-term rental brand wants to develop in the long term,Going public may be an urgent goal to be achieved now。

Profit model is still the key

From the perspective of operating model,Long-term rental apartments belong to the sharing economy,It was once regarded as an important investment outlet,Attracted countless venture capital injections。So far,Ziru、Eggshell completed 3 rounds respectively、6 rounds of financing,Among them in the recent Series C financing,Danke Apartment also attracted Tiger Fund、The joining of Ant Financial。

Data source: Compilation of opinion index

It’s worth noting,Although it has attracted a lot of capital injection,But the unclear mature profit model may become the biggest obstacle to listing 。

Refer to the listing valuation of co-working giant WeWork which was “cut in half”,Insufficient profitability problem questioned by investors,Also exists in Ziru、In the eggshell。Profitability is the core issue that the capital market is most concerned about,Not just a matter of size。

At present, there are four main profit points for long-term rental apartments: first, earning the rent difference;The second is income from providing value-added services to residents,Housekeeping 188bet app included、Shopping、Income from members, etc.;The third is the room vacancy period,If the actual vacancy period is shorter than the vacancy period agreed in advance between the long-term rental agency and the owner,You can earn net rent within this vacancy period;The fourth is financial income,Including VC and rental loan income。Compared to the first three,Financial income contributes significantly to cash flow,Better to increase income,So it is not difficult to explain why many long-term rental brands take the risk of using rental loans。

Little profit from rental income,Financial instruments such as rental loans have high risks,It is easy to cause adverse consequences such as a break in the capital chain。According to incomplete statistics,As of August this year, more than 20 small and medium-sized long-term rental brands have experienced "thunderstorms",Among them, Lejia Apartment, which has attracted much attention, officially announced on August 7 that it will officially cease operations。

Source: Online public information, compiled by opinion index

Except for thin profits,The most troublesome thing is the serious losses,Long return period,This is the most criticized by investors。In order to reduce the impact on the main business,Some real estate companies will also divest their long-term rental business,For example, Langshi。

May 14,Landsea announcement,Long-term rental apartments that are at a loss will be divested、Property Management、Architectural Design、Five types of non-real estate businesses including life services and landscaping to the controlling shareholder Landsea Group,Estimated net proceeds are approximately 9.8.1 billion yuan。According to its annual report disclosure,Landsea Apartment suffered serious losses in 2018,Da1.9.4 billion yuan,Added losses in 2017,Total loss 2.400 million yuan。

so far,There has not been a profit model that investors are optimistic about in the field of long-term rental apartments。Now the industry is gradually returning to rationality 188bet sports betting app download after consolidation and reshuffle,If a long-term rental brand is successfully launched,Maybe the situation will improve。

*This articleSource: Guandian Real Estate Network, authorAuthor: Viewpoint Index Research Institute, originalTitle:《Original report》.

- Response to the call for “double carbon”,Huazhu Group releases “Green Living” service brand

- World's first Warner Bros. hotel opened on Yas Island, Abu Dhabi

- Tripalink, a long-term rental apartment brand for North American youth, completed US$30 million in Series B+ financing

- 291 accommodation companies in Yunnan plan to receive subsidies of 60.3 million yuan