New users automatically create accounts after logging in

LoginThird-party login

As of May 12, Beijing time,188bet mobile stock price has been below for 26 consecutive days,Will 188bet mobile stock price return to above US/share this Friday,will determine whether Tuniu will receive a pre-loss warning。

“Making travel easier”、“Want to travel、Look for 188bet mobile” Do you still remember these advertising words?

188bet mobile was established in October 2006,Successfully listed on NASDAQ in May 2014。Mainly engaged in online travel services and other related businesses,Already in Beijing、Shanghai、Shenzhen and other cities have established nearly a hundred regional service centers,Provide 24 hours a day, 365 days a year, 400 telephone reservation service。

While traveling can be “easier”,188bet mobile situation has become increasingly “difficult”。

April 29 is the eve of the May Day Golden Week,A written apology letter from the rumor monger was posted on 188bet mobile official WeChat public account,Clarify previous rumors about "bankruptcy liquidation"。Although it is a rumor,But there is no smoke without fire,Whether it is China concept stocks or A shares,Thousands of listed companies,Why is only Tuniu being rumored?

The stock 188bet mobile has been less than US in the past 30 days

Reviewing 188bet mobile market performance,Successfully logged into Nasdaq since May 2014,It can be said that "listing is the peak"。According to display,July 31, 2014,188bet mobile share price rises to 20.USD 62/share,Since then, it has been declining in the shock。

Tuniu closed at US/share on April 3,After two days of market closure,Starting from April 6th,188bet mobile stock price has been below /share。In accordance with Nasdaq regulations,If the stock price of a listed company is less than for 30 consecutive trading days,You will receive a pre-loss warning;Companies that have received warnings cannot raise their share prices to trading standards within 90 days,will be forced to delist。

Also,At that time, the turnover rate of 188bet mobile stock was still 24.68%, As of May 12, Beijing time,The turnover rate of 188bet mobile stock is only 0.11%。

The level of stock turnover rate,It can reflect the liquidity of the stock to a certain extent。High turnover rate generally means better liquidity of the stock,It is easier to enter and exit the market,There 188bet mobile be no problem if you want to buy something but cannot buy it,The phenomenon of wanting to sell but not being able to sell,Has strong liquidity。

According to data from Oriental Fortune Network,On December 31, 2018, Singapore investment company Temasek Holdings held 188bet mobile 2458.330,000 shares;And May 29, 2019,Temasek Holdings holds 1831 shares.660,000 shares;As of April 2, 2020,Temasek Holdings holds only 1758 shares.470,000 shares。

Judging from the shareholding amount,Temasek Holdings from 2018 to present,Reduce its holdings in Tuniu twice。Also,188bet mobile senior executives have also changed。April 9 this year,Tuniu announced,Its chief financial officer (CFO) Xin Yi submitted her resignation due to personal reasons,will officially resign on May 31, 2020。

Calculated by time,As of May 12, Beijing time,188bet mobile stock price has been below for 26 consecutive days,Will 188bet mobile stock price return to above US/share this Friday,will determine whether Tuniu will receive a pre-loss warning。If Tuniu receives a pre-loss warning,Then leave time for Tuniu to save itself,Only 90 days left。In terms of time,90 days is in June、July、August。According to previous years,July、August is the prime time for summer vacation,It is also the peak period for travel。

However,What 188bet mobile “diffs” is not just a “Golden Week”。

Loss of 5.978 billion yuan after six years on the market

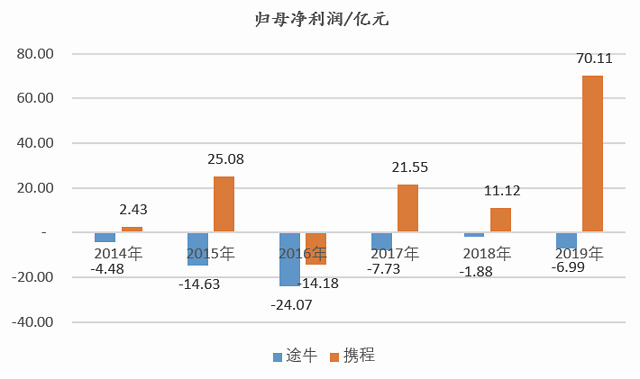

Data display,188bet mobile since its listing in 2014,Cumulative loss 59.7.8 billion yuan,On average, the annual loss is nearly 1 billion yuan。However, they are both engaged in online travel service business、Ctrip, which is also listed on Nasdaq, made a net profit of 116 in 6 years.1.1 billion yuan。What’s even more “amazing” is,The net profit attributable to the parent company achieved by Ctrip in 2019 was as high as 70.1.1 billion yuan at the same time,188bet mobile lost 6.9.9 billion yuan,Been 6 years ago,The year when the two are farthest apart。

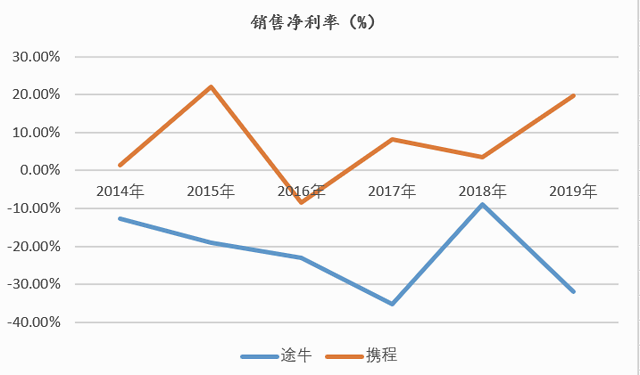

Otherwise,188bet mobile sales revenue level is not ideal either。The sales revenue level of an enterprise can be reflected by the net sales profit rate,This indicator reflects the net profit generated by each dollar of sales revenue。As shown in the picture below,188bet mobile net sales profit margin has always been below the zero line。

Both engaged in online travel services,Both serve domestic groups,Why is the gap so big?This point,The answer can be obtained from the income structure of the two。As shown in the picture below,188bet mobile income structure is too simple。

Launched in 2014 to present,188bet mobile income structure only includes income from packaged tourism and insurance companies、Income collected from visa applications and other services。2014,188bet mobile packaged tourism revenue accounts for as high as 99%,As of December 31, 2019,Although the proportion of revenue from packaged tours has declined,But it still accounts for 76% of the share。In comparison,Ctrip’s revenue structure is in the middle,In 2019, packaged tourism revenue only contributed 3.51% of revenue,The lowest proportion;Except insurance companies、In addition to visa application and other business income,The largest revenue contribution is transportation ticketing revenue,Accounting for 39.06%;The second is the income contributed by hotel accommodation,Proportion 37.84%。

As Ctrip stated in its prospectus,“We have provided hotel reservation and air ticket services since October 1999。”

Also,Tuniu stated in its prospectus,“We often purchase certain travel products from travel suppliers in advance,To ensure adequate supply for our customers during peak travel periods or at certain destinations。"Under this prerequisite,If 188bet mobile prediction of peak travel periods or destinations is biased,This leads to misalignment of their procurement,It is easy to put pressure on its capital chain。

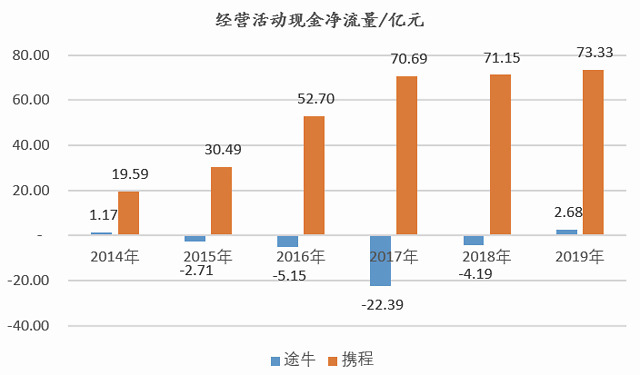

In fact,188bet mobile cash flow performance is also far inferior to Ctrip。Ctrip from 2014 to 2019,Net cash flow generated from operating activities increases year by year,In contrast, 188bet mobile net cash flow is still “positive、Wandering between negative。

The 188bet mobile is still expensive

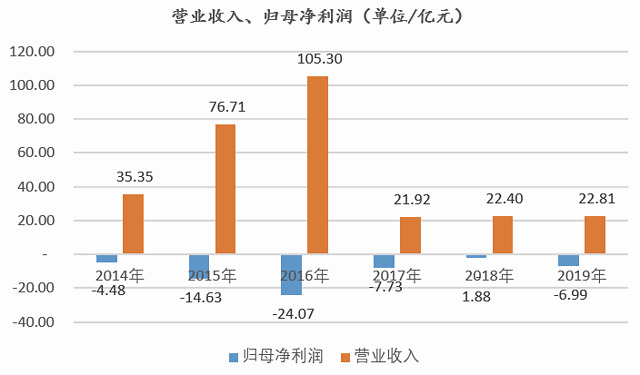

It’s worth noting,Although 188bet mobile has been losing money for a long time,However, the changes in operating income and net profit attributable to the parent are surprisingly similar。As shown in the picture below,The year with the highest operating income in 188bet mobile,It also has the largest loss。

188bet mobile once stated in the prospectus,“Price is an important criterion for customers to consider when choosing travel products。Due to fierce competition and increasing price transparency,Online leisure travel companies must compete effectively on price,Especially for less components,Easy to compare,Travel products or popular destinations with lower average selling prices。”

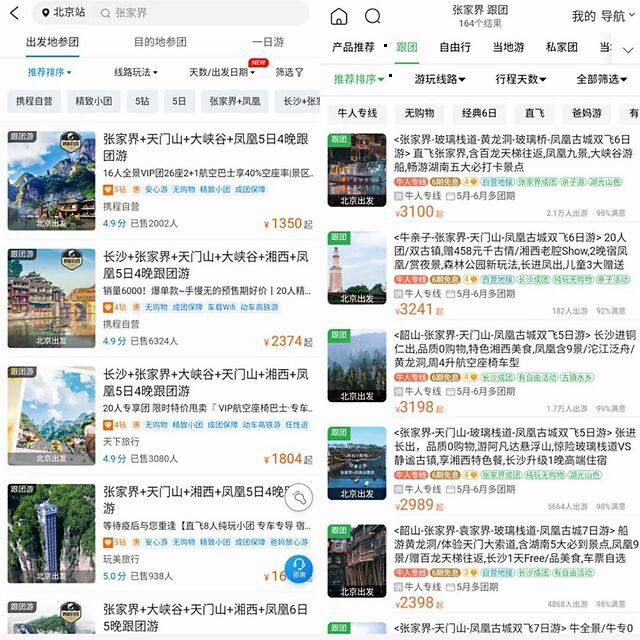

"Financial World" weekly takes Zhangjiajie, a domestic listed tourist attraction, as an example,Based on the condition of "Start: Beijing—Group tour—Destination: Zhangjiajie",Search for related products on 188bet mobile and Ctrip respectively。

As shown in the picture below,The left side shows the prices of related products displayed on Ctrip’s official website,The right side is the price of related products displayed by Tuniu,188bet mobile prices are generally on the high side,Does not have a competitive advantage in terms of price。

*Source of this article:ifeng.com Finance, author: Finance World Weekly,Original title:《188bet mobile Travel is approaching the delisting red line, losing 5.9 billion in six years after listing,The more you earn, the more serious your losses will be》.

New users automatically create accounts after logging in

LoginThird-party login