Change your focus from the hot taxi market to the car rental market,We will make new discoveries。August 20,The 2015 mid-year report released by China Car Rental shows that the company’s revenue in the first half of the year was 2.3 billion、24% year-on-year increase;Net profit 4.6.1 billion、66% year-on-year increase。

China Car Rental produced such a beautiful interim report,The stock price did not rise but fell。Close at 13 on August 21.02 HKD、Drop 10.21%,69% lower than the intraday high price of HK$22 on May 20。Hong Kong stocks rebounded in the following three trading days,China has made no achievements,The market value is approximately HK$30.8 billion (approximately HK$254.500 million yuan)。Falled 60% in three months,In addition to macro factors,It is impossible not to have its own reasons。

Hertz, a leader in the global car rental industry and holding approximately 20% of China Car Rental,Started in the car rental business in 1918,Today there are more than 8,500 car rental stores in 146 countries。End of 2014,The scale of the direct-operated fleet reaches 660,000 vehicles (excluding franchisees)。Revenue in the first half of 2015 51.USD 4.5 billion,But ended up with a net loss of US$47 million。

The current market value on the New York Stock Exchange is around US$8 billion (approximately 51.2 billion yuan),About twice as much as China Car Rental。

Despite fleet 188bet app size、Revenue and other aspects are one order of magnitude behind Hertz,But the market value of China Car Rental is already half that of the global industry leader,As for economic benefits, "China is in the sky、Hertz is underground”。So the two companies can basically be discussed together。

188bet sports betting app download

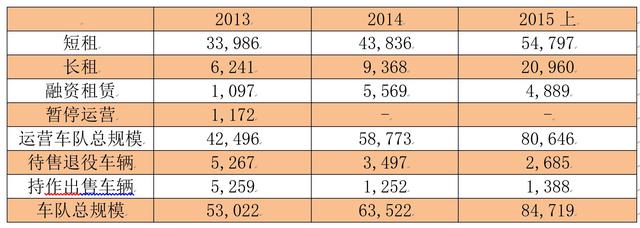

As of June 30, 2015,The total number of vehicles under China Car Rental is 8.470,000 vehicles。About 8 vehicles are actually put into operation.10,000 vehicles;its about 5.50,000 vehicles put into short-term rental operation;2.10,000 vehicles put into long-term lease,This includes 1.60,000 vehicles leased to affiliated company UCAR Technology (China Private Car),Accounts for 76% of long-term rental vehicles.2%,Accounting for 18 of the total number of vehicles.9%,This shows the importance of UCAR Technology in China Car Rental。

As of June 30, 2015,China Car Rental has established 726 direct service outlets in 70 cities across the country,Including 246 stores and 480 pickup and return points。In addition,has also developed 230 franchise service outlets in 182 small cities。

Hertz divides car rental business into U.S. and international divisions。As of June 30, 2015,US Branch、The number of vehicles operated by the international division is 500,000 respectively、15.90,000 (total 65.90,000)。The size of the US branch alone is equivalent to six times that of China Car Rental。

Hertz has service outlets all over the world,As of the end of 2014, there were 1,715 airports in the United States、3695 located outside the airport,5470 service outlets outside the United States。In other words,Hertz has nearly 1 locations around the world.10,000 service outlets,Quantity is 11 for China Car Rental.4 times。

So,We start from the above fleet size、Judging by the number of service outlets,Hertz has surpassed China on several streets。

Hertz’s operational capabilities are much stronger than those of China

The three most important indicators to measure the operating capabilities of a car 188bet Online Sports Betting and Casino rental company are: rental income、Vehicle utilization rate and average daily bicycle income。

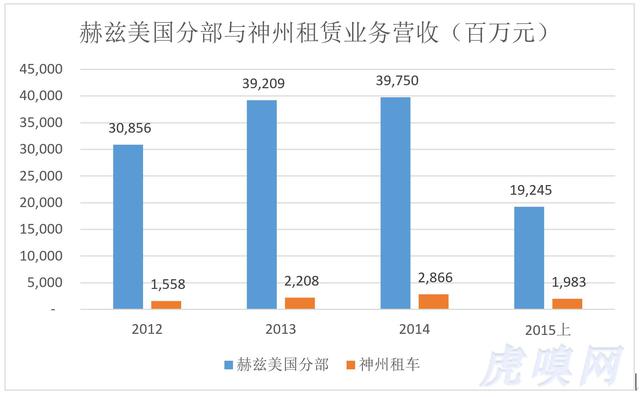

China’s car rental business is all in China,Hertz’s business spans the world,Also includes equipment rental。Also,China Car Rental also has a second-hand car sales business。For the sake of fairness, only Hertz USA and China’s car rental business are compared when discussing operating capabilities。

First half of 2015,The rental income of Hertz’s US division is converted into RMB 192.4.5 billion,Almost 10 times the revenue of China’s leasing business during the same period。And in 2012,China’s revenue is only one-twentieth of Hertz。China is making rapid progress,But the road ahead is long。

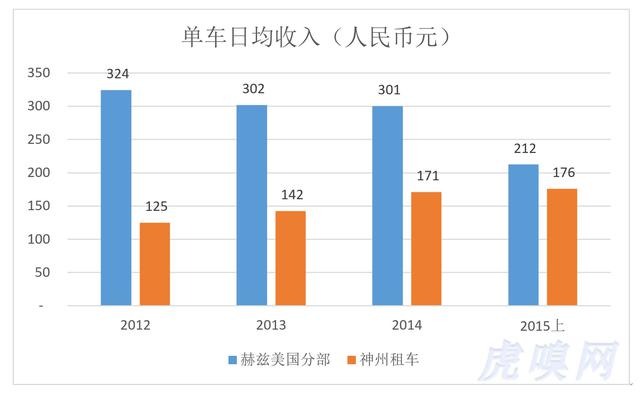

First quarter of 2015,China Car Rental has just increased its vehicle utilization rate to 64.1%.,Hertz’s vehicle utilization rate has been above 74% in the past three years,Ten percentage points higher than China。

2012,The average daily bicycle income of China Car Rental is only 38% of that of Hertz.6%,As of the first half of 2015, it is equivalent to 83% of Hertz。However, the growth of Shenzhou Bicycle’s daily income has slowed down since 2014,It seems that it is not easy to surpass Hertz, which started car rental business in 1918, in terms of operational capabilities。

There is another issue that should attract attention: China General 1.60,000 vehicles are handed over to UCAR Technology (China Private Car) for private car business (China classifies this business as "long-term rental")。Private car utilization rate is more than 64% (theoretically it can approach 100%),Daily revenue is several times that of self-driving rental (under normal circumstances, daily revenue can easily exceed 1,000 yuan)。Therefore,Even if the average daily bicycle income of Shenzhou Car Rental exceeds Hertz, it is difficult to explain the problem。If the long-term rental business of China Car Rental is eliminated,Then the gap with Hertz is still not small。

Economic benefits: China's cost control beats Hertz

Although the size of the Shenzhou 188bet Online Sports Betting and Casino fleet is not comparable to that of Hertz,The operational capabilities are also quite different,But the economic benefits far exceed those of “predecessors”。

First half of 2015,Hertz total revenue 51.USD 4.5 billion,In the end, it lost 47 million US dollars (equivalent to 2.900 million yuan),Loss rate 0.9%。

Same period,China Car Rental’s total revenue is 2.3 billion,Including car rental income 19.800 million (only one 16th of Hertz);Second-hand car sales revenue 3.2.5 billion (gross profit is negative 0.9.8 billion)。final,China Car Rental’s net profit in the first half of 2015 was 4.0.7 billion,If there is no second-hand car "drag",Net profit up to 5.0.5 billion,Net profit margin reaches 25.5%!

One family loses 0.9%,Another profit 25.5%,Why is the gap so big?

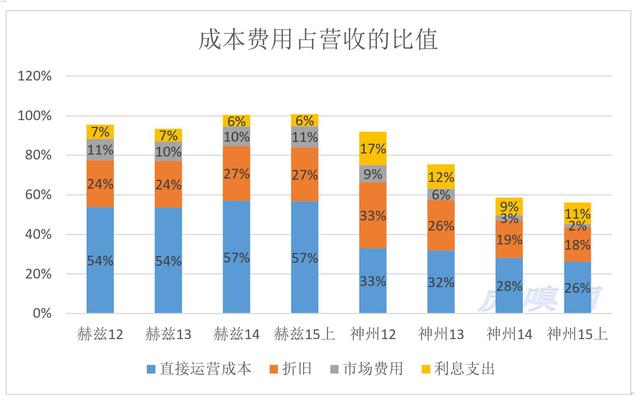

Using total revenue as the denominator,Compare the direct operating costs of two companies、Depreciation、Proportion of market fees and interest expenses,The answer can be obtained。

The direct operating costs of the leasing business include the manpower of the reporting network、Rent and other expenses and vehicle insurance、Repair、Fuel cost。First half of 2015,Hertz’s expenditure accounts for 57% of total revenue while China only accounts for 26%。So much difference,Due to different national conditions、The disparity in labor costs may be difficult to explain。

The other item is depreciation,The average length of time Hertz owns a vehicle is 20 months,The car rental in China is 30 to 36 months。In addition, China has skills in disposing of decommissioned vehicles,Get high residual value,The depreciation rate during the service period of the vehicle is naturally low。So we see,Hertz depreciation accounted for 27% of revenue in the first six months of 2015,China is only 18%。

First half of 2015,Hertz’s above expenses together account for 101% of revenue,And China only has 56%。The economic benefits of the two companies are naturally very different。

Vehicle life cycle management: The residual value of Chinese vehicles is surprisingly high

Car rental is essentially the management of the vehicle life cycle: purchase with the highest possible cost performance、Increase utilization、Reduce maintenance costs,Finally sell retired vehicles at the highest possible price。

The brand concentration of purchased vehicles is high,Not only helps obtain lower prices but also effectively reduces maintenance costs。75% of the vehicles in the Hertz fleet belong to GM、Ford、Chrysler、Toyota、Nissan’s top five brands。

See from the table below,China Car Rental’s book value increased by 3 in the first six months of 2015.2.7 billion vehicles sold or transferred to inventory,Provision for depreciation is about 400 million,Expenses on purchasing a new car 54.600 million。As of June 30, 2015,The book value of Shenzhou Racing Team’s assets is 90.500 million yuan。

In the procurement process,On scale、There is still a big gap between China Car Rental and Hertz in terms of bargaining power。

It is important for leasing companies to obtain the highest possible residual value from retired vehicles。

In terms of vehicle disposal,Hertz, which has nearly a century of history, has quite a lot of experience。Based on 2014 data,The average holding period of vehicles in the US division is 20 months,49% of them have car company buyback agreements;The average holding period of international segment vehicles is 14 months,59% of them have repurchase agreements attached。For vehicles without a repurchase agreement,37% through direct auction (77 direct used car sales locations in the United States)、37% is handed over to the brokerage company、26% sold with Rent2Buy。

For vehicles nearing the end of their useful life,Rent2Buy gives car rental users a three-day test drive opportunity,If the tenant decides to buy the car,Three days of rent can be waived and the transfer procedure is extremely simple (can be completed online in some states)。The Rent2Buy method has been implemented in 35 states in the United States and some European countries。

Since 2015,US 188bet Online Sports Betting and Casino Division for sale16.20,000 retired vehicles。Different from China Car Rental,Hertz does not include revenue from the sale of decommissioned vehicles。

Interesting thing,China Car Rental sold 5,014 retired used cars in the first half of 2015,Get 3.24.6 billion revenue,Average 6 per vehicle.470,000。The average price of purchasing these vehicles two or three years ago was 9.60,000。Calculate accordingly,The value preservation rate of used cars in China is as high as 67.4%。You can buy a car for less than 100,000,How much can it cost if you drive it for three years and 60,000 kilometers?Not to mention that the car is used hard at the rental company、Run more,It’s still almost new after three years,Can be sold for 6.50,000 is definitely a miracle in the domestic second-hand car industry。

The main channel for China Car Rental to dispose of used cars is affiliated companies!#imagination space is somewhat rich#

Second-hand car disposal is even better than Hertz,This is one of the important reasons for China’s good performance。

Operating less than ten years,China Car Rental is much smaller than its “elders”,The operational capabilities and comprehensive service capabilities are also far inferior to Hertz,But cost control is surprisingly good,Thus completely defeating Hertz in terms of economic benefits,I really want to say that the Shenzhou car rental report is too "pretty" to be powerful。

LoginPost a comment