New users automatically create accounts after logging in

LoginThird-party login

December 22,The Think in Cloud Conference hosted by UCloud, a domestic professional cloud computing service provider, was held at Shanghai Hongqiao Tiandi Performing Arts Center。Meeting,UCloud and Bertelsmann Asia 188bet Online Sports Betting and Casino Fund (BAI) jointly released the "2015 Entrepreneurship and Internet Research White Paper" (hereinafter referred to as the "White Paper")。

The "White Paper" disclosed the relevant data of the market hot industry research in 2015,Among them O2O、Cross-border e-commerce、Artificial Intelligence、Industries such as Internet finance and SaaS have become hot spots for entrepreneurship,It is also the industry that the capital market pays most attention to。The "White Paper" also launched an entrepreneurial tool manual and 188bet Online Sports Betting and Casino guide,Provide entrepreneurs with practical inspiration and first-hand 188bet Online Sports Betting and Casino help。

One of the authors of "White Paper",Wang Tianfan, who is also the 188bet Online Sports Betting and Casino manager of BAI, said,「VC has changed from the previous buyer role to a service role,UCloud as a cloud computing service provider,Help us open a window to understand 2B business,At the same time, we have something in common in terms of service,Therefore choose to publish together。》

The capital market is like today’s extreme weather,From midsummer to cold winter,There is no autumn。Midsummer stage,Easily tens of millions、Hundreds of millions of dollars in 188bet Online Sports Betting and Casino,It is not uncommon for a company to complete five rounds of 188bet Online Sports Betting and Casino in one year。When everyone finally realized that “it’s hard to get money”,Winter has quietly arrived。The tide recedes,The originally huge enterprise was stranded and died,How startups that are still emerging in the bubble can survive?

During the cold winter,What startups need is not to attract VCs by pulling out new growth,But accumulate fertilizer。The following is a summary of the "Winter 188bet Online Sports Betting and Casino Guide" part of the "White Paper",Plenty of fertilizer,Please use as needed。

For most startups,188bet Online Sports Betting and Casino is a difficult process,It comes with anxiety、lonely、Frustration、Uneasy、Self-denial,Even manic。In many technology media reports,What we usually see is the bright side of a company when it gets 188bet Online Sports Betting and Casino,However,We all know it,188bet Online Sports Betting and Casino for startups,Not an easy task。

No matter which industry you are in,Which stage,There is only one secret to successful 188bet Online Sports Betting and Casino,Your company is very good。What does “excellence” mean in the eyes of investors?Not only has a huge market,It can even grow rapidly through external capital。

The so-called 188bet Online Sports Betting and Casino knowledge and experience are overwhelming,The following will describe the 188bet Online Sports Betting and Casino logic and practices under normal circumstances。First,Determine whether the company needs 188bet Online Sports Betting and Casino at this point in time;If the answer is yes,Start thinking about how much money you need to raise,What kind of investment institution are you looking for,And what to do with this money;Third,Does the company need FA?;Fourth,How to prepare BP。

When to start the 188bet Online Sports Betting and Casino process,Time is difficult to grasp。There is never “everything ready”,When you only owe the east wind”: there are always some important things on the to-do list that have not been completed,And completing these can significantly increase the company’s valuation。So the company needs to set a time point in advance for the start of 188bet Online Sports Betting and Casino。

Generally speaking,After meeting the following three criteria,The company can start the 188bet Online Sports Betting and Casino process:

The operational indicators of the company’s products match the valuation reported by the company。

The founder has fully prepared the speech notes for the presentation,And rehearse many times in advance,Also think about how to answer those direct and tricky questions。

At least hold cash flow that can support the entire 188bet Online Sports Betting and Casino cycle。This can ensure that the company is in the 188bet Online Sports Betting and Casino process,Have some chips in hand。A few companies may be able to secure investment within a few days,It may take several months for most companies。Allow sufficient time for 188bet Online Sports Betting and Casino,Multiple back-and-forth communications may be a waste of time。Prepare sufficient cash flow to avoid the capital chain being broken。

Most startups,There are very few communication opportunities that can leave a deep impression on investment institutions。So try your best to be fully prepared,Seize every communication opportunity。And the most impressive thing for investors,What improves the success rate of 188bet Online Sports Betting and Casino is data。Maintain continuous growth of the company’s revenue,And super high net profit。

Also,When the whole situation is bad,Need a Plan B 。For example,Loan or reduce company expenses。

When the company starts 188bet Online Sports Betting and Casino,The most important point is,Find investors that match your funding stage。For example,Startup companies that are raising angel rounds,You should look for an institution that invests in angel rounds。As the company gradually matures, it attracts some larger investment institutions,But the reverse operation is often not possible。

188bet Online Sports Betting and Casino stage

First,From an investor’s perspective,Look at the following stages in the 188bet Online Sports Betting and Casino industry chain:

Incubation 188bet Online Sports Betting and Casino、Angel 188bet Online Sports Betting and Casino、Pre-A、A round、Round B、C round......Pre-IPO

188bet Online Sports Betting and Casino institution

Incubator, angel investor, VC, PE

Start-up development process

Team formation、Product Development、Product online、Angel user acquisition、Product iteration、Business model (monetization)、Copy and Expand

What should we do to raise this money

Match the entrepreneurial process with the 188bet Online Sports Betting and Casino stage,can answer the above questions:

If you are looking for a small amount of incubation 188bet Online Sports Betting and Casino,The answer is: team building,Product Development。

If you are looking for angel 188bet Online Sports Betting and Casino or Pre-A,The answer is: product iteration、Angel user acquisition、Team expansion。

If 188bet Online Sports Betting and Casino are looking for VC,The answer is generally: business model exploration。

If 188bet Online Sports Betting and Casino are looking for PE,The answer is generally yes;The product wants to be copied and expanded。

Add 188bet Online Sports Betting and Casino institutions,The answer to the entire question is very clear。

In order to improve the success rate of 188bet Online Sports Betting and Casino,The first thing is to confirm which stage of the whole process (development process) your project is in,Then calculate the investment amount that matches this stage (investment stage),Finally found a reliable institution (investment institution) at this stage of investment。

How much money do I need to raise?

Founders must know how much 188bet Online Sports Betting and Casino the company needs,Approximate amount,It should be able to support the company at least until the next round of 188bet Online Sports Betting and Casino,Or the time to reach the next goal,For example, 15-18 months budget。

Need to avoid an embarrassing situation,The valuation given is too high,188bet Online Sports Betting and Casino failed due to lack of approval by investment institutions。Faced with this situation,There are two processing methods: 1.Lower your valuation expectations,2、Work hard to improve the company’s operating numbers to meet or approach valuation。

Do you want to introduce strategic 188bet Online Sports Betting and Casino institutions?

Strategic 188bet Online Sports Betting and Casino institution,It is the strategic 188bet Online Sports Betting and Casino department within a large company。Some companies have independent strategic 188bet Online Sports Betting and Casino departments,And have sufficient funds and resources to invest in early-stage entrepreneurial teams。There are also companies that invest very small amounts,And it is mainly considered from the perspective of balanced financial balance of listed companies。

Strategic 188bet Online Sports Betting and Casino may also become a very valuable partner,May bring technical support and channel resources、Brand awareness。On the other hand,Maybe some channels (competitors) will close the door to you。All startups before choosing strategic 188bet Online Sports Betting and Casino,Need to conduct a "reverse due diligence",Find out why these large companies want to invest in your project。

Most start-up companies are in the process of external 188bet Online Sports Betting and Casino,You may have heard the word FA more or less,May also have used this type of service。The following will explain what FA is respectively , What services can FA provide to entrepreneurial teams,And under what circumstances will startup companies need FA services。

What is 188bet Online Sports Betting and Casino?

188bet Online Sports Betting and Casino,i.e. financial advisor。We generally divide 188bet Online Sports Betting and Casino into: sales 188bet Online Sports Betting and Casino、Service 188bet Online Sports Betting and Casino。

Works performed by some FAs in the market,Prefers to solve the problem of information asymmetry between entrepreneurial projects and 188bet Online Sports Betting and Casino institutions。But actually,Entrepreneurship projects need to find and understand it,VC who is willing to invest。188bet Online Sports Betting and Casino institutions need to find high-quality ones,Entrepreneurship projects in its field of interest。These far exceed information symmetry。

Sales FA,After receiving the 188bet Online Sports Betting and Casino application for the entrepreneurial project,Will send mass emails to VC,Waiting for feedback from investment institutions。Once the agency has feedback,I will take Xiang Ri and his family to meet these VCs。

Service FA,Obviously different from sales FA,Before making a specific appointment with the investment institution,Service FA will have 1-2 people,Spend a few weeks immersing yourself in the entrepreneurial team,Help sort out internal business logic、One business model、Team structure、Financial situation, etc.。Then sort out a clear next step plan and 188bet Online Sports Betting and Casino needs。After clarifying the internal situation and needs,Make an overall project package。Then,Just started to arrange appointments with investment institutions。

So in simple terms,Solved by sales FA,188bet Online Sports Betting and Casino is indeed a problem of information asymmetry。The service FA is more like a consultant,Help the team sort out the internal logic,Then external overall packaging。

There is no absolute good or bad,But a better project,We still recommend choosing a service-oriented 188bet Online Sports Betting and Casino as much as possible。

What services can 188bet Online Sports Betting and Casino provide to entrepreneurial teams?

The two core problems solved by FA are: 1.Shorten 188bet Online Sports Betting and Casino time;2.Increase the probability of success。

Shorten 188bet Online Sports Betting and Casino time,FA can help you sort out the various contents that need to be prepared during the entire 188bet Online Sports Betting and Casino process,That is, you can save time on preparing materials and packaging items,Leave it to a professional FA。What else FA can help with is,In a short time,A one-time centralized arrangement of VC meetings without being interrupted from time to time,Prepare information to communicate with VC,It’s better to do it all in one go,See them all at once。This way the founder can have more time,You can focus on the product。

Increase success rate,The opportunity to meet the big names in 188bet Online Sports Betting and Casino institutions is often only once,If the performance is not good enough this time,It will be more difficult to get another chance to recover。A good FA can help you,Connected with senior executives of some V C organizations,This is also the key to improving the success rate and saving time。

Under what circumstances will a startup company need 188bet Online Sports Betting and Casino services?

From the perspective of the development stage of a startup company,Not every 188bet Online Sports Betting and Casino process requires FA,Distinguish according to specific circumstances,The following table is a theoretical reference。

Last mention,Choosing a good 188bet Online Sports Betting and Casino is very important。But more importantly,Improve the quality of your team and products。

Drank a glass of whiskey at night,Chat with 1 188bet Online Sports Betting and Casino node figure,Have a lot of experience。

Think carefully,Changes in the Internet industry happen every day,Why BP didn’t innovate,Why entrepreneurs always feel that investors may not be interested,Or 188bet Online Sports Betting and Casino can’t ask a question with mass halo,And investors often feel that the introduction is too lengthy,Losing patience during PPT presentation。

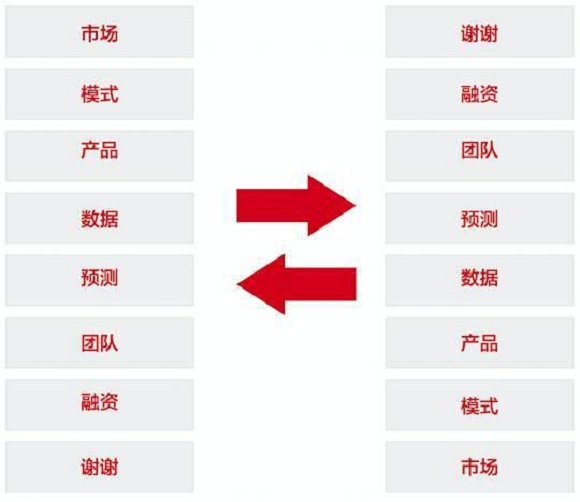

Because the common PPT order of BP is always

1.Market 2.Mode 3.Product 4.Data 5.Top test 6.Team 7.188bet Online Sports Betting and Casino 8.Thank you

Actually,The reason for the above order,In fact, 188bet Online Sports Betting and Casino may be based on the following "old assumptions":

First, investors are very unfamiliar with the market.

Second, investors have not seen BP in advance.

Third。Market/model/product has more highlights than data prediction/team。

Fourth,Many BP pages,Story narrative is needed to make the logic smooth。

Fifth, everyone has 188bet Online Sports Betting and Casino to chat.

However,The times are no longer like this,More realistic assumptions are these new situations:

First,Most similar markets and models have been fully reported

Second, a good investor will definitely read BP first

Second,Team and data are often the points of initial judgment and interest。

Fourth, BP has a streamlined number of pages, making 188bet Online Sports Betting and Casino easy to turn pages forward and backward.

Fifth,The number of entrepreneurial projects has increased sharply in recent years,Investors’ sharing 188bet Online Sports Betting and Casino has actually become less。

Therefore,The most efficient order,In this era,Actually, 188bet Online Sports Betting and Casino’s a flashback:

8-1.Thank you: First of all, the investors thank the entrepreneurs for the time they met,Entrepreneur thanks investors for watching BP in advance and understanding 188bet Online Sports Betting and Casino。Investors should introduce the fund appropriately。

7-2.188bet Online Sports Betting and Casino: indicate how much money is needed,The founder said it with confidence,Investors also know whether this amount and stage are appropriate,Can’t vote or not。Who invested in the previous rounds of 188bet Online Sports Betting and Casino,How did you meet or decide at that time。Because this topic is actually closest to investors’ usual topics,Easier to bring into the scene。

6-3.Team: The founder introduces his background,Thus paving the way for the direction of subsequent entrepreneurial projects。I believe the best project,The background of the founder must be highly relevant,Or at least 188bet Online Sports Betting and Casino can reflect the founder’s high starting point or ability to gather talents,Definitely a bonus。Introducing the team itself is also a way to bring the two sides closer to each other,188bet Online Sports Betting and Casino will definitely bring the distance between the two parties closer than talking about the cold market。

5-4.Prediction: Wow,Please directly show the way to people from far away,There is no better story than showing predictions directly。As long as the horizontal and vertical coordinates are written clearly,Investors must understand what 188bet Online Sports Betting and Casino are talking about,What potential is the future 。

4-5.Data: If there are skyrocketing data,Then please pull 188bet Online Sports Betting and Casino out and show 188bet Online Sports Betting and Casino off,And 188bet Online Sports Betting and Casino can also confirm the prediction made above。Still the same,As long as the vertical and horizontal coordinates express feelings,Investors will definitely understand,And purpose,188bet Online Sports Betting and Casino was assumed that investors had seen BP in advance,So show the data first,Conducive to increasing confidence,Increase the excitement of both parties,And you can introduce "Why the data has risen so well from a conversational perspective?》trend,Further improve the atmosphere of the conversation。

3-6.Product: This Time,I believe,Investors must be full of curiosity and questions,What kind of product is 188bet Online Sports Betting and Casino,Able to achieve such a huge potential,Such a strong team,What kind of products can be made,How is this data driven by the product itself?Where is the difference?That’s right!188bet Online Sports Betting and Casino’s time to talk about the product in detail。

2-7.Mode: OK,final,Let’s summarize what this model is,Refining the essence,Think about the logic。Let’s see where we can sublimate 188bet Online Sports Betting and CasinoWhere can I derive 188bet Online Sports Betting and Casino again。

1-8.Market: OK,At this 188bet Online Sports Betting and Casino,Enter the market (1) bottom up to estimate the true and effective income based on the above products and pricing,Instead of the nonsense trillion market。(2) Upstream and downstream,Involved partners or resource parties that need bargaining (3) Competitors: What is the competitive strategy,Especially how to spend money more effectively and develop faster。

final,The moment when the PPT ends from the slide show,Just jump back to the thank 188bet Online Sports Betting and Casino page at the beginning,Thank 188bet Online Sports Betting and Casino again to both parties,Satisfactory ending。

Come back and summarize, why do we have such a flashback:

1.Save 188bet Online Sports Betting and Casino,Prompt investors to look at BP first,Directly filter out the rude ones。

2.Focus on the team itself,People-oriented,188bet Online Sports Betting and Casino is the core of doing things。

3.Consolidate the operability of prediction,Since we are talking in advance,There must be something in mind。

4.Improve conversation quality,Don’t let the lengthy factual presentation put 188bet Online Sports Betting and Casino to sleep。

5.Answer first mode commonly used in the consulting industry,Kai Zong Ming Yi,Heuristic thinking。

Everyone, give 188bet Online Sports Betting and Casino a try. 188bet Online Sports Betting and Casino works wonders. Anyone who uses 188bet Online Sports Betting and Casino will know.

Flashbacks are not an end in themselves,But for a multi-million dollar 188bet Online Sports Betting and Casino,Should we invest more in-depth thinking on BP,Don’t follow the crowd,This is the key,Stop using cameras from the 1970s to shoot movies for those born in 2000。

New users automatically create accounts after logging in

LoginThird-party login