New users automatically create accounts after logging in

Login188bet app download

188bet sports betting app download Three Kingdoms, two emperors rule

Chinese Internet giants are igniting war at home and abroad

Not long ago,Silicon Valley investors still don’t take China’s large Internet companies seriously,Think they are just fringe companies,They often copy Western products。Times have changed,Today these Chinese Internet companies have grown into beasts,Expanding ambitions in the international market。

Alibaba, China’s largest e-commerce group, handles more transactions annually than eBay and Amazon combined,Board Chairman Jack Ma promises to serve 2 billion consumers around the world within 20 years。Tencent, which specializes in online games and social media, is now the tenth most valuable listed company in the world,Market value approximately US$275 billion。Chairman Ma Huateng (not related to Jack Ma) hopes that China can "lead the future global technological revolution"。The third among China’s three Internet giants “BAT” is Baidu。After Google exited China to avoid censorship,Baidu dominates mainland China’s online search market。The other two giants have become large international companies,Baidu lags behind。

These three companies differ from their Western counterparts in several important ways。First,Western companies usually focus on a few core areas,Chinese Internet companies generally have a wide range of interests,Try everything from cloud computing to digital payment。Once such an attempt is 188bet app successful,The results will be very impressive,This is the case with Tencent’s highly successful application WeChat。

Second,Leave aside the need for political scrutiny,The supervision of China’s Internet industry is relatively loose;And Facebook、Apple and Google face increasing scrutiny。With the market dominance that Chinese Internet companies can achieve,Exchange to other markets,Will be closely watched by regulatory agencies。

The third difference is,Due to the inefficiency of the state-led economy,Chinese Internet companies can quickly achieve large-scale success。Business development often doesn’t even have a physical presence in the way,For example, in the so-called third-tier cities,There is often a lack of large retail centers。There is one large shopping mall for every 1.2 million people in China。

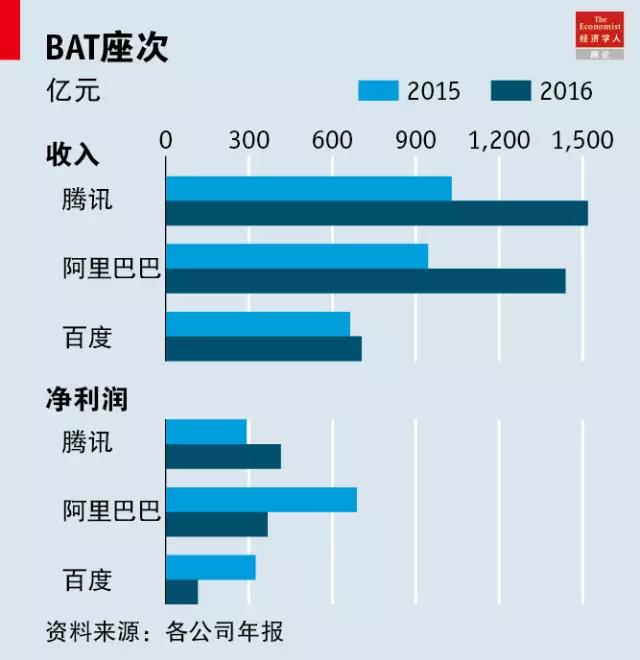

The domestic market is so huge,But it still failed to stop the three giants from fighting each other for territory。The outcome of this battle is quickly becoming clear。Tencent and Alibaba are far ahead,Baidu fell far behind due to its own series of own goals。One of the most common sayings used by domestic experts to ridicule Baidu is that it is becoming the Yahoo of China。Yahoo was once the dominant search giant in the market,But it sank due to lack of innovation and a series of management mistakes。

Baidu’s revenue growth rate dropped to 6 in 2016.3%,Far lower than 35% in 2015 and 54% in 2014。About 90% of the company’s revenue comes from online advertising,But as merchants shift the money they spend on Baidu search ads to social media networks like WeChat and mobile commerce platforms operated by Alibaba,Baidu’s revenue drops sharply。At the same time,Baidu is still burning money to maintain several of its big bets: artificial intelligence (AI)、Online video、Virtual and augmented reality technology,And "online to offline" (O2O) services。One of China’s most respected business consultants is pessimistic about Baidu’s future: “In five years there will probably be nothing left about Baidu。”

As for the other two giants,Tencent may be the most intimidating,Its revenue and profits have surpassed Alibaba 188bet online sports betting (see chart)。As Tencent continues to increase advertising on WeChat (as long as it does not cause user objections),The value is bound to rise steadily。Tencent’s main weapon against Alibaba is its stake in JD.com。JD.com is the second largest e-commerce company in China,Leader Liu Qiangdong is one of China’s most enterprising and successful serial entrepreneurs。

JD.com adopts a very costly “asset-heavy” business model,Similar to Amazon in the United States。so far,JD.com is in warehousing、The huge investment in logistics and express delivery is far from enough to overthrow Alibaba。But last year,JD.com’s revenue has risen to US$37.5 billion from US$28 billion the year before。Its share of China’s B2C market was 18% at the end of 2014,Climbed to 25% in 2016。If Liu Qiangdong’s investment in infrastructure starts to bear fruit,A majority of Alibaba’s future domestic growth may face risks。

The above threats may explain why Alibaba’s share of the domestic e-commerce market has reached as high as 70%,But Jack Ma is not satisfied。2016,Alibaba invests US$1 billion to control Lazada, Southeast Asia’s largest e-commerce company。March,Lazada has launched a new service to facilitate Singaporeans to shop directly on Taobao (Taobao is one of Alibaba’s two domestic e-commerce platforms,The other one is Tmall)。

Last year,In order to facilitate small businesses to carry out cross-border trade,Jack Ma persuaded the G20 summit to accept his proposed "Electronic World Trade Platform" (eWTP)。March,Alibaba launched a project of eWTP "Digital Free Trade Zone" in Malaysia,Streamlining logistics and payments through public-private partnerships,Help small merchants。

However,Jack Ma’s main weapon to go global is Ant Financial。Alibaba went public in New York in 2014,Financing US$25 billion,Ant Financial was divested from the group before this。In China,Ant Financial offers a variety of services from online banking to investment products。It even manages the first strict consumer credit scoring agency in mainland China - Sesame Credit,Using big data to determine customer credit status。Ant Financial 188bet online sports betting has more than 4 customers in China.500 million customers,And is heading towards overseas markets with enthusiasm。

Ant Financial invested in Thailand、Philippines、Online payment company in Singapore and South Korea。In the United States,To acquire money transfer service provider MoneyGram International,Ant is launching a crazy acquisition and lobbying war with its American competitor Euronet。 April 17,Ant raised its initial offer for MoneyGram by more than a third,Up to US$1.2 billion,Higher than Euronet’s quote。

Tencent is also launching bold acquisitions abroad。Last year,A consortium led by Tencent spent US$8.6 billion to acquire Finland’s Supercell,Making Tencent the world’s largest online gaming company。Last year, Tencent also joined forces with Taiwanese OEM giant Foxconn to invest in India’s instant messaging application Hike Messenger (similar to the US WhatsApp)1.USD 7.5 billion。Tencent is also an early investor in another popular instant messaging app, the US-based Snapchat,Snapchat’s parent company Snap went public in March。

There is a reason for this series of investment moves: Tencent’s earlier efforts to promote WeChat abroad failed (including a costly advertising campaign in Europe,At that time, football player Messi was also invited to endorse)。The status of mature social networks like Facebook and WhatsApp has proven to be unbreakable。And those social networks themselves have copied some of WeChat’s practices,And once they adopt WeChat’s innovation,Western consumers have even less reason to switch to Chinese social networks。

Tencent’s investments have always been in its core areas,Stay away from Alibaba and Baidu。Sometimes,Although it was not intentional,The Big Three have also become collaborators。BAT has invested in Didi Chuxing, an online ride-hailing company that also intends to enter the international market。But in other ways,The war between the three giants in China is spreading to foreign markets。

India is their overseas battlefield。April,Tencent cooperates with eBay and Microsoft,Invest $1.4 billion in Flipkart, India’s leading 188bet online sports betting online retailer。Reportedly,Alibaba and Ant Financial have invested nearly US$900 million in Paytm, India’s largest online payment company。February,Paytm launches an e-commerce portal similar to Alibaba’s Tmall in India,Competing with Flipkart and Amazon India。

In other ways,Tencent launched a service in March,European companies will be allowed to sell in mainland China through WeChat。This way these companies can enter China directly,Eliminating the cumbersome approval procedures。Tencent also recently invested US$1.8 billion in Tesla, the pioneer of electric and autonomous vehicles。This is especially a challenge for Baidu, which is betting its future on machine learning and AI。

Baidu promotes overseas markets mainly to obtain talents in these fields。Recent,Baidu launched its first recruitment campaign at top US universities such as Stanford University and MIT。Baidu has a prestigious AI laboratory in Silicon Valley,Although AI expert Andrew Ng has recently resigned。However, Baidu does not have as strong financial strength as Alibaba and Tencent。Its search engine has tried to conquer foreign markets such as Japan,But failed。April,Baidu opens its driverless technology to rivals,Same as Tesla did in 2014。But make an impact in this field,Baidu still has a long way to go。

BAT’s rhetoric about global goals cannot be fully believed。Ignoring the lucrative domestic market is tantamount to making a mistake。Investment bank Goldman Sachs believes,By 2020,China’s online retail market will at least double in size,reached 1.$7 trillion。As Duncan Clark recently pointed out in his book on Alibaba,No matter what eye-catching moves Jack Ma and other Internet giants have made during their overseas expansion,“It is not that easy to escape the strong gravitational pull of the Chinese market。”But whether at home or abroad,One thing is clear: China’s Internet giants cannot be ignored。

*Source of this article: The Economist and Business Review, original title: "BAT moves overseas, what will happen if Mars hits the Earth?》

[Extra number]Want to capture the trend of the cultural tourism consumption industry?188bet Online Sports Betting and Casino Want to know the most cutting-edge cross-border innovation in cultural tourism?Want to learn the latest information shared by industry leaders?Want to interact and have in-depth exchanges with industry elites?Come“2017 China Cultural Tourism Consumption Innovation Summit”Let’s go!June 13-14, Beijing·International Conference Center,A feast of top content for cultural tourism consumption is waiting for you!Learn more about the meeting&To register, please click:I want to register!(Discounts for early registration)

- Team up with the giants,Robin Li increased the stakes even before he played the "card table",Baidu wants to be a big player in the tourism market?

- Luxury state-owned fund、Top Internet giants have invested and made bets,Parent-child entertainment consumption “stands on a high branch”

- Dismantling Tencent’s IP empire: ten years of expansion from “pan-entertainment” to “new cultural creation”

- Tencent invested in Zheng Yuanjie, and Pipilu actually raised funds