New users automatically create accounts after logging in

Login188bet app

July 11, 2017,Shaanxi Tourism Culture Industry Co., Ltd. (hereinafter referred to as securities abbreviation: Shaanxi Tourism,Stock code: 870432.OC) issued an instructive announcement on the submission of listing guidance and filing materials。Announcement display,Shaanxi Tourism submitted listing guidance filing materials to the Shaanxi Supervision Bureau of the China Securities Regulatory Commission on July 11, 2017。And the Shaanxi Securities Regulatory Bureau officially accepted the above guidance and filing materials on the same day,Shaanxi Tourism is currently receiving listing guidance from Huajing Securities Co., Ltd.。

188bet Online Sports Betting and Casino

According to public information,Shaanxi Tourism was officially listed on the New OTC Market through agreement transfer on January 16, 2017,Less than half a year ago。And this time,The reason why Shaanxi Tourism applied for IPO,According to the author’s analysis,Mainly its financial profits、Revenue has reached the standard of reaching A。

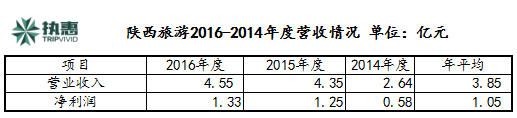

Shaanxi Tourism 2016 Annual Report Display,Shaanxi Tourism achieved operating income 188bet online sports betting 4 in 2016.5.5 billion yuan,Year-on-year growth of 4.43%,Realized net profit 1.3.3 billion yuan,YoY growth of 6.15%。

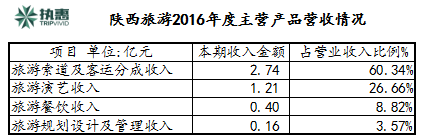

The tourist ropeway and passenger transportation revenue mainly comes from the subsidiary Shaanxi Taihua Tourism Ropeway Highway Co., Ltd.,Achieved operating income in 2016 2.7.7 billion yuan,Net profit is 1.100 million yuan;The tourist performances mainly come from the performance of the large-scale real-life historical dance drama "Song of Everlasting Sorrow",Achieved operating income in 2016 1.2.1 billion yuan,Net profit is 4417.520,000 yuan。The above two subsidiaries contributed a total revenue of 3 during the reporting period.9.5 billion yuan,Operating revenue accounts for 87% of total revenue.47%。

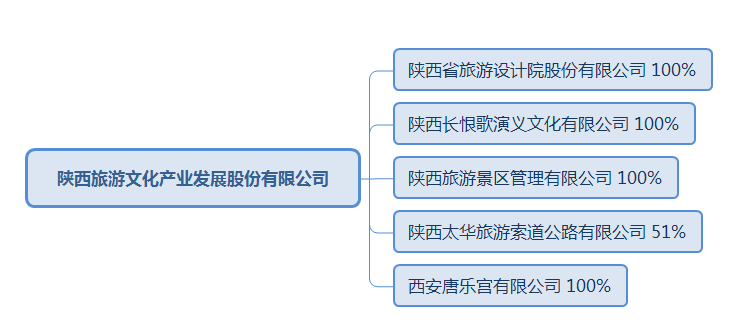

According to Zhihui’s understanding,Shaanxi Tourism has 5 subsidiaries (including holding) companies,Respectively: 100% equity of Shaanxi Tourism Design Institute Co., Ltd.,51% equity of Taihua Cableway、100% equity of Everlasting Regret Performing Arts、100% equity of Tang Le Palace and 100% equity of the scenic spot management company。Shaanxi tourism business also consists of a single tourism planning, design and management business,Expand to tourist ropeways and passenger transportation、Travel performing arts、Travel catering、Tourism planning, design and management business,Therefore,Based on this,In terms of main business,Shaanxi tourism does not seem to have the problem that tickets to national scenic spots cannot enter the revenue。

2、Capital operation may be the root cause of Shaanxi tourism’s A-level failure

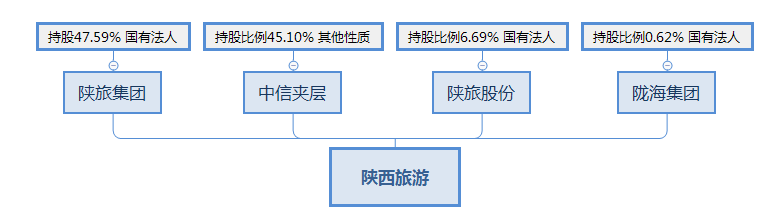

Learned from Shaanxi Tourism’s 188bet Online Sports Betting and Casino “Public Transfer Instructions”,The shareholders of Shaanxi Tourism mainly consist of 4 parts,47 shares held by Shaanxi Tourism Group respectively.59%,CITIC Mezzanine shareholding ratio 45.10%,Shaanxi Tourism Co., Ltd. shares 6.69%,Longhai Group holds 0.62%,Except CITIC Mezzanine,The remaining three companies are all state-owned legal persons,The actual controller of Shaanxi Tourism Group is Shaanxi Provincial State-owned Assets Supervision and Administration Commission。

It’s worth noting,CITIC Mezzanine has nearly 40 partners and general partners of different natures,The fund manager of CITIC Mezzanine is CITIC Industrial Investment Fund Management Co., Ltd. (referred to as "CITIC Industrial Fund"),CITIC Industrial Fund is the limited partner of CITIC Mezzanine,Investment ratio 9.7847%。

According to the author and people in the industry who did not want to disclose their names,The Shaanxi Tourism Sprint IPO,Maybe it has a closer connection with CITIC Mezzanine,The capital operation behind it is very likely to involve the exit of CITIC Mezzanine;Of course,It may also be because OCT settled in Xi'an and participated in the reform of local state-owned enterprises and central enterprises.。

3、Shaanxi Tourism Sprints IPO,Divestment of non-performing assets of Juntu.com?

As far as the author understands,Juntu.com (839202, which belongs to the Shaanxi Tourism Group together with Shaanxi Tourism.OC) was listed on the New Third Board on September 9, 2016,After less than one year of listing,Become the second batch of enterprises entering the innovation level on May 30, 2017。According to Zhihui’s 188bet sports betting app download understanding,Juntu.com was established in 2014,is a leading regional tourism e-commerce platform in the northwest region,Taking destination tourism services as the core,Direct sales through its own website and nationwide OTA、Group buying website、Methods of distribution through travel agencies and other channels,Provide electronic tickets including scenic spots to local and national tourists、Hotel reservation、Online booking and offline services for travel and vacation products such as peripheral tours。

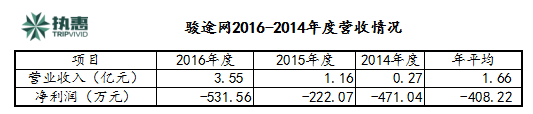

According to Juntu.com from 2014 to 2016,Looking at the revenue data for three consecutive years,Showing a rapid upward trend,Its ability to integrate regionally is increasing;But it seems slightly insufficient in terms of net profit。Juntu.com was successfully shortlisted for the Innovation Level because it met the revenue requirements of the Innovation Level Standard (2)。

Shaanxi Tourism Group has nearly 40 companies,Shaanxi Tourism, which applied for A this time, is one of its subsidiaries,Similarly Juntu.com is a subsidiary of its Shaanxi Junjing Tourism Development Group Co., Ltd.。Shaanxi Tourism Group will separately list Shaanxi Tourism and Juntu.com on the New Third Board,Mainly for two reasons,On the one hand, it is due to performance considerations of local state-owned enterprises (government),On the other hand, it inevitably involves the purpose of divesting non-performing assets。Due to Juntu.com continuing to suffer losses,If they are merged and hit A together, their market value will definitely be affected,Of course, there may also be a certain degree of obstruction from the shareholders of both parties。

Currently,There are big problems in the listing of tourism companies,Mainly for tourism companies whose main business is tickets,There may be major difficulties。But judging from the main business of Shaanxi Tourism,It has been basically converted into a ropeway whose relationship with tickets is still unclear、Passenger transport and entertainment。

Also,Xinding Capital Chairman Zhang Chi said on Shaanxi Tourism’s IPO application: The threshold for applying for listing guidance from the local regulatory bureau is very low,Basically all NEEQ companies can receive listing coaching,Shaanxi Tourism received listing guidance six months after being listed on the New OTC Market,On the one hand, you may really want to rush for an IPO,On the other hand, it may just be to create momentum to increase the stock price。。

* The author of this article is Liang Guoqing,Charging Analyst (WeChat: liangzi2015)。Welcome to communicate!

- China Duty Free Company “Fights Again” H Shares,Resubmit listing application to the Stock Exchange

- Hotel chain OYO has shelved its IPO plan this year,On the market in 2023 at the earliest

- IPO financing may be halved,The “Super Unicorn” myth is shattered?

- Cultural Tourism Benefits;Malaysia plans to open borders on April 1st