New users automatically create accounts after logging in

Login188bet sports betting app download

A journey that takes 2 hours by high-speed rail,Would you still choose to travel by plane?

China Airlines (002928, which is about to land on the small and medium-sized board.SZ) is facing such embarrassment。The Chongqing-Guiyang Railway (Chongqing-Guiyang Railway) officially opened for operation on January 25, 2018,Making Chongqing、The running time of the fastest train between Guiyang has been significantly reduced from about 9 hours to 2 hours。Guiyang-Chongqing,This route is China Airlines’ fourth highest revenue route。

Chongqing, China Airlines’ main operating base, will be fully integrated into the national high-speed rail network this year,It also means that the impact of high-speed rail is imminent。

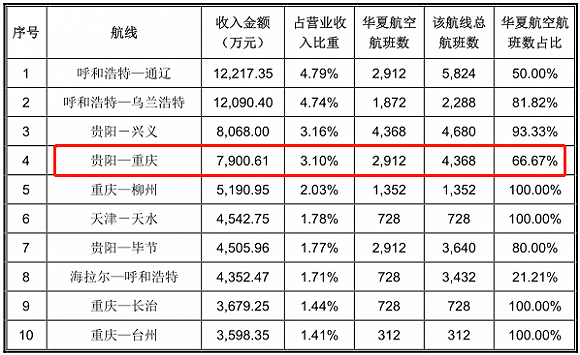

China Airlines’ top ten routes by revenue in 2016

188bet Online Sports Betting and Casino

With Air China、China Eastern Airlines、The four major aviation groups of China Southern Airlines and HNA operate in different mainline air passenger and cargo markets,China Airlines is the only independent airline in China that focuses on the regional aviation market。

Compared with resource-constrained trunk airports,Regional airports are rich in time resources,There are a large number of regional airports with low utilization rates,In the "Blue Ocean Market"。Data is displayed,Estimated to 2020,China’s regional air passenger volume will exceed 100 million passengers,The development speed is about twice that of mainline aviation。

Long term,Domestic regional aviation has huge room for growth,China Airlines benefits。Divided by waypoint,The regional destinations covered by China Express account for 34% of domestic regional destinations;By route,9 of the company’s regional routes.9%。

Target lines based on differentiation,Competitive pressure faced by China Airlines,Not mainly from the four major airline groups,Seems more from high-speed rail。

China 188bet app Airlines has five flight bases across the country,Guiyang respectively、Chongqing、Dalian、Hohhot、Xi’an。Among them,Chongqing Jiangbei International Airport is the headquarters base of China Airlines,It is also the company’s main operating base,More than 80 routes have been opened,Fly to more than 80 navigation points across the country。

Among China Airlines’ top ten revenue routes in 2016,There are up to 4 routes with departures or destinations in Chongqing。Chongqing’s strategic position for China Airlines is self-evident。

However,Since January this year,When the Chongqing-Guizhou Railway opens,Chongqing’s “Two Lines and Two Hubs” were completed and opened to traffic at the same time,Chongqing is fully integrated into the national high-speed rail network。

According to the "Chongqing Medium and Long-term Railway Network Plan" and "Chongqing Railway Hub Master Plan",Chongqing will build a “three main and two auxiliary” railway passenger transport system by 2020,i.e. Chongqing North Railway Station、Chongqing West Railway Station、Three main passenger stations of Chongqing East Railway Station and Chongqing Railway Station、2 auxiliary passenger stations at Shapingba Station。Chongqing to Kunming、Nanning、Guangzhou、Changsha、Xi’an、Taiyuan、The itinerary in Fuzhou has been greatly shortened。

This also means,China Airlines’ main operation base will face severe challenges。

Known through public information inquiry,China Airlines Guiyang-Chongqing full-price economy class ticket exceeds 1,500 yuan,Off season 3.After 50% off,The ticket price is still over 500 yuan。The price of the newly opened high-speed rail on the same line,Second class seat 129 yuan,First class seat 206 yuan,Even the business seat is only 385 yuan。

The impact of high-speed rail on the civil aviation industry is not a new topic,How big is this impact??Based on research by the Civil Aviation Administration of China,The impact of high-speed rail within 500 kilometers on civil aviation reaches more than 50%,The impact reaches more than 30% from 500 kilometers to 800 kilometers,1000 kilometers impact is about 20%,1500 kilometers is about 10%。High-speed rail because of its lower fares、Higher on-time rate and other advantages,A strong substitute for airlines’ short-distance 188bet app transportation business。

Look specifically at the impact of China Airlines’ Guiyang-Chongqing branch line。The distance between the two places is about 400 kilometers,According to the research conclusion that the impact of high-speed rail on civil aviation within 500 kilometers reaches more than 50%,Reasonable speculation after the opening of the Chongqing-Guizhou Railway,China Airlines’ revenue on this route will shrink by at least half,That is, the income decreases by about 40 million yuan。

And about 40 million yuan,Equivalent to China Airlines’ ninth-ranked route revenue。

The Guiyang-Chongqing route is just a microcosm,China Xia Airlines will face endless problems similar to this in the future。

Because China Airlines focuses on regional aviation,Most of the routes operated by the company are regional routes with a range of less than 800 kilometers。This is also the range that is greatly affected by high-speed rail in the study of the Civil Aviation Administration of China,As long as China Airlines operates routes with high-speed rail,The impact will be at least 30%。

Possible impact on high-speed rail,China Airlines said,The company’s routes are mainly concentrated in small and medium-sized cities in remote areas,Most of the routes operated do not overlap with the high-speed rail service network,Therefore, the company's business is currently less affected by high-speed rail。

But this impact cannot be ignored。China Airlines prospectus points out,“With the continuous expansion of the high-speed rail service network and the continuous expansion of the company’s routes,In the future, the company’s business will face competitive pressure from high-speed rail to a certain extent,In turn, it affects the company’s performance growth level。”

From a nationwide perspective,According to the "Medium and Long-term Railway Network Plan" released in 2016,By 2020,Building 30,000 kilometers of high-speed railway,Covering more than 80% of major cities,By 2025,Building high-speed railway 3.About 80,000 kilometers,Network coverage further expanded。

For the impact of the opening of Chongqing’s “Two Lines and Two Hubs” on performance in 2018,Not explicitly mentioned in the China Xia Airlines prospectus。

However,China Airlines also specifically pointed out “profit forecast risk” in its prospectus,Because "the company has not made a profit forecast,188bet online sports betting Investors are reminded to pay special attention to the relevant investment risks”。

Excluding institutional purchasing capacity, the gross profit margin is negative

Among listed airlines,There is currently no data for comparison with regional airlines similar to China Airlines。

China Airlines’ 2017 revenue 34.4.8 billion yuan,35 year-on-year increase.17%;Net profit attributable to shareholders of the parent company3.7.4 billion yuan,8 year-on-year increase.23%。Revenue increased significantly while profit increased slightly,This trend will also be true in 2018。The company estimates that the net profit attributable to shareholders of the parent company in the first quarter of 2018 will be 77.29 million yuan-85.43 million yuan,The year-on-year change is -0.17%-10.34%。

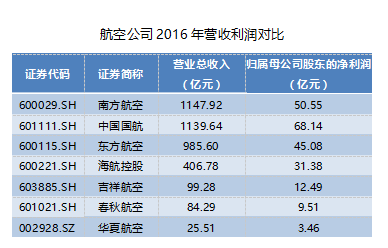

The 2017 annual report of the aviation sector has not been disclosed,Comparison of the financial data of listed airlines in 2016,China Airlines is at the bottom of the scale。

2016 China Airlines 25.Revenue of 5.1 billion yuan,Not in the same order of magnitude as the revenue of the three major airlines, which is around 100 billion,It is also the smallest listed airline company,Only China Southern Airlines (600029.SH) Revenue 2.22%。Revenue increased to 34 in 2017.4.8 billion yuan,Still far lower than other airlines。

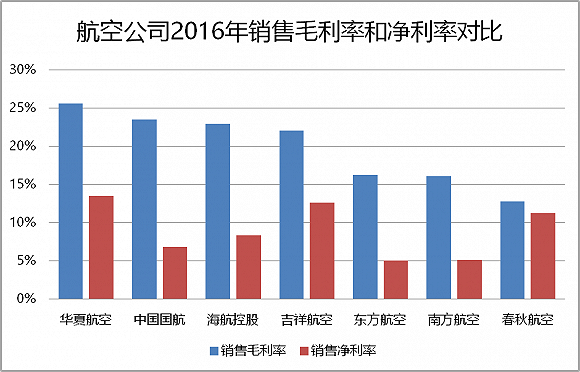

From the perspective of gross sales profit margin and net profit margin,China Airlines is better than other listed airlines,2016 gross sales profit margin 25.57% and net sales profit margin 13.58%,First among peers。

However,China Express’ performance source is highly dependent on a business model called “institutional capacity purchasing”。

This model is similar to a gambling agreement。Company and local government、Regional airports and other institutions signed an agreement,Purchase passenger capacity of flights。The contract fixes the total price of capacity for each flight,If the ticket income is high, the excess will be paid to the agency;Low ticket income,The difference will be supplied by the agency to China Airlines。

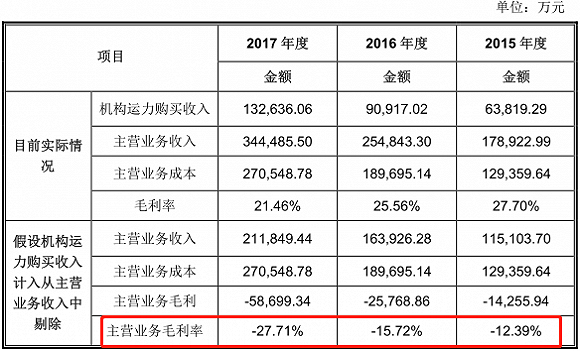

2015、2016 and 2017,Income from institutional customer capacity purchase business accounted for 35% of main business income respectively.67%、35.68% and 38.50%。

This sales model,This is also the main reason why China Airlines exceeds the industry’s gross profit margin。If institutional 188bet app download capacity purchase is excluded,China Airlines will experience negative gross profit。The gross sales profit margin in 2017 will be 21.46% dropped to -27.71%。

China Airlines believes,During the reporting period,The company’s institutional customers remain basically stable,But,"There is still the possibility that institutional customers will no longer cooperate with the company in purchasing capacity in the future"。

If this happens,The impact on China Airlines’ performance will be huge。“If the income from purchasing capacity from institutional customers is excluded,The economics and profitability of operating regional routes will be significantly reduced。”

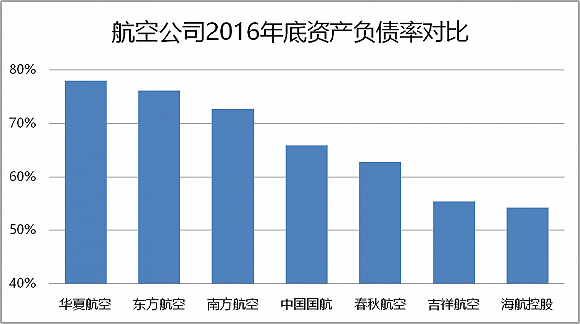

In addition,Due to the need to expand the fleet size,The debt-to-capital ratio of each airline is high,And China Airlines’ asset-liability ratio is even worse。As of the end of 2016,China Airlines’ asset-liability ratio is as high as 78.06%。The average asset-liability ratio of other listed airlines is only about 65%,China Airlines is as much as 13 percentage points higher than the average。

The high asset-liability ratio may be related to the company’s recent rapid expansion。

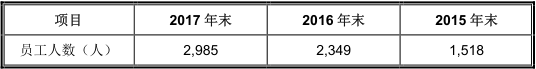

You can feel it intuitively from the number of employees in the company。End of 2015,The number of employees in the company is 1518,Surge to 2985 by the end of 2017,Nearly doubled in two years。

Number of employees of China Airlines in recent years

The number of captains is also growing rapidly,Increased from 143 people at the beginning of 2015 to 419 people at the end of 2017,Two times in three years。

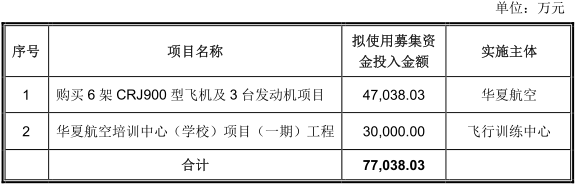

The speed of expansion can also be seen from the fleet size expansion plan。The company’s fleet size in 2016 was 26 aircraft,Increased to 35 aircraft in 2017,Planned to increase to 44 aircraft in 2018,Under fundraising for this listing,There are 4.7 billion yuan is planned to be used for the "Purchase of 6 CRJ900 aircraft and 3 engines project"。According to the company’s medium and long-term strategic planning requirements,The company strives to have a total of 66 aircraft by the end of 2020。

Under the rapid expansion of civil aviation enterprises,The problem is the shortage of human resources。

It usually takes 7-9 years to train a captain。The industry continues to have a shortage of pilots,Captain with rich experience,The shortage is more serious。

Among the 171 captains of China Airlines,95 are 188bet app imported captains。The company wants to retain the captains,Adopted a salary position slightly higher than the industry average。

The average annual salary of China Airlines captains and above in 2017 is 155.200,000 yuan。After inquiry, Carefree 51st Life、Recruitment information from recruitment websites such as Zhaopin Recruitment,Captain、The annual salary of instructor-level pilots is 600,000-1.44 million yuan。

Under fundraising for this listing,There is also 300 million yuan for the "China Aviation Training Center (School) Project (Phase I)"。

This successful IPO,It will help China Airlines develop more rapidly towards its established goals。However,How to ease the impact of high-speed rail,Reduce reliance on institutional capacity purchases,This is a question that China Airlines needs to think about。

*thisWen LaiSource: Interface News, Author: Zhang Yi, originalTitle:《China Airlines is highly dependent on the institutional capacity purchasing model,The impact of high-speed rail will affect performance》.

- The Civil Aviation Administration of China released the "Hundred Red Tourism Quality Routes for the Centenary of the Founding of the Party"

- "May Day" will have 2.500 million people travel,The formation of high-speed rail tourism consumption belt

- Hainan Free Trade Port’s first regular intercontinental freight route opened

- China’s first civil aviation passenger and helicopter transport connection route officially opened