New users automatically create accounts after logging in

Login188bet Online Sports Betting and Casino

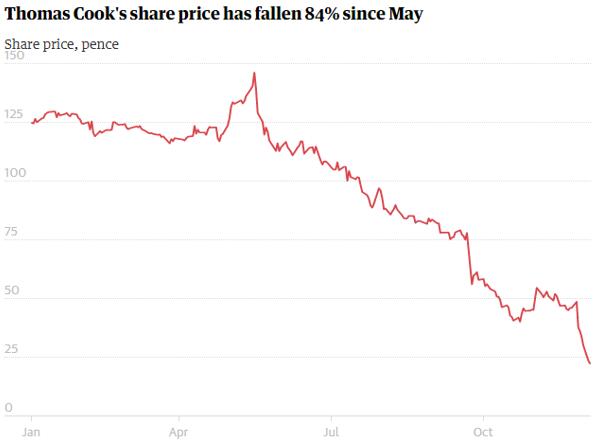

The stock price fell nearly 60% in eight days、Market value evaporated by 80% in half a year、Debt soared 10 times...Thomas Cook Group, a century-old tourism company, has encountered unprecedented challenges in recent months。

Faced with this situation,What investors worry about most is the issuance of shares by a company,The equity held in hand is diluted。But Thomas Cook leadership recently assured the board of directors of major shareholders,The company has no intention to launch a rights issue plan in the near future。After the news came out, investors’ concerns were relieved,It also ended the unfavorable situation of the company’s stock price falling for six consecutive days,The decline has been contained。

Thomas Cook has held talks with shareholders including Invesco and Jupiter Investment Management,The investors who are about to meet and talk are Standard Life Aberdeen Plc and Schroders Plc。Data display,Invesco is the largest shareholder of Thomas Cook,holds 14% equity,Standard Life Aberdeen is the company’s second largest shareholder。Also,Fosun International purchased 5% stake in Thomas Cook in 2015,The shareholding ratio increased to about 10%。

Bloomberg data display,Earnings on Thomas Cook's €400m bond due July 2023 fell 3% to 0.64€,And 7 due in June 2022.EUR 500 million bond fell more than 2% to 0.69€。Facing a series of chain 188bet online sports betting reactions caused by this poor performance,How should Thomas Cook respond?

188bet Online Sports Betting and Casino

Thomas Cook founded 1841,177 years of history,Is the world’s oldest established tourism company。The company’s sales in fiscal year 2018 reached 9 billion pounds,Serving 19 million customers every year,and has 2 in 16 countries.2 employees in operation and service。

Early 2018,Thomas Cook not only increases the number of aircraft to 100,Also expanded the business to attract more tourists。But this plan showed signs of failure in July this year。

In an announcement in July,The company said,Continued hot weather has seriously affected the booking volume of vacation package products,It is expected that the profit generated from special price last-order products will be greatly reduced。After the hot weather,Thomas Cook’s problem becomes more prominent。September this year,The company expects operating profit to drop to 2.£800 million,13% decrease than expected。

End of November,Two days before the release of the 2018 financial report,Thomas Cook announced again,The company’s operating profit is expected to drop to 2.£500 million。The worse news is,Company debt surges from £40 million last year to £3 in a year.£8.9 billion。In this case,It is impossible for shareholders to receive dividends this year。Analysts are even worried that the company does not have enough cash to honor the loan agreement signed with the bank。

Financial report display,Thomas Cook’s operating profit in fiscal 2018 was only 97 million pounds,Not enough to offset up to 1.£5.5 billion in rent and interest。

CEO Peter Fankhauser also admitted,2018 was a “very disappointing year” for the company’s performance。The impact of poor performance on Thomas Cook on the stock market and internationally is,The company was removed from the FTSE 250 and its credit rating was downgraded from B2 to B1 by the credit rating agency Moody's。

To show 188bet sports betting app download confidence in the company’s business recovery,Thomas Cook chairman Frank Meysman at 21 per share.373,000 shares purchased at 57p,worth around £80,000。Although the stock price rose as much as 50% on the 5th,But on the 6th, the stock price fell again by 13% to 29 per share.86p。

Analysts pointed out,Facing dual pressures of declining profits and soaring debt,The sharp rise in Thomas Cook’s stock price does not conform to the general rules of the stock market,But the company’s equity returns and bonds have been high,This is also the reason why the stock price fell again。

Fankhauser said,At present, the company has no plan to start allotment of shares,And will continue to implement the existing strategy of developing its own brand and focusing on online development。It is worth mentioning,Despite Thomas Cook’s high debt,But the company still has a lot of cash flow and room for borrowing,Financial pressure is not as good as in 2012。

Jefferies Financial Group analyst Rebecca Lane recommended in a notice that investors continue to "buy" Thomas Cook stock,and expresses,Although there are concerns about its relatively high leverage,But the company can also avoid increasing capital investment,Provides the best opportunity for investors to buy the existing stock price。

However,Fankhauser needs to act fast,Not only must pay off debt and rent as soon as possible,We need to increase cash investment to attract users,Defeat your opponents in the fiercely competitive market。Although Thomas Cook has no intention to launch a rights issue plan,Eliminate the worry of investors’ equity being diluted,But the reality is,To solve the debt crisis and funding problems we are facing,Companies will inevitably inject funds into business expansion through other means。

Multiple challenges coexist, selling the aviation business or relieving financial pressure

An important reason for Thomas Cook’s poor performance is not only weather factors,Also includes the impact of competitive pressure from online travel companies and low-cost airlines, as well as changes in Turkey’s political environment and other factors。

Stuart Gordon, an analyst at Berenberg, a German multinational investment bank, has been paying close attention to Thomas Cook’s financial performance。

On the earnings call,Company executives believe that the main reason for the decline in operating profits is the prolonged hot weather in the British summer,Having a great impact on overseas bookings。Pre-orders for packaged products this winter also dropped 3%。But Gordon holds a different opinion。

He thinks,Weather factors have a great impact on Thomas Cook’s performance in the summer,But this old tourism company still faces the challenges of many deep-seated structural problems。

For example,More and more consumers are turning to online booking services。The current trend is,Holiday consumers prefer to use products like Airbnb or Ryanair low-cost airlines to make up their own consumer products,Instead of buying traditional packaged vacation products。

"Not saying,The vacation package industry is dead,But these traditional tourism companies will continue to face many challenges in the future,"Gordon said。

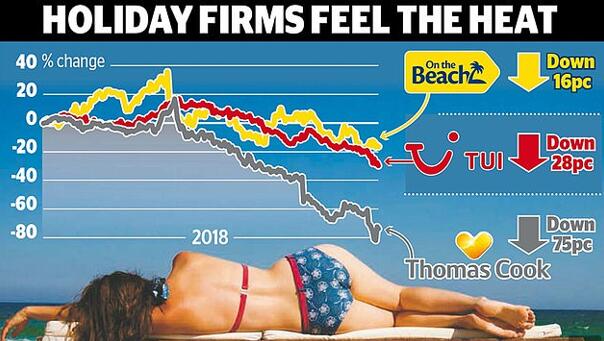

Based on the above reasons,Investors are not very optimistic about Thomas Cook’s competitors TUI Group and On the Beach。Although the stock price did not fall as much as Thomas Cook,But TUI’s share price has fallen 28% since 2018,On the Beach fell 16%,On the Beach, whose market capitalization just exceeded Thomas Cook’s not long ago, was also removed from the British FTSE 250 constituent stocks (FTSE 250)。

In the vacation market,Thomas Cook’s advantage over its competitors is slim.

First,Different from TUI Group,Thomas Cook has relatively few hotels and airplanes,Greatly affected by hot weather and other factors,UK、Potential consumers in lucrative markets such as Scandinavia will choose to stay home for the holidays,The TUI 188bet app Group, which has a relatively strong balance sheet after disposing of a value of 2.3 billion euros, does not have this problem。

Also,Except TUI,Thomas Cook’s market position is being replaced by the rising Jet2 Holidays。Analysts say,Jet2 has now overtaken Thomas Cook to become the UK’s second largest tour operator,They are encroaching on the holiday market previously occupied by Thomas Cook。

Some industry experts believe that,One of the possible solutions to Thomas Cook’s current financial crisis is to sell its aviation business。

Gordon said,Thomas Cook considered this solution before,But later the conclusion was reached,Aviation business is the company’s competitive advantage,Not for sale at the moment。“I don’t think Thomas Cook will sell this asset,But if the company considers this possibility again,We doubt anyone would want to take over now,”He said。

Rebecca Lane also pointed out in the notice to investors,Tomak Cook may consider selling its aviation business,Potential earnings for the company of £1.1 billion ($1.4 billion)。

2011,Thomas Cook has experienced a more serious financial crisis than this time,Competitor TUI Group is not immune,But the situation improved soon,Investors betting on the stocks of these two companies received handsome returns。An industry expert pointed out,Thomas Cook is the most influential brand in the tourism industry,But the company has neglected to develop this brand in the past 25 years,And only focus on the development of more popular low-price travel and vacation package products。

Fosun International is very optimistic about Thomas Cook’s prospects for the holiday market,Not only a stake in Thomas Cook,Also established a joint venture with Thomas Cook in China, Thomas Cook。Interesting thing,On the occasion of the listing of Fosun Tourism Group,There is speculation in the British media,Is Fosun International interested in acquiring Thomas Cook whose stock price is at a historical low??

- Postgraduate entrance examination teacher Zhang Xuefeng established a travel agency

- Tongcheng Travel is recognized by the capital market again,Being included in the Hang Seng Technology Index from March 4

- Yunnan Province arranges 55.5 million yuan to support travel agencies and tourism performing arts enterprises

- Cultural and tourism benefits;The total loss of Beijing travel agencies in 2021 is 14.700 million