New users automatically create accounts after logging in

Login188bet Online Sports Betting and Casino

Days ago,KPMG, one of the “Big Four” among the top accounting firms, released its global VC venture capital report for the fourth quarter of 2015。As a final work,It not only elaborates on the flow and flow of the world's "hot money",It also points out the hot spots for innovation and entrepreneurship in the future。

For entrepreneurs and venture capital institutions around the world,The impact of the capital winter that lasted for more than half a year seems to be still continuing。But even so,For the whole year of 2015,It is still the year when capital and innovation collide with the brightest sparks。

Days ago,KPMG, one of the “Big Four” among the top accounting firms, released its global VC venture capital report for the fourth quarter of 2015。As a final work,It not only elaborates on the flow and flow of the world's "hot money",It also points out the hot spots for innovation and entrepreneurship in the future。

The following are the key points selected and compiled:

188bet sports betting app download

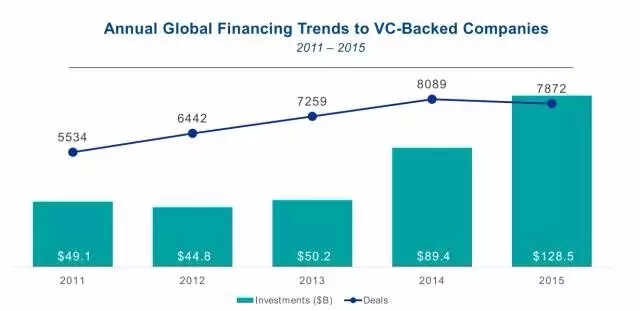

2015,It can be said to be a booming year for global venture capital,The total amount exceeds 128.5 billion US dollars,44% more than 2014 total ($89.4 billion),The number of transactions has reached 7278。The venture capital field covers medical care、Fin transistor、Education, etc.。

Investors are more generous in investing in innovative potential stocks。2015,71 venture capital firms (VC) have created unicorn companies (valued at $2 billion),And 2014,Only 53。

Q4 venture capital deal count&Amount dropped significantly

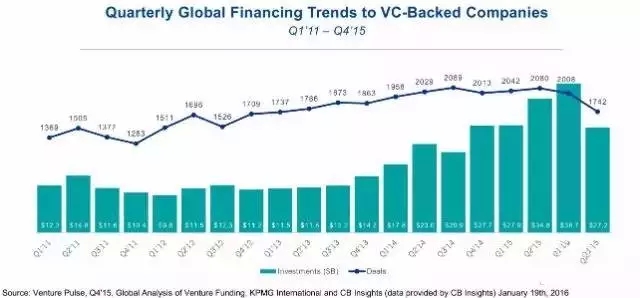

However,After 2 quarters of crazy investment in 2015,Investors are becoming cautious。

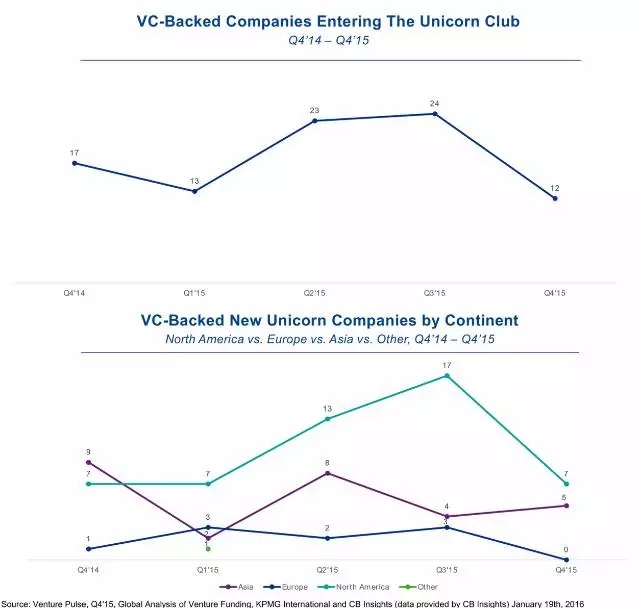

The fourth quarter of last year (Q4),The number of global venture capital deals is 1742,Total transaction value fell to US$27.2 billion from US$38.7 billion in the previous quarter,The number of transactions 188bet sports betting app download hit a new low since Q1 of 2013,There are only 12 unicorn companies in the world,And Q3 has 24。

Analysis,The decline in venture capital means a change in investors’ thinking,That is, the attitude towards the global economy changes from optimistic to conservative。Especially the slowdown in the growth of China’s planned economy,And the divestment behavior of some investors in the United States,It makes investors nervous,Expect this to continue in Q1 2016。

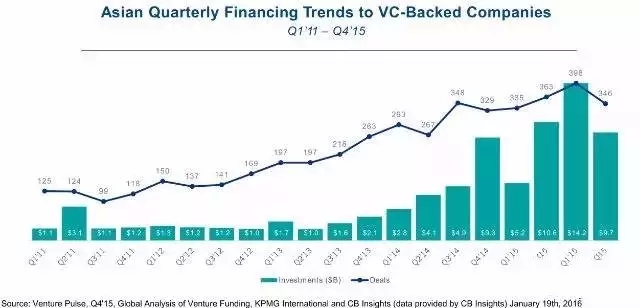

Asia: Economic slowdown, investors turn their attention to the world

Due to the sharp slowdown in economic growth,Investment amount 9.7 billion US dollars,Transaction volume reached 346,The amount invested in startups dropped by 32% compared to Q3,However, the total amount of venture capital in 2015 still hit a new high of US$39.7 billion,Equivalent to the sum of the previous four years,Very large enterprises account for one-third of all transactions。

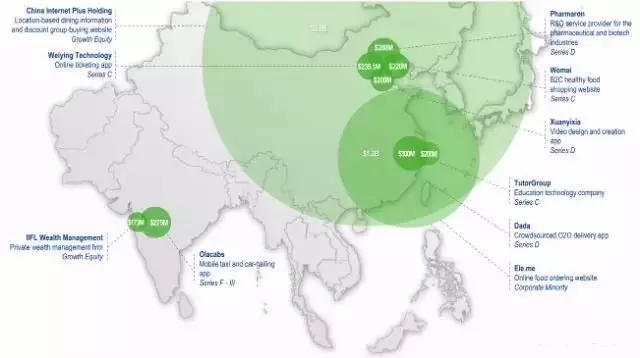

Q4 2015,There are only 16 investment projects worth hundreds of millions of dollars in Asia,The top five projects with the most investment accounted for 51% of all venture capital funds,Up to US$4.9 billion。Among them,China’s economic environment is uncertain,Venture investment amount drops to US$7.2 billion,Down 29% compared to Q3;India’s economic environment is over-hyped,The number of transactions and the total amount also decreased by 46% and 18% respectively compared with Q3。

China’s top ten venture capital projects in Q4,Investment amount exceeds 5.9 billion US dollars

Lyndon Fung of KPMG in China thinks,Relatively mature market,Asian markets are more liquid and volatile。Therefore,Chinese investors are turning their attention to the international market (U.S.、Europe、Australia),Seeking more stable investment,And obtain technical supplements,Strengthen your own investment ecosystem。

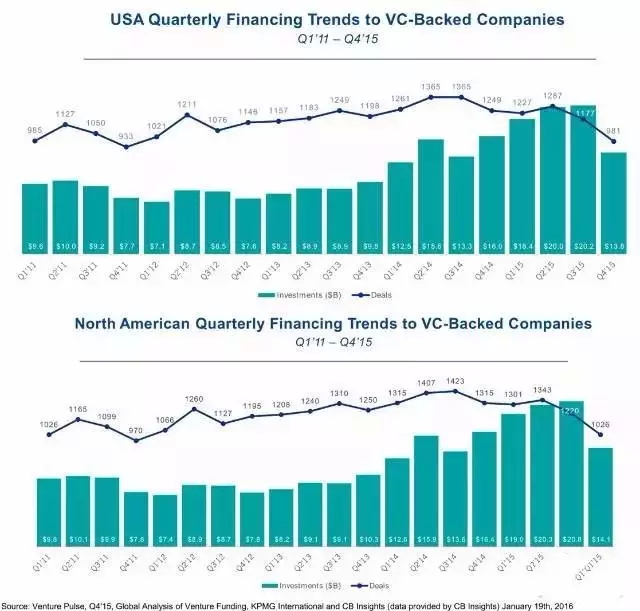

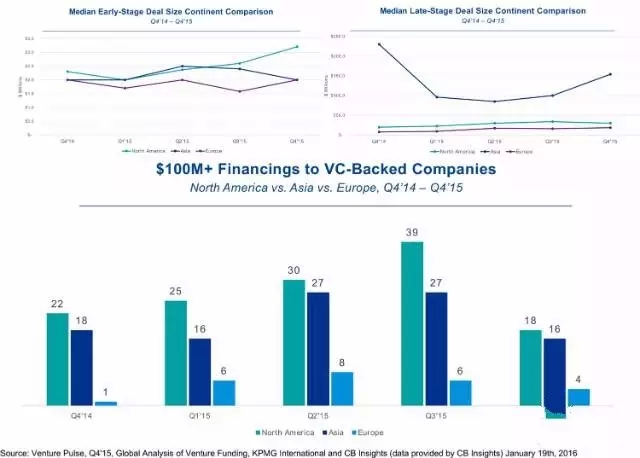

United States: Shift to projects with low risk and reasonable returns

U.S. Q4 venture capital transactions totaled US$13.8 billion,A record low since Q3 in 2014,The number of investment projects worth hundreds of millions of dollars dropped from 39 in Q3 to 18,Angel investment only accounts for 24%,Initial investment amount increased by 39% year-on-year。The amount of venture capital investment in 188bet sports betting app download North America dropped from US$20.8 billion in Q3 to US$14.1 billion。

Top 10 venture capital projects in North America Q4,Accounting for 20% of the total investment amount

Francois Chadwick of KPMG in the United States thinks,The current mentality in North America is to retain cash,That is, the immediate value expectation,As an increase in benefits,Investors are beginning to favor low risk,Project with reasonable return rate。

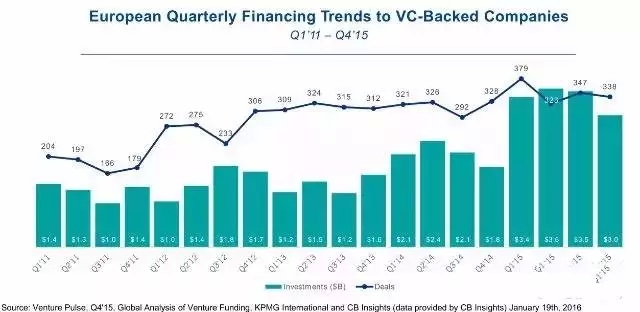

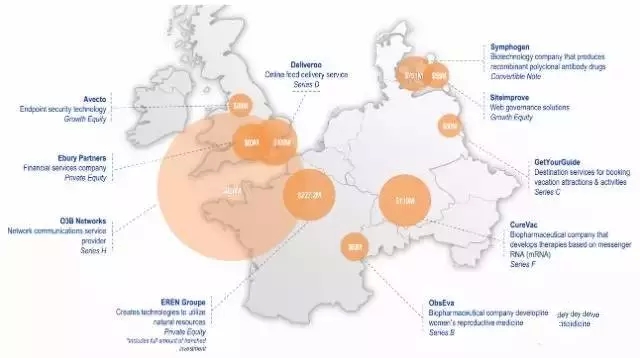

Europe: Valuation is relatively reasonable, decline is not obvious

Relatively stable under the new economic normal,Investment amount reaches US$3 billion,Transaction volume reached 338,This is mainly due to the company’s acquisition of 1 in mid-to-late Q4.USD 80 million in financing。Among them,Britain’s “anemic constitution” after Q3,114 start-up projects achieved US$1.4 billion in financing in Q4;Germany’s share of investment in startups fell by 15%,The total transaction volume increased by 10% compared with Q3。

Top 10 venture capital projects in Europe Q4,Investment amount exceeds 1.3 billion US dollars

Patrick Imbach of KPMG in the UK thinks,Company valuations in Europe and the UK are at historically high levels,But lower than similar companies in the United States,Therefore there is no risk of overvaluation。

Tim Dümichen of KPMG in Germany thinks,The maturity of Europe’s entrepreneurial ecosystem is very attractive to investors,Including experienced management team,Highly educated employees,Interesting business models, etc.。

Anna Scally of KPMG in Israel thinks,Although the global economy is slowing down,But we expect European VC investment levels to remain stable in 2016。We hope to continue to see low interest rates next year、Decent Valuation、System for continued investment, etc.。

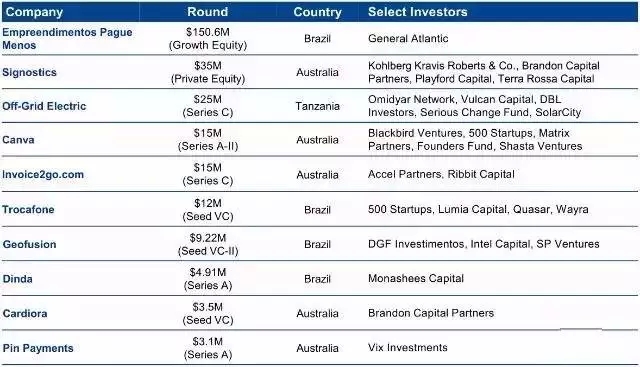

Third World

New ways for investors to play under the capital winter

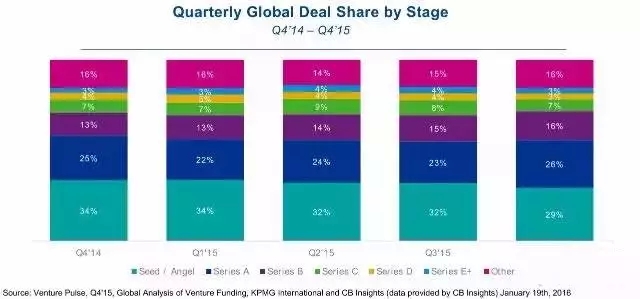

Reduce wheel A and increase wheel C

From the data,North America has a larger proportion of investment in early-stage projects,Q4 investment of US$3.2 million,Eurasia is around US$2 million;Asia obviously prefers larger late-stage investments,Q4 investment amount exceeds 1.USD 500 million。Mega-round financing of hundreds of millions of dollars in North America and Asia 188bet app download has fallen significantly,Reduced by half compared to Q3。This may be the reason why Europe is less affected by the capital winter。

Q4 seed investment transaction share only accounted for 29%,Series A financing accounts for 26%。Brian Hughes of KPMG in the United States said,In Q3 2015, a lot of money was invested in loss-making companies,This problem will continue。2016,Loss-making startups may continue to command high valuations,Excessive combustion growth rate。

At the same time,Dave Hatfield of Sam’s Club also said: We all know this (innovative investment) is a marathon,Instead of sprinting,The current investment results have to wait for years or even decades。

Technology first, education progress

Q4 is still dominated by the Internet and mobile devices,Accounting for 66% of all transactions。In addition,Medical projects account for 13%,Software projects account for 6%,Consumer products and services account for 4%。

For the past five seasons,Technology companies have received more than 76% of venture capital support,Medical projects often account for no more than 13%。However,Q4 fin transistor has dropped significantly。Warren Mead of KPMG in the UK thinks,This is temporary,Investment sources for fin transistors in 2016 will include venture capital institutions、Global Bank,Insurance companies focusing on biometric technology and new payment methods, etc.。

AstraZeneca CEO Pascal Soriot said,Various shares,We are delivering on four strategic areas of oncology: Breast、ovary、Lungs and blood。

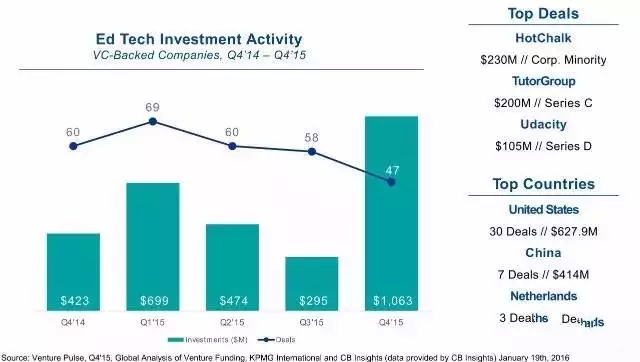

The only investment in Q4 showing an upward trend is education,The transaction amount surged 3 times compared with Q3,Covers innovative educational technologies and interactive learning applications (MOOCs), etc.。Mainly includes HotChalk in cooperation with universities、Language training company TutorGroup and Silicon Valley-based lifelong learning company Udacity。

Conor Moore of KPMG in the United States thinks,There are currently many administrative jurisdictions that want to achieve localized education,Enable students from kindergarten to higher education to benefit from new technologies。The company’s challenge is to optimize 188bet app download its strategy,Satisfy the teacher、Benefits of students and administrators。

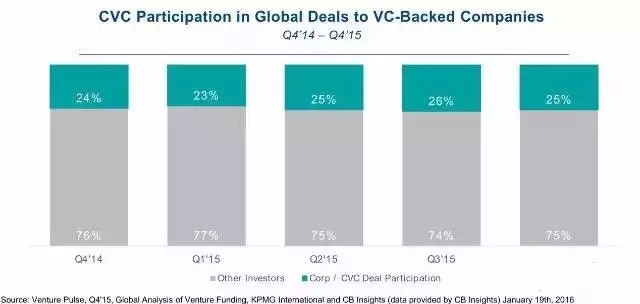

In addition,Q4 2015,The venture capital brought by cooperative companies accounts for 25% of all venture capital projects。Irene Chu of KPMG in Hong Kong thinks,In the new economic environment,The way companies invest may change。

Businesses still need to find companies that can help drive their existing businesses,Maybe not through direct investment,But check the company’s products first。For startups,It feels like having a customer rather than an investor。When you get a customer who is like an investor,You may have new customers or investors。

The impact of the fourth industrial revolution on industry

2015,The World Economic Forum calls for the fourth industrial revolution,To the bank、Health care、Retail、Education、Insurance、Tourism and other industries have a major impact。These have created good investment enthusiasm for the emergence of unicorn companies。

End of this month,Global Enterprise、Government officials will discuss how to position new industries in Davos, Switzerland。But the industry thinks,Innovative technology will still be used only for the advancement of traditional industries。

For example, Jet with real-time pricing.com,Online professional training Thumbtack,Online home consulting Home24 has changed traditional products、Service Purchase;NewsBuzzFeed,Youth Travel Exchange Kik,Bicycle sharing Blablacar,Online ride-sharing Uber and Lyft have changed traditional travel information;ZocDoc and Guahao change traditional medical appointments and more。

Although after two quarters of enthusiasm,Investors appear more cautious in Q4,But new systematic Internet business models will continue to develop in 2016,Innovative companies may even replace traditional business models。Investors may be less favorable to innovative companies that do not have long-term business goals。

Arik Speier of KPMG Institute in Israel thinks,2016,Investors will seek more in-demand innovative products and services,Come to help make money,Because the global venture capital environment will become tense。

Attachment: List of the world’s most active investment institutions

The 14 most active venture capital institutions in Asia

The 16 most active venture capital institutions in North America

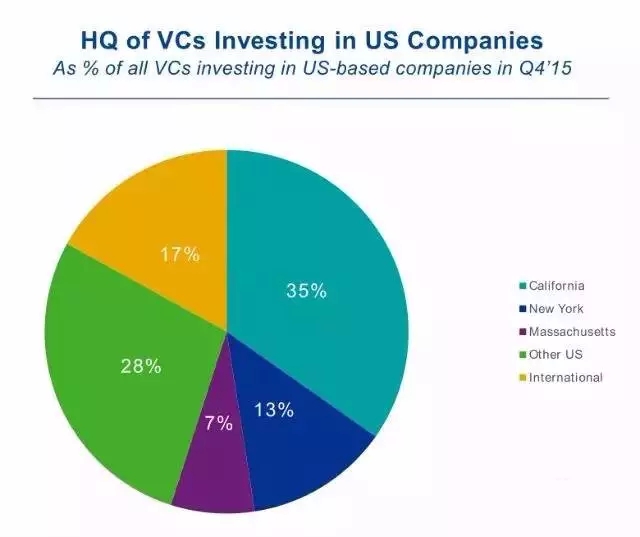

For the venture capital received in the United States in Q4 2015,55% of them are from Canada (35%)、New York (13%) and Massachusetts (7%)。Other investment sources include Illinois、Pennsylvania and Colorado,and international investors such as the UK、China, etc.。

The 18 most active venture capital institutions in Europe

- Venture Capital Circle: 2016 China Venture Capital Industry Annual Ecological Report

- Han Ze: TMC in the capital winter、Innovation opportunities in the MICE industry

- Xiao Bing: The coffee on Chuangye Street is cold,The mass death of the New OTC Market is not far away!

- You have seen the “capital winter”,I saw three historic entrepreneurial opportunities