New users automatically create accounts after logging in

LoginThird-party login

188bet is known as the “King of OTAs”。In the global online travel market,188bet GMV continues to dominate,On income、Net profit、Market value,Travelers are far better than 188bet。Where to go、Elong belongs to 188bet,Alibaba is laying out the layout,Meituan is quietly rising,Domestic OTAs once again formed three major camps。

Study 188bet financial data,Discovered that there are many "secrets" hidden in it。After many years of expensive purchases,Ctrip has formed huge amounts of goodwill and intangible assets,Driving down the return on assets。188bet R&D expenses and revenue ratio are significantly higher than those of leading Internet companies and peers,Behind this,The company’s financial services income may exceed business travel,Become the fourth largest source of income。

Globalization is an important strategy for Ctrip,Buy Skyscanner for Ten Billions、Holding nearly 50% of shares in MakeMyTrip,is its important layout。India with a population of over 1.1 billion,Perhaps the breakthrough point of 188bet overseas strategy。Expedia invested heavily in eLong and ultimately failed,Ctrip goes overseas and confronts its old rival,Can we counter attack,Hard to see a conclusion in the short term。

188bet (09961.HK/TCOM.O) Listed on the main board of the Hong Kong Stock Exchange on April 19。This is nearly 18 years later,188bet enters the capital market again。

188bet rose 4 on the first day of its secondary listing.55%,Until the market closes on May 6,Rising to HK6/share,The cumulative increase in 14 trading days is 14%,Acceptable performance。

The first batch of domestic OTAs (online travel platforms) including 188bet,Both were founded in the late 1990s,And Tencent (00700.HK)、Alibaba (BABA.N/09988.HK)、SINA.O)、NetEase (NTES.O/09999.HK) is equivalent to a "hardcore" player in the Internet industry。December 2003,188bet is the first to land on Nasdaq;End of October 2004,LONG.O)listed,OTA “two heroes” continue to compete in the US stock market。

There will be a window period of nearly 10 years,No new member of domestic OTA has entered the capital 188bet。Afterwards,Qunar(QUNR.O) in November 2013、TOUR.O) was launched in May 2014。So,There were 4 Chinese OTA companies on Nasdaq at one time。

Promoted by capital,OTA competition is fierce,188bet founder Liang Jianzhang returned in 2013,Lead employees to “start a second business”,Finally,Qunar’s major shareholder Baidu (BIDU.O/09888.HK) and 188bet turned hostility into friendship,Qunar is included in 188bet system。Later, 188bet became an important buyer consortium,Participate in the privatization of eLong。OTA listed companies once again become 2。

Another important OTA player is Tongcheng, which was founded in Suzhou,In Wanda Group、Tencent、Grow bigger with the support of 188bet,Later merged with eLong,November 2018,Tongcheng Yilong (00780.HK)logged on the Hong Kong Stock Exchange,188bet is its largest shareholder。

188bet major shareholder Baidu will be listed on the Hong Kong Stock Exchange on March 26,Less than a month,Ctrip also joins the camp of returning to Hong Kong stocks。

Rising 3300%, the “most handsome guy” in online 188bet

Starting from November 2019,Represented by Alibaba,On Nasdaq、Chinese concept stocks listed on the New York Stock Exchange are returning to the Hong Kong Stock Exchange。March 2021,Baidu、BILI.O/09626.HK)listed successively,188bet in April is the latest one。

As of April 25th,China concept stocks listed in the United States,A total of 9 companies’ stock prices have increased by more than 10 times relative to the issue price after listing,188bet with 33.43 times increase, ranking sixth (Figure 1),In the second camp of gains。NetEase is the only stock that has doubled its share,Baidu increased by 80.83 times。

TOP9 Chinese Concept Stocks Gained,Baidu、NetEase、New Oriental (EDU.N/09901.HK)、Huazhu (HTHT.O/01179.HK)、BeiGene (BGNE.O/06160.HK),Add 188bet,Completed secondary listing on the Hong Kong Stock Exchange,They are also leaders in their respective fields。

Among the world's leading OTA companies,188bet cumulative increase surpassed that of Booking (BKNG.O)、Expedia(EXPE.O)、TripAdvisor(TRIP.O,Chinese name "TripAdvisor"),These three OTAs rose 2395% respectively、1313%、91%;Also more than Tongcheng Yilong and Tuniu,These two companies rose 104% respectively,-67% (Figure 2)。Domestic tourism concept stocks,There are 3 companies with more than 10 times increase,China Free Shipping (601888)、Jinjiang Hotel (600754) and Qujiang Cultural Tourism (600706),up 5435% respectively、3618%、1099%。

On the domestic OTA track,Meituan (03690.HK) Because there is "in-store、Wine Travel” Business,The scale cannot be underestimated,Thus regarded as half OTA。Alibaba owns the “Fliggy” brand in the tourism sector,OTA upstart and established powerhouse 188bet、Gathering in Xiangjiang with Cheng Yilong。Tuniu, which has suffered long-term losses,Still holding on to Nasdaq。

188bet has four major brands to conquer the world,“188bet”、“Qunar” mainly targets domestic users;For global users, it is "Trip.com (188bet International Edition)" and "Skyscanner (天行)"。In the industry,188bet is also known as the “King of OTAs”,What about its gold content?

GMV continues to lead, “OTA King” still lacks hard-core indicators

According to Analysys report,Statistics based on gross merchandise volume (GMV),188bet leading advantage in the country is obvious。2019,The top five OTAs in China have a market share of 21.5%,188bet market share is 13.7%,Exceeds the combined market share of the second to fourth place (7.9%)。

188bet total GMV in 2020 is 395 billion yuan,Compared with 865 billion yuan in 2019,Reduced by more than 54%,Beheaded in half。If it weren’t for the COVID-19 epidemic,188bet goal of achieving one trillion yuan in GMV by 2020 proposed many years ago should be achieved。

The "2020 China Online Travel Industry Report" released by Fastdata shows,Based on GMV,188bet annual market share is approximately 40%.7%,Meituan is 18.9%,Qunar for 17.5%,The same journey is 12.9% (Figure 3)。Ctrip + Qunar,Market share is 58.2%,Three times more than Meituan。

And in the global market,2019,The market share of the top five OTAs is 7%,188bet with 2.3% market share surpasses competitors,Still ranked first。New coronavirus pneumonia has spread more widely in European and American countries,OTA business becomes increasingly difficult。Booking, one of the world’s leading OTA platforms ,Income fell nearly 55% in 2020,Net profit dropped by nearly 99% like an avalanche,Expedia revenue fell 57%。But look at it from this,Expedia、Booking’s transaction volume last year may not surpass 188bet。

If based on the total transaction size,188bet is still the “OTA brother”。However,Compare income、Net profit、Market value,There is still a long distance between 188bet and the “King of OTAs”。

188bet is a sales platform,Its income mainly comes from commission,And other income including advertising and financial services。The company’s total revenue in 2020 is 18.3 billion yuan,Down 49% year-on-year,Nearly cut in half。

Meituan 2020 Annual Report Display,His arrival at the store、Total hotel and tourism revenue 21.3 billion yuan,Although compared with 22.3 billion yuan in 2019,Down about 4.6%,But to the store、The total scale of wine tourism has exceeded 188bet total revenue。Need some explanation,Meituan has not subdivided into stores、The respective proportions of wine and tourism。

Secondly,Meituan in store、The wine and tourism business achieved an operating profit of 81% last year.8.1 188bet,Operating profit margin from 37.7% increased to 38.5%,And became Meituan’s largest source of profit。Meituan’s takeaway revenue 662.6.5 188bet,Operating profit is only 28.3.3 188bet;Innovative business and others272.7.7 188bet,Operating loss as high as 108.5.5 188bet。Hotels and hotels are less than 1/3 of takeaway income,The operating profit is about three times that of the other party。

188bet 2020 operating profit-14.2.3 billion yuan,Far lower than Meituan’s store、Operating profit from wine and travel business。Meituan in store、Comparison of the full business of Liquor Travel and Ctrip,Whether it is revenue scale or profitability,All surpass Ctrip。Meituan’s business model uses high-frequency (takeaway) and low-frequency (wine and travel) business,Total revenue achieved 17% growth in 2020,Show Meituan as a super platform,Business Resilience,Stronger ability to resist risks。

There is also a saying in the industry that OTA "Three Kingdoms Kill",188bet system、Meituanwai,The third pole is Ali Travel (Flying Pig),The revenue data is not disclosed separately。From the perspective of transaction size,Alibaba Travel’s annual revenue ranks among Alibaba’s total revenue of nearly 500 billion yuan,Basically can be ignored。

According to transaction size,188bet revenue in the past three years (2018-2020) was 725 billion yuan respectively、865 billion yuan、395 billion yuan (Figure 4),Remains the largest OTA platform in the world。But income、Compared with overseas OTA giants in profit scale,Ctrip is still at a disadvantage。

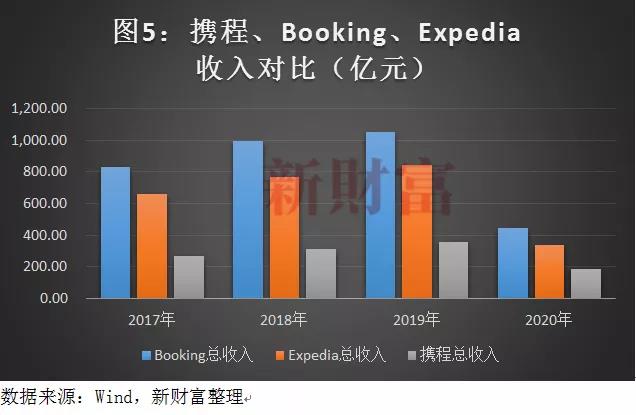

Expedia achieved revenue of 65.7 billion yuan from 2017 to 2019、77 billion yuan、84.2 billion yuan;Net profit 24.700 million yuan、27.8.6 billion yuan、39.4.2 billion yuan。Expedia revenue fell 57% in 2020,There is still a scale of 33.9 billion yuan (Figure 5),Obviously more than 188bet,But the profit scale of the two varies in different years。

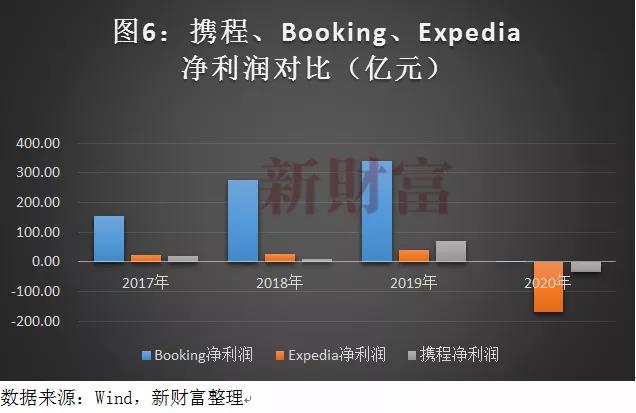

Another global OTA giant Booking,Revenue from 2017 to 2019: 82.9 188bet、99.7 188bet、105.1 188bet;Profit 15.2 188bet、27.4 188bet、33.9 188bet。Booking revenue fell 55% last year,reached 44.3 188bet,And achieve net profit 3.8.5 188bet。

Expedia revenue surpasses 188bet,Booking “double-kills” 188bet in terms of revenue and net profit,And the scale is about three times that of 188bet in the long run (Figure 6)。In other words,188bet is proud that its total transaction volume has ranked first for many years,And Expedia、Booking has a higher realization rate and profit scale。

2019,188bet GMV is 865 billion yuan,In the global market with 2.3% occupy the first place,Second、The market share of the third place is 1.9%、1.7%,Not surprisingly, it should be Booking、Expedia。The GMV of these two companies is approximately 714.6 billion yuan、639.4 billion yuan,Corresponding to respective operating income of 105.2 billion yuan in 2019、84.2 billion yuan。

The top two overseas OTAs also have higher monetization rates,14 respectively.58%、13.17%。188bet 2019 realization rate 3.7%,Booking、Expedia’s monetization rate is about 3 times that of Ctrip.94 times、3.57 times。

According to market capitalization size,As of April 18th,Booking、Expedia market value is US1.5 billion、 billion,Leading Ctrip、Meituan Hotel and Tourism Business Division。If it corresponds to 188bet market-to-sales ratio on April 18 (8.13 times),The scale of Meituan’s in-store hotel and travel business was 21.3 billion yuan last year,The market value is also US.4 billion,Overwhelming 188bet market value of approximately US billion。

188bet wants to become the real “King of OTAs”,Required outside GMV,In income、A breakthrough in profit scale,Market value growth will come naturally。

Market value increased by 88.3 188bet, total investment 69 188bet

188bet divided the company’s important development stages into: Entrepreneurship (1999)、IPO (2003)、Acquisition of Qunar+ (2015)、Acquisition of Skyscanner (2016)、Introducing Trip.com (2017)、Upgraded to 188bet Group (2019)。

If you look at Ctrip from an investment perspective,The year 2010 can be used as the boundary,Divided into two stages。2004-2009,188bet net cash from investing activities totals approximately 1.8 billion yuan,I can only say testing the waters。Subsequent 2010-2020,188bet total investment increased to 77.2 billion yuan,High investment intensity (Figure 7),The total historical investment is nearly 80 billion yuan。

Not like Tencent、These leading CVCs in Alibaba cast their nets everywhere when making acquisitions,188bet chooses investment targets,The goal is very pure,Focus on tourism industry chain companies,And he has a lot of money in domestic and overseas assets。

Important companies invested by Ctrip in China,Where to go、Tongcheng Yilong、Tuniu、Boutique Hotel (600258)、Huazhu、China Eastern Airlines (600115)、Tujia。Ctrip invests in First Travel,Because Ctrip was once an important shareholder of Home Inns,The merger of Homeinn and Beijing Tourism,Ctrip gets a stake in BTG。188bet main overseas investments include Skyscanner、MakeMyTrip(MMYT.O)、TripAdvisor。

Viewed from the industrial chain,China Eastern Airlines、Boutique Hotel、Huazhu、Tujia belongs to the upstream resource party,The two main businesses are transportation booking (air tickets) and 188bet、Accommodation reservation related,Other targets are mostly channel parties。Although 188bet is the number one OTA in the world,Invest more in platform channels,High-quality resources can continue to be distributed to consumers through other platforms。

A significant investment in 188bet,The domestic project is Qunar、Elong、Tongcheng;By this,188bet ended the years-long melee between OTAs in one fell swoop。Overseas projects are Skyscanner and MakeMyTrip,Laid the foundation for 188bet to go overseas。

188bet “wins” Qunar in three steps。October 2015,Exchanging shares with Baidu through the issuance of additional common shares,Obtained 45% of the total voting rights of Qunar。As consideration,Baidu obtains 12.48 million newly issued ordinary shares from 188bet,Baidu’s shareholding in 188bet was once as high as 26%.63%。

December 2015,188bet issues common shares to Qunar Employee Stock Ownership Institution,Replacement of Qunar Class B ordinary shares,And consolidate Qunar’s financial statements since December 31, 2015。The first day of construction in 2016 (January 4th),Qunar founder Zhuang Chenchao announced his resignation as CEO、Director Position。October 2016,188bet joins buyer consortium in Qunar privatization transaction,After the completion of the privatization transaction in February 2017,188bet will transfer its shares to an entity wholly owned by Qunar。To this point,Qunar, which had been fighting with 188bet for several years, was delisted,Completely integrated into 188bet system。

188bet has participated in the privatization of eLong,Strategic Investment Tongcheng。Finally Tongcheng and eLong merged,And listed on the Hong Kong Stock Exchange in November 2018。188bet holds Tongcheng Elong 5.600 million shares,The share ratio is 26.98%,is the largest shareholder;Tencent’s shareholding ratio is 22.93%,is the second largest shareholder;Tongcheng’s original founding shareholder team and original investment institution OCT Group,Each holds about 10% of the shares,Their equity is "dispersed and concentrated",So there is no actual controller。

Liang Jianzhang, who has an international perspective, looks further ahead.

December 2016,188bet acquires almost all shares of Skyscanner, a search and travel website headquartered in Edinburgh, UK,The total price is 1.4 billion pounds (1.2 billion pounds and 188bet shares)。

Another major overseas acquisition by 188bet occurred in India。January 2016,188bet invested in MakeMyTrip, India’s largest online travel company, through convertible bonds1.USD 800 million。August 2019,188bet and Tencent’s major shareholder Naspers reached a deal,Issuance of new shares to Naspers,In exchange for its MakeMyTrip equity,The final shareholding ratio in MakeMyTrip is 49%,Although it is a major shareholder,But no holding。

As consideration,Naspers holds 4.11 million ordinary shares of Ctrip,Shareholding ratio is 5.59%。MakeMyTrip is not consolidated with Ctrip,But 188bet shareholding is close to 50%,Seeking control is the right thing to do,Maybe waiting for the right time。

From 2004 to 2020,188bet cash flow for investment totals approximately 79 billion yuan,Nearly 80 billion yuan。However, 188bet investment is not evenly distributed,Before 2013,Their investments tend to be cautious,At most, it is only about 4 billion yuan a year,Subsequently investment maintained a high intensity,19.8 billion yuan invested in 2016-2018 respectively、15.2 billion yuan、14.1 billion yuan,Nearly 10 billion yuan in 2014。

2014 to 2020,188bet total investment amount is 69 billion yuan,This is also the 8th year of Liang Jianzhang’s “second return”。The number for reference is,End of 2014,188bet market value is US.4 billion,By the end of 2020,Market value rose to US.2 billion,Net increase of US6 (88.3 billion yuan),Increase 2.13 times。The total investment amount is 69 billion yuan (converted according to the latest exchange rate,USD 10.6 billion),Approximately equal to 80% of 188bet market capitalization increase。

Among the listed companies invested by 188bet,There are two state-owned enterprises,That is, holding 15 shares.29% of BTG Hotels、Holding 2.84% of China Eastern Airlines。

April 2016,Strategic cooperation between China Eastern Airlines and 188bet,188bet invested 3 billion yuan through its subsidiary Shanghai Journey,Obtained about 4 new shares of China Eastern Airlines.6.6 billion shares,And have the opportunity to increase holdings of China Eastern Airlines to up to 10%,Appointment of a Director。Over the years,188bet has not reduced its holdings of China Eastern Airlines by one share,No increase in holdings。

Until the end of last year,China Eastern Airlines asset value 21.8.1 billion yuan,and 27 at the end of 2019.compared to 0.7 billion yuan,188bet included China Eastern Airlines investment loss 5.2.6 billion yuan。Because of the epidemic,Boutique Hotel also suffered losses for the first time in many years,Preliminary loss last year 3.9.8 billion yuan,188bet will suffer an investment loss of 66 million yuan。

Two OTAs in which Ctrip has a stake,Mixed gains and losses。Tongcheng Elong made a profit of 3 last year.2.8 billion yuan,The cumulative increase after listing is 92%,188bet book floating profit is higher。Ctrip and Tongcheng-Elong also have large related-party transactions every year。

2019,188bet received commission from Tongcheng Elong 2.1.7 billion yuan,Pay commission 5 to the other party at the same time.7.9 billion yuan,"Deficit" 3.6.2 billion yuan。2020,Tongcheng Yilong once again obtained "surplus" 1.7.3 billion yuan。Both parties mainly sell each other’s hotel inventory,188bet has advantages in mid- to high-end hotels,Complementary to Tongcheng Yilong’s mid-range and below hotels。

Before Tuniu went public,188bet invested US million in Tuniu Hotline at the issue price of US,And one director seat。December 2014,Tuniu Xiang Hongyi、JD.com、188bet and other additional issuance value 1.US.8 billion in new shares,188bet invests US million,Price per ADS 12.USD 06。

188bet still has representatives as directors of Tuniu,should not reduce stock holdings。Tuniuzhi’s stock price on April 25 was 3.USD 01,188bet invested US million twice,The total number of shares held is 2.91 million shares,The value of the stock holding is approximately US.7 million,The floating loss is about 71%。

Tuniu’s former second largest shareholder,All shares were sold last year,Caesar Group takes over。188bet and JD.com reach strategic cooperation,JD.com intends to participate in the private placement of Caesars Tourism。HNA Group is also the largest shareholder of Tuniu and the second largest shareholder of Caesars Travel,And HNA Group undergoes bankruptcy reorganization。Caesar series、JD.com、188bet、HNA and other parties,There may be the possibility of further capital integration。188bet invested US million in Tuniu,Higher floating loss rate,But the net loss is limited,Easy to advance and retreat。

The assets of MakeMyTrip in which 188bet has a stake,Using the fair method in 2018,2019、Processed using the equity method in 2020,value respectively 18.0.2 billion yuan、84.6.2 billion yuan、56.9.4 billion yuan。

This change is related to the substantial increase in 188bet shareholding in MakeMyTrip;Before 2019,188bet shareholding ratio is about 10%,Now increased to approximately 49%。Because of changes in accounting treatment methods,Also increase the fluctuation of 188bet net profit,2016、2020,Ctrip all recorded losses。

Goodwill is overwhelming, lowering return on assets

188bet Group is now among the four major brands,“188bet” and “Qunar” mainly target domestic users,Skyscanner and Trip.com faces global users (mainly overseas users),Form a "2+2" pattern。

Qunar and Skyscanner brands come from strategic mergers and acquisitions。188bet passes strategic mergers and acquisitions,Recruiting strong opponents,Be large-scale,Meanwhile,Formation of huge goodwill。

End of 2015,188bet “goodwill and intangible assets” surged to 56.7 billion yuan,compared to 25 at the end of 2014.600 million yuan net increase of 53.1 billion yuan。Internet companies are mostly asset-light operations,Qunar’s net assets at the end of 2015 were approximately 1.2 billion yuan,188bet goodwill and intangible assets increased by 53.1 billion yuan in 2015,Mainly from Qunar。Mentioned in Ctrip prospectus,This example brings goodwill of 43.6 billion yuan and intangible assets of 9.9 billion yuan。

2016,Ctrip acquires Skyscanner,Once again formed goodwill of 9.5 billion yuan and intangible assets of 3.1 billion yuan。End of 2016,188bet total goodwill and intangible assets increased to 69.9 billion yuan。The following years,Goodwill and intangible assets increased slightly,The total amount by the end of 2020 is 73.6 billion yuan (Figure 8)。

2020,The tourism industry has been hit hard,The two important assets of Qunar and Skyscanner have not been impaired。188bet said,2018-2020,Qualitative assessment by comparative market capitalization method,No impairment charges were recognized for goodwill or intangible assets。188bet also acknowledges,If different rules are used to judge,Other results may occur。

The huge amount of goodwill accounts for a very high proportion of 188bet total assets and net assets。End of 2020,188bet total assets are 187.2 billion yuan,Total shareholders’ equity (net assets) 101.6 billion yuan,The proportion of goodwill and intangible assets is 39% respectively、72%。where,Goodwill scale is 59.4 billion yuan,Accounting for 32% of total assets、58%。This is rare in large Internet companies。For example, Tencent is more generous、Alibaba,By the end of 2020,Goodwill and intangible assets are 172.4 billion yuan respectively,367.3 billion yuan;13% of total assets、22%,Accounting for 22% of net assets、34%。

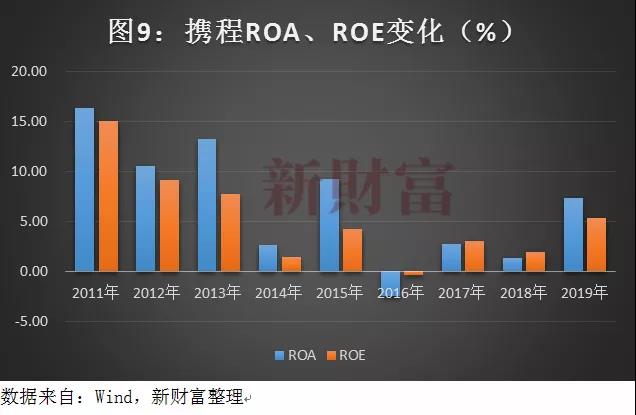

What this brings is,188bet return on assets has been greatly diluted。

Vertical comparison,2011-2015,188bet return on total assets (ROA) average is 7.54%,Return on equity (ROE) average 10.44%。Next 5 years (2016-2020),188bet average ROA is 1.9%,And in 2016、Negative value in 2020,Slight improvement in 2019,ROA reaches 5.4%;Ctrip average ROE reduced to 1.15%,The same is not the same as before the big merger (Figure 9)。

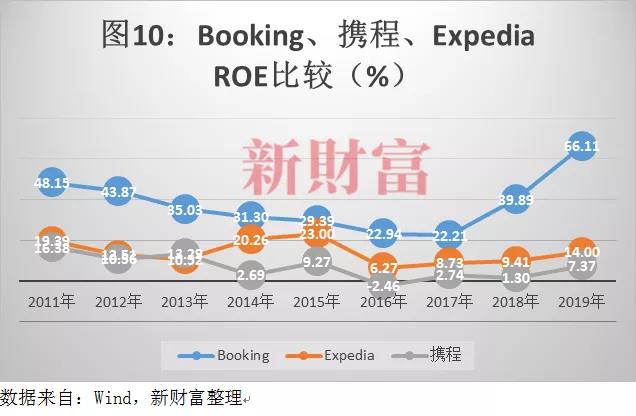

Horizontal comparison with OTA peers,Booking’s average ROA over the past 10 years is 23.78%,ROA averaged 17 over the past 5 years.98%;ROE averaged 34% over the past 10 years,Average 30 over the past 5 years.45%。Expedia’s return on assets was on par with 188bet before 2013,After 2014, it is obviously better than 188bet。Booking has always been significantly ahead of 188bet (Figure 10)。

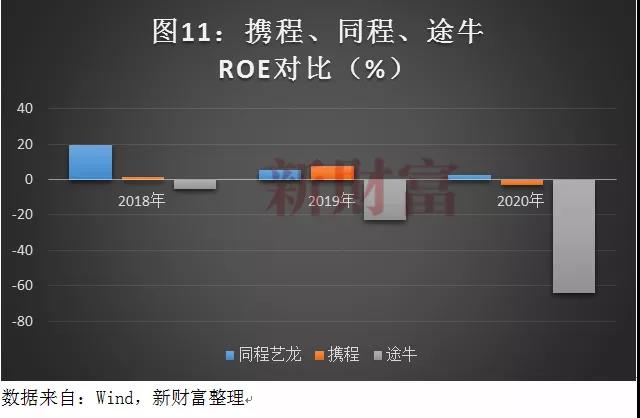

Domestic OTA now,188bet asset return rate is naturally better than Tuniu,In the past three years, it has been weaker than Tongcheng Yilong。2019,40 A-share tourism concept stocks,Median ROE is 5.33%,10 companies are above 10%,Better than Ctrip (Figure 11)。

Before merging with Qunar,i.e. September 30, 2015,188bet market value is US.9 billion。December 31, 2015,188bet market capitalization is US.6 billion (already reflected in Qunar’s market capitalization)。Until the end of 2020,188bet market capitalization is US.2 billion,In the past 5 years, Skyscanner was acquired,But the market value only increased by US.6 billion。

If investors who believe in long-termism have been optimistic about 188bet since 2015,Always hold firmly,The total return rate in 5 years is less than 15%,Average 3% per year,Even lower than the more conservative bank financial management yield or medium and long-term government bond yield。

Same period,The Nasdaq’s cumulative increase is 180%,The S&P 500 also rose 105%,188bet significantly underperformed the market index gains。

Big deposits and big loans, the yield may be "inverted"

Last 5 years (2016-2020),188bet total net cash flow from operating activities is approximately 23 billion yuan,Net cash flow from financing activities totaled 29 billion yuan,The total net cash flow from investing activities is approximately 55.4 billion yuan,Greater than cash flow from operating and financing activities,Present the state of “making ends meet” (Table 1)。

This makes Ctrip continue to look for money in the market,Use new debt to pay off old debt,Cash has been tight in the past two years。2019、End of 2020,188bet total current assets are 68 billion yuan、58 billion yuan,Barely more than the current liabilities of 69.2 billion yuan in the same period、58.4 billion yuan (Table 2)。

188bet interest-bearing liabilities are high,The annual interest expense is high,But because there is a lot of cash and short-term investments,Bringing interest income,Therefore, the phenomenon of “large deposits and large loans” is obvious。

5 years from 2016 to 2020,188bet total interest income is 77.3.5 billion yuan,Interest expense for the same period 69.1.9 billion yuan,Comparing the two,There is still a slight surplus 8.1.6 billion yuan (Figure 12)。

188bet interest income in 2020 21.8.7 billion yuan,Corresponding liquidity (cash + short-term investment) totaling 42.9 billion yuan,The average rate of return is estimated to be 5.09%;Interest expense last year 17.1.6 billion yuan,Corresponding interest-bearing liabilities (short-term loans、Short-term loan maturity and long-term loan) totaling 56.4 billion yuan,Then the average lending interest rate is 3.04%。

Actually,There are a large number of convertible bonds in 188bet debt,Its interest rate is lower。Wind display,Ctrip has 5 remaining convertible bonds,Total amount 31.US.5 billion,Interest rate from 1.Varies from 25% to 2%。31.USD 7.5 billion (equivalent to RMB 20.8 billion),Basically consistent with 188bet long-term loan (22.7 billion yuan)。The above 5 convertible bonds,Calculated based on respective interest rates,Ctrip had to pay interest of US.94 million last year (approximately 3.100 million yuan),The weighted average interest rate is 1.48%。

So,188bet short-term loan and other interest expenses are 1.4 billion yuan,Corresponding short-term loan scale of 33.7 billion yuan,You need to pay a higher average interest rate,About 4.15%;But even so,Still lower than 188bet average interest rate for short-term liquidity,About 1 percentage point。

188bet cash investment yield 5%,The rate of return is 2 percentage points higher than investors’ return on 188bet shares。

The R&D investment ratio is far higher than that of peers, and the financial service has hidden strength

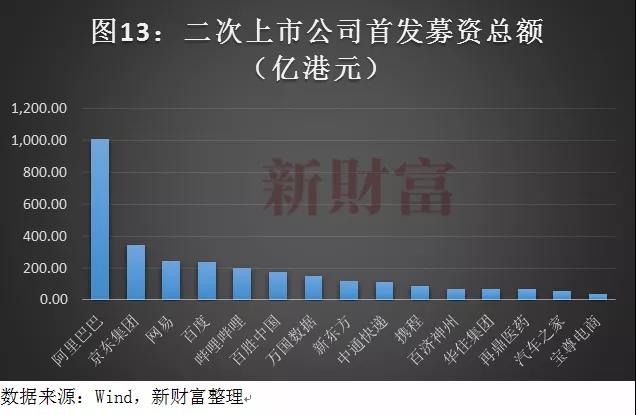

During secondary listing in Hong Kong,188bet sold 31.64 million shares globally,where,Hong Kong offering shares 3.48 million shares,International offering of 28.16 million shares,Another 15% over-allotment option;The final offer price is determined to be HK8 per share,The total amount of funds raised before the over-allocation exercise is approximately HK.5 billion (Figure 13)。

Since Alibaba was listed on the Hong Kong Stock Exchange,The number of companies returning to Hong Kong for the second time has increased to 15,Ctrip ranks tenth with nearly 8.5 billion yuan in raised funds。Issue price of HKD 268,HK3, which is significantly lower than the upper limit of the offering price range。Entering April,188bet U.S. stock price has obviously dropped,Also affects its pricing。

188bet announcement display,The underwriters have exercised all 474.530,000 shares,HKD 268 per share,The total funds raised is approximately HK.8 billion。

According to plan,About 45% of the net proceeds from 188bet fundraising will be used to expand one-stop travel services and improve user experience,10% for general corporate purposes、Working capital needs and potential strategic investments and acquisitions,About 45% may be used to invest in technology,Ctrip plans to add artificial intelligence (AI)、Big data analysis、Application of virtual reality and cloud technology。

188bet R&D expenditures over the years account for a very high proportion of total revenue。2018 to 2020,Their product research and development expenditures are 9.6 billion yuan、10.7 billion yuan、7.7 billion yuan,Accounting for 31% of total revenue、30% and 42%。Same period,188bet sales and marketing expenses account for 31% of revenue、26%、24%。

Among the large domestic Internet companies,Alibaba’s ratio is 8.46%,Meituan is 9.49%;Baidu, a company proud of its technology,is 18.11%;188bet is far ahead of them (Figure 14)。The total scale of R&D expenses last year,188bet also surpassed Kuaishou (6.5 billion yuan) and Pinduoduo (6.9 billion yuan)。

With Expedia、Booking、TripAdvisor、Tongcheng Yilong、Comparison with Tuniu peers,188bet R&D investment in total revenue is also significantly ahead (Figure 15)。

Why do R&D expenses account for an unusually high proportion of 188bet revenue?

188bet pointed out,Product R&D expenditures mainly include company maintenance、Expenses incurred by monitoring and managing the platform,And expenses incurred in developing a network of ecosystem partners。As of the end of 2020,188bet cooperates with 480 airlines around the world,And more than 30,000 partners。Other companies will pay development expenses incurred by connecting with upstream and downstream channels,Attributed to selling expenses,And 188bet is included in R&D expenses。

At the same time,These 30,000 partners,Also broadened 188bet revenue model。Ctrip financial services mainly target ecosystem partners,That is, Ctrip provides him with a credit loan,This is common supply chain finance。For example, just last year,Ctrip provides loans to joint-stock company Tujia B&B 3.400 million yuan,Interest income is 7 million yuan。

188bet Financial Services and brand marketing are all attributed to the "other" items of revenue,This part of the income will have the smallest decline in 2020,And the scale reaches 19.3.1 billion yuan,Already close to the sum of the two traditional sectors of business travel and vacation travel (21.1.8 billion yuan)。

Ctrip pointed out,Financial services account for 5% of total revenue.Below 5%。Looking at its financial data in the past three years (2018-2020),Total revenue (31 billion yuan、35.7 billion yuan、18.3 billion yuan) of 5.5%,17 respectively.100 million yuan、19.6.4 billion yuan、10.0.7 billion yuan,Any year will exceed the business travel revenue for the same period (9.8.1 billion yuan、12.5.5 billion yuan、8.7.7 billion yuan),Financial services business thus becomes 188bet fourth largest source of income,It can be called a “hidden” strength section。

If 188bet financial services revenue in 2020 is 17.100 million yuan,is equivalent to Tuniu’s total revenue last year 4.500 million yuan 3.8 times,And exceeded the total revenue of domestic tourism company Caesar Travel (000796) last year 16.100 million yuan。

Natural,Risks also coexist with returns。Due to the epidemic in 2020,188bet confirmed a credit loss provision of 700 million yuan and long-term investment impairment for partners 9.0.5 billion yuan,And 1 in 2019.9.1 billion and 2.0.5 billion yuan,The changes are very obvious。

Also,R&D also became the “hardest hit area” for 188bet headcount reduction last year。

According to personnel structure,188bet product R&D staff will be about 1 by the end of 2020.620,000 people,Secondly, there are over 10,000 customer service staff,Sales and Marketing 4000 people,About 3,200 management and administrative staff。With 4 at the end of 2019.Compared to the total number of 430,000,Because of the epidemic,188bet reduced its headcount by nearly 1 last year.10,000 people,to 3.340,000 people,or reduce staff by 1/4。

Compare 188bet personnel structure at the end of 2019,Management and Administration、Customer Service、Marketing and Sales、Product R&D (including supplier management and technical support) are 4000 each、12900、5700、21700 people,Reduced by 800 last year、2900、1700、5500 people,Product R&D personnel reduced by nearly 1/4,Accounts for nearly half of the company’s total headcount reduction (Figure 16)。

March 2020,188bet issues letter to all employees,Voluntary salary reduction for senior management、No salary increase for employees except front-line employees,CEO Sun Jie and Chairman Liang Jianzhang will not receive salary until the company’s business returns to normal。Extraordinary times lead to extraordinary actions,For Liang Jianzhang,Not the first time。

The secret of running a company with 3% equity: “Poison Pill Plan”

Before secondary listing,All directors and officers of 188bet as a whole,Direct shareholding ratio is 6.7%,where,Liang Jianzhang holds 3 shares.1%,Fan Min holds shares 1.7%,Sun Jie holds shares 1.5%,These three senior executives hold a total of 6 shares.4%,Both serve as directors。Baidu holds 11 shares.5%,Send two directors。

As for Pzena Investment Management、T.ROWE PRICE ASSOCIATES、MIH Internet SEA Private Limited、Morgan Stanley,Both hold more than 5% of the shares (Figure 17),Mainly as a financial investor,No representative appears on 188bet board of directors。Baidu’s shareholding ratio has been declining,Naturally, it is the idea of uncontrollable Ctrip。The company has no actual controller,Liang Jianzhang undoubtedly has a greater say in the board of directors。

The post-"188bet Four Gentlemen" era,Said Liang Jianzhang is the "spirit" of 188bet,No exaggeration。Liang Jianzhang, whose English name is Jamse, has retired twice,One time was a duel between Qunar and eLong,Another time is the epidemic。

But when the company's life and death are at stake,188bet "James" is fully responsible,Come forward。After March last year,Liang Jianzhang traveled to various parts of the country,He Zi Fang (scenic spot、Hotel) Cooperation,57 live broadcasts throughout the year,Directly contribute 2 billion yuan in GMV,Although the annual GMV is less than 5%,But the boss works so hard,It is also a great boost to company morale。

Liang Jianzhang’s leadership position within the company,No one can replace。How to ensure that 188bet is always led by the management team,No interference from "barbarians",188bet also has designs。

Sina (SINA), one of the earliest companies to list Chinese concept stocks.O)、SOHU.O)、NetEase,The "AB share" structure has not been adopted yet。NetEase and Sohu,The founders each have a higher shareholding ratio,Less worry about being acquired when you control a company,Sina because of its dispersed shareholding,Was raided by Shanda Network in early 2005。Shanda collects chips in the secondary 188bet,Once held nearly 20% of Sina shares;Finally, Sina defeated Shanda through the "Poison Pill Plan"。

188bet also has its own “poison pill plan”,The full name is "Defense Plan against Hostile Takeovers"。The plan was adopted in November 2007,The main content is,If 188bet is subject to a hostile takeover,All shareholders except the hostile acquirer,Entitles you to purchase 0 worth of common stock at a significant discount。

Revised after defense plan,If an institution maliciously acquires 20% of 188bet equity,then trigger the plan。Once the "Poison Pill Plan" is implemented,The shareholdings of brutal acquirers will be greatly reduced,The shareholding ratio of other Ctrip shareholders will basically not be diluted,To ensure "the coherence of management and strategy,Minimize potential business disruption”。

Several important shareholders of 188bet are included in the “exempt persons”,That is, Baidu’s shareholding does not exceed 27%,Booking’s shareholding does not exceed 15%,MIH’s shareholding does not exceed 11%。This defense plan expires in August 2024,Can be extended for another 10 years。

The final implementation of this plan will depend on the Board of Directors,Who has the greatest influence on 188bet board of directors?

Currently there are 9 members on 188bet board of directors,The specific composition is 5 directors and 4 independent directors。The major shareholder Baidu has two director representatives,That is, Baidu CEO Robin Li and Executive Vice President Shen Dou。Three people from 188bet management are serving as directors,Executive Chairman Liang Jianzhang、Vice Chairman and President Fan Min、CEO Sun Jie。The four independent directors are Shen Nanpeng、Ji Qi、Lee Ki-bae (also serves as vice chairman)、Gan Jianping。

Shen Nanpeng、Ji Qi,He was also the second of 188bet “Four Entrepreneurial Gentlemen”,Then leave Ctrip,Each started a new business。Shen Nanpeng is now the head of Sequoia China,Ji Qi led Home Inns one after another、Hanting listed,Now the controller of Huazhu Group、CEO。Li Jipei is the executive director of Lanxin Asia Investment Group,Gan Jianping is the managing director of Qiming Venture Partners、Partner,Both of them were senior executives of Carlisle Group。Lee Ki-bae、Gan Jianping is also an old acquaintance,Respectively from March 2000、Served as independent director of Ctrip in April 2002,Served for about as long as the founder became a director。

As long as we get co-founder Shen Nanpeng、Ji Qi’s support,188bet current management team can dominate the board of directors,And sink、Ji Erren supports the existing team,Suicide without saying anything。Also,According to 188bet Articles of Association,Three of the original four co-founders must serve as directors,And the company’s CEO will naturally become directors,Another perspective,Basically ensure that 188bet original founding team has control over the board of directors。

188bet version of “poison pill”,Always take the lead for the founding team,Another insurance added。188bet seems to have no actual controller,In fact, it is mainly the founding team,And Liang Jianzhang is the "Secretary Soul" who refuses to give up。

Planning for 188bet future,Globalization is the focus of Liang Jianzhang,This is also the key to whether Ctrip can find the "second growth curve"。

Can the Indian 188bet become an overseas “surprise”?

The company’s 20th anniversary celebration held in October 2019,188bet Group launches new English name "Trip.com Group Limited.”,The security code subsequently changed from "CTRP" to "TCOM"。188bet also proposed the “G2 strategy”,That is, Great Quality (high quality) and Globalization (globalization)。

G2 Strategy,Quality more reflects the company’s values,Globalization is the focus of business。Want to achieve a global breakthrough,188bet faces great challenges。

2018-2020,188bet total revenue from Greater China is 280.6.4 billion yuan、312.5.6 billion yuan、170.1.9 billion yuan;The income of other countries is 30.400 million yuan、44.600 million yuan、13.0.8 billion yuan,The ratio of total revenue is 9.8%、12.5%、7.2%,where,Overseas business revenue fell by nearly 70% in 2020,Higher than the 46% decrease in Greater China。

Many domestic companies have gone overseas,Huawei is the benchmark;Other companies,If overseas income accounts for less than 30% of total income,It’s hard to say victory。188bet current revenue from overseas markets accounts for 7%,But it is not difficult to reach 30%。

188bet overseas revenue mainly comes from Skyscanner and Trip.com,The two form a greater synergy effect。Trip offers products and services in 20 languages and 31 local currencies;Skyscanner supports 30 language services,Covering 52 countries and regions。Skyscanner brings huge traffic to Trip,The Trip product increases conversions for Skyscanner。Trip has experienced triple-digit growth in transaction volume for 13 consecutive quarters,It’s because the original base number is too low。

From the perspective of total revenue,Last 3 years,188bet overseas revenue and global leading OTAs such as Booking、Expedia is far different (Figure 18)。Take 2019 as an example,Booking、Expedia’s total revenue is approximately 24 times that of 188bet overseas revenue、19 times。

Analysys Prediction,The compound annual growth rate of the global tourism market in the next five years (2021-2025) is 10.6%,Far larger than 4 in 2017-2019.6%。To 2025,The total size of the global tourism market reaches 7.1 trillion US dollars (Figure 19),equivalent to about 4.6 188bet。

In a very difficult year for the tourism industry in 2020,PE and industrial capital are all using their checkbooks,Or buy the bottom,Or continue to strengthen shortcomings。188bet has not stopped its acquisitions,Acquire Travix, a small but beautiful flight booking service provider overseas。

From the perspective of industry rules,When the per capita GDP of a place reaches US,000,Explosive demand in the tourism market。2020,India’s GDP is 2. trillion,Per capita GDP is less than 2,000 US dollars。But as the second most populous developing country in the world,With a large population of 1.3 billion,Contains huge tourism consumption potential。This is also Alibaba、Xiaomi Group (01810.HK) and others continue to invest in India。If India’s per capita GDP exceeds US,000 in the next five years,188bet invested early in MakeMyTrip,Maybe become a "surprise soldier"。

Outside India,East Asia and Northeast Asia are both areas Ctrip is targeting。Ctrip CEO Sun Jie said in an interview,To invest and expand the Asian market,This is also a natural extension and expansion of 188bet business growth。

But 188bet also needs to avoid the “Expedia story” from happening again。Expedia changes from eLong minority shareholder to controlling shareholder,Once held more than 60% of the shares,Bloody Battle 188bet,Finally failed,188bet becomes the main takeover of eLong。Indian localization company,Are there any rising stars,Sniping at MakeMyTrip?Or after Expedia defeated China,Will 188bet be firmly suppressed in the global market?

MakeMyTrip earned 7.5 billion yuan last year,If consolidated,Then 188bet overseas revenue will increase to 8.8 billion yuan,The proportion of total income will increase to about 30%,Internationalization results appear。

Based on the current situation, domestic tourism is still 188bet focus.

At 188bet 21st anniversary,Liang Jianzhang announced “deep development in China、Overall Strategy of "Global Mind",and raised from content、Product、Development goals such as deepening the domestic tourism market in the four directions of supply chain and quality,Pointed out 188bet development direction in 2021。

A group of heroes competing for the 10 trillion 188bet,The "smart money" layout is earlier and longer

Because of the epidemic,Starting from the end of January 2020,Domestic tourism has been pressed on the pause button。Domestic travel restrictions will be gradually lifted from May 2020,But outbound travel has not yet been unfrozen。Ministry of Culture and Tourism statistics show,Total domestic tourism revenue in 20202.23 trillion 188bet,Down about 60%。

Look to the future,National consumption power continues to increase,Superimposed on increasingly convenient high-quality 188bet,After the recovery of the new coronavirus epidemic,The 188bet blowout is inevitable。

The future of the domestic 188bet market is closely related to the middle class group。The domestic middle-class population is expected to grow to 6 in 2025.600 million。The development of new wealthy people has reached an inflection point,And is expected to boost 188bet demand,This is similar to the growth trajectory of 188bet consumption in domestic first-tier cities。The rise of the middle class is continuing to change consumption patterns,And this group is usually more familiar with technology,More willing to spend more on quality service and experience。Tourists on small group tours、Free travel、Short distance travel、Customized demand for night tours and other immersive experiences continues to surge。

188bet as the leading travel platform,Heavy investment in R&D every year,Whether it is basic development or application development,Empowered by artificial intelligence (AI) and big data analysis,Ability to effectively attract users through targeted marketing。Air tickets、Hotel、Ticket resources are all standard,And the price per customer is relatively low,The decision-making cycle is very short when users place orders。

For packaged travel、Customized travel and other high-priced products,The product link involves hotels、Air tickets、Use a car、Attractions、Diet、Visa、Shopping and many other links,Customer decision-making cycle is long,Therefore face-to-face communication is very necessary。188bet opens offline franchise stores,Covering third, fourth and fifth tier cities,There are more than 6,000 stores。

Another important factor in the recovery of the 188bet industry-outbound and inbound 188bet returns to normal,This is closely related to the new crown vaccination rate。There have been 200 million vaccinations in China,About 6 million people added every day,The proportion of vaccinated people is gradually increasing。

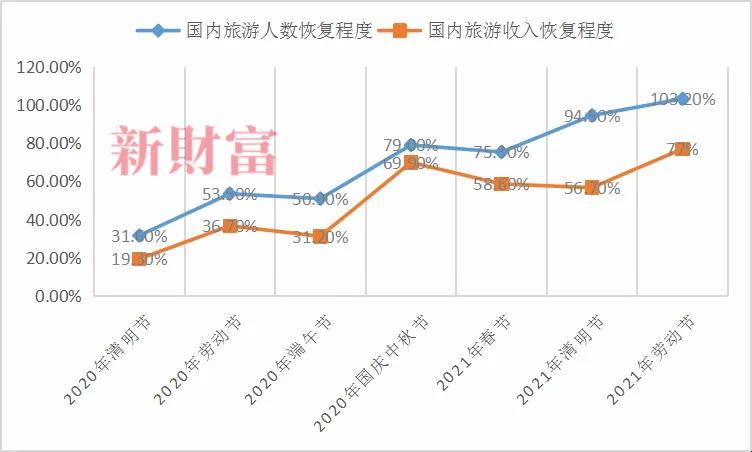

Currently,Although there is a partial rebound 188bet domestic epidemic,But overall it has been effectively controlled,The suppressed travel demand of Chinese people is beginning to be gradually released。CICC data display,Compared with before the epidemic (2019),Holidays starting in 2020,Number of domestic travelers and income,Showing a gradual recovery state (Figure 20)。

Figure 20: Domestic 188bet recovery

Data source: CICC, compiled by New Wealth

Ministry of Culture and Tourism Data Center Calculation,May Day holiday,Domestic travel times 2.300 million,Recovered to 103% of the same period during the epidemic;Realized tourism revenue of 113.2 188bet,Recovered to 77% of the same period before the epidemic。

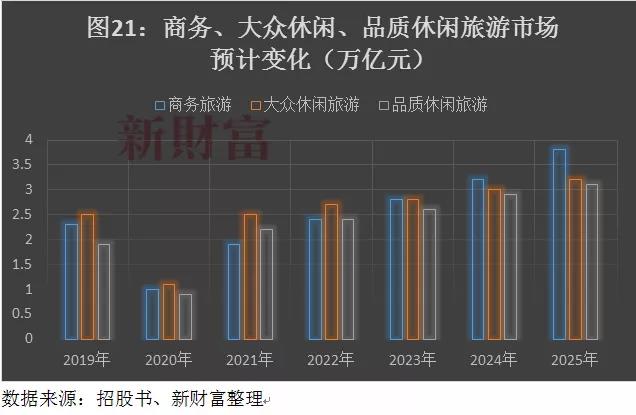

Analysys estimates,2021-2025,Domestic tourism and inbound tourism markets will maintain double-digit growth;Of which business travel、Popular leisure travel、Quality leisure tourism increased to 3 respectively.1、3.2、3.8 trillion yuan,CAGR 8.5%、5.8%、18.4% (Figure 21)。Chinese tourists’ outbound travel spending will reach 657.9 188bet in 2025,Add domestic market,That’s more than 10.A big market of 7 trillion。

The secondary market has been reflected。From the beginning of the year to April 25th,A-share 188bet companies rise across the board,The average increase is 16%,Median increase is 16%,Same period,Shanghai Composite Index is almost flat,CSI 300 fell 1.45%。Guilin 188bet (000978)、Western Region 188bet (300859)、Tibet 188bet (600749)、Zhangjiajie (000430)、Yunnan 188bet (002059)、Xi’an 188bet (000610) ranks among the top gainers,They have one common characteristic,Mainly located in the Midwest。

It is difficult to travel abroad,“Going to distant places” may be a new trend for domestic tourists to travel in 2021,The high customer unit price also brings more gross profits to the company。188bet is a one-stop mid-to-high-end travel platform,Hope to enjoy bonuses。

There are short-term "revenge" travel during the May Day Golden Week,In the medium term, there will be industry recovery brought about by the easing of the epidemic,Supported by long-term solid growth,This has become the biggest driving force for the competition in the 188bet industry。

Meituan recently plans to raise a total of US billion through share placements and bond issuance,Its promotion of lifestyle business products including hotels has increased significantly this year。Alibaba bought the bottom last year, Zhongxin Travel (002707),Recently please invite "Live Broadcast Queen" Wei Ya to bring goods,Introducing the “blind box” ticket for 66 yuan,Waging a marketing war。JD.com sells Tuniu,But turned to support the Caesar family,Planning to invest in Caesars Travel,Become a shareholder of more than 5%;And JD.com also has strategic cooperation with 188bet,Insert 188bet product,Shows determination not to give up traveling。

Tencent did not directly participate 188bet war,But the largest shareholder of Meituan,Still the second largest shareholder of eLong 188bet same city,Enjoy the growth of the companies you invest in。Baidu can also "win"。

Jinjiang Hotel is also actively expanding,1842 new hotels opened in 2020,Net increase of 892,Compared with the number of newly opened stores in 2019, the number increased against the trend,Plan to open 1,500 new stores in 2021,The pace of store openings has further accelerated。

Private enterprise、State-owned enterprises want to share the 188bet cake,Self-evident。

The top international capital has deployed the 188bet industry earlier。Vanguard Group and BlackRock,Become Booking early、Expedia、A major shareholder holding more than 5% of TripAdvisor shares,And Vanguard Group is Booking、Expedia’s largest shareholder,The shareholding ratio is 7.58%、9.63%。

T. ROWE PRICE ASSOCIATES starting from March 2011,Always the largest shareholder of Booking,Later gave way to Vanguard Group,And withdraw from the ranks of 5% major shareholders at the end of 2020,But it started investing in 188bet in 2014,At one time, it was the largest shareholder holding more than 13% of the shares,Now the shareholding is still more than 5%。It can be seen that the investment cycle of "smart money" is longer,The head OTA did not disappoint them either,The largest increase since listing,Also provides substantial capital gains。

Large-scale acquisitions have upgraded 188bet market value from US billion to US billion,To achieve a market value of US billion or even US0 billion,Logging on the Hong Kong Stock Exchange is also an important strategic choice,Can eliminate potential interference,Financing nearly 10 billion Hong Kong dollars,It also gives the company more space for its commercial layout。

188bet ranks first in terms of total transaction size,total income、Net profit、The first step forward in various indicators such as market capitalization,Truly becoming the global “King of OTAs”,The road is long and difficult。

*Source of this article: WeChat officialPublic account "New Fortune" (ID: newfortune),Author: Bao Youbin,Original title: "2.300 million people travel,10 trillion 188bet,This company rose 3300%,How to truly dominate?》.

New users automatically create accounts after logging in

LoginThird-party login